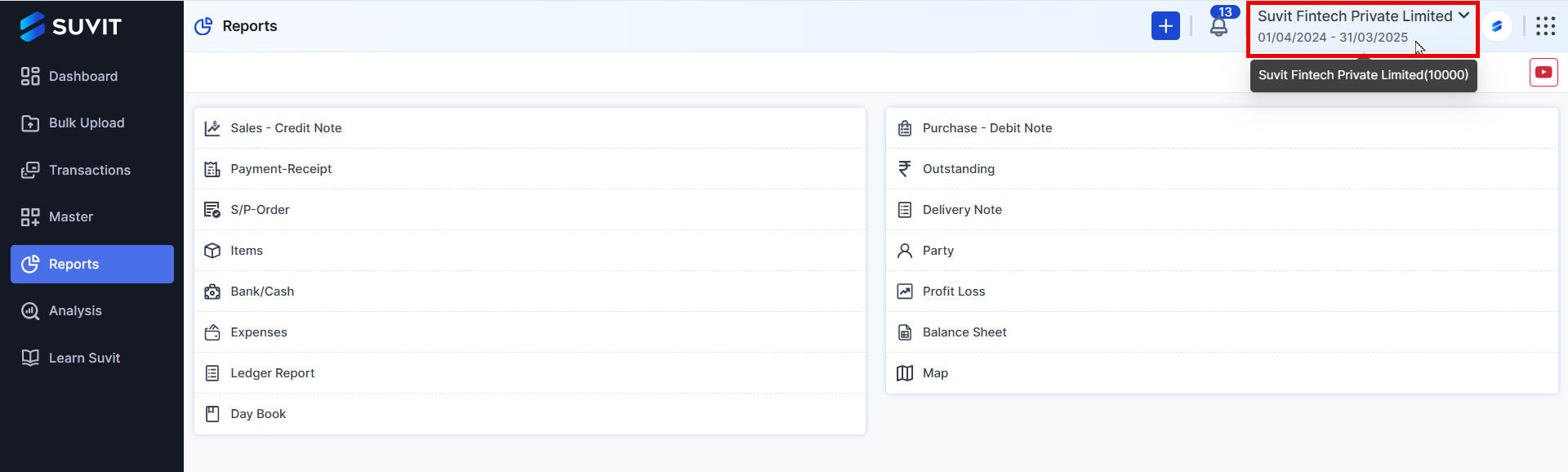

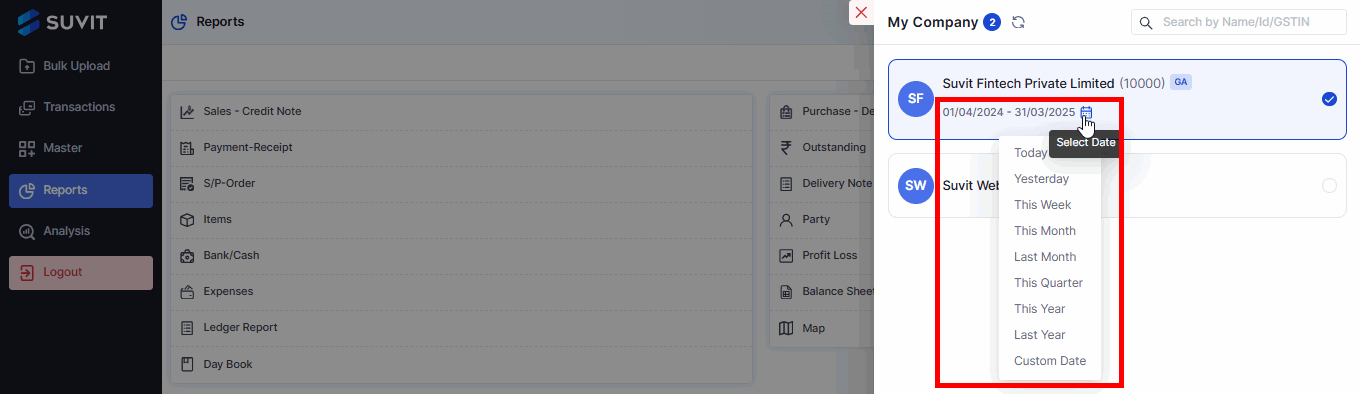

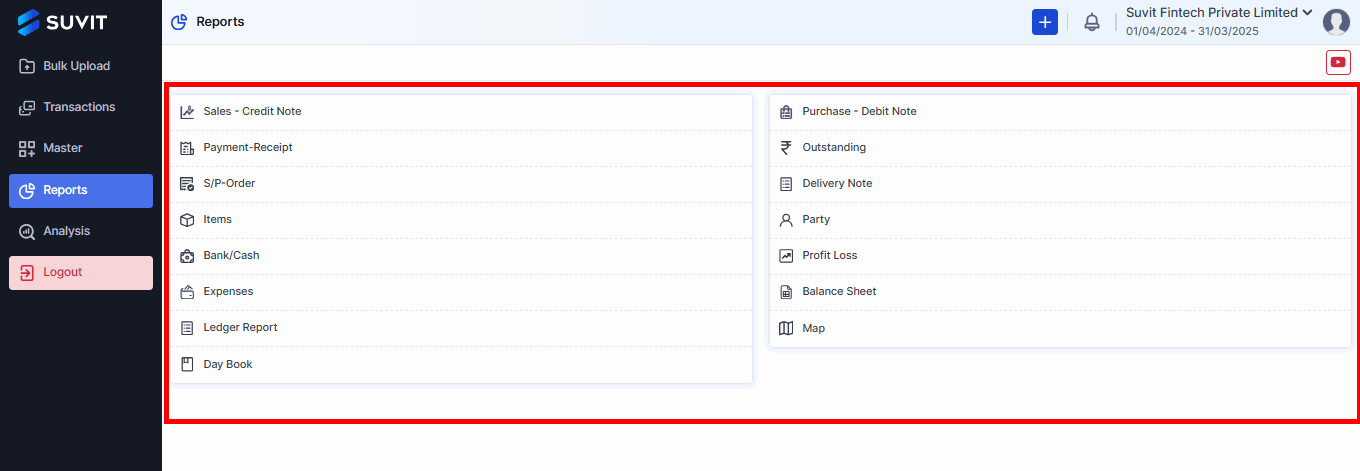

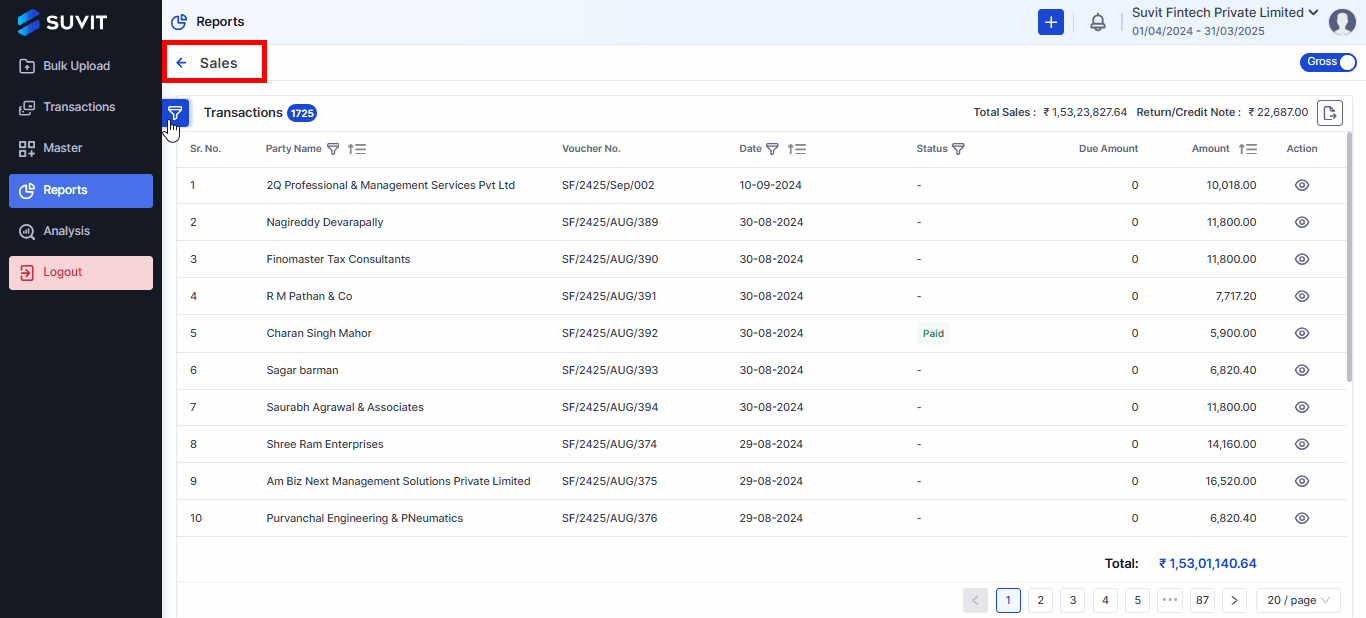

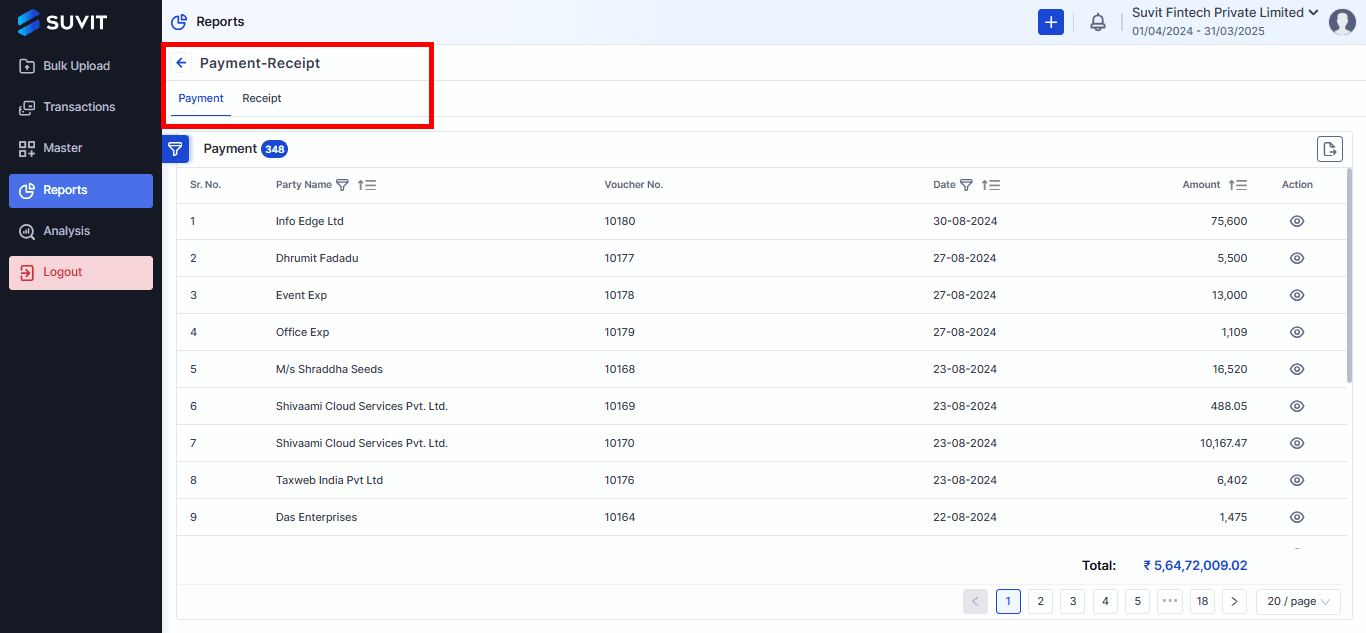

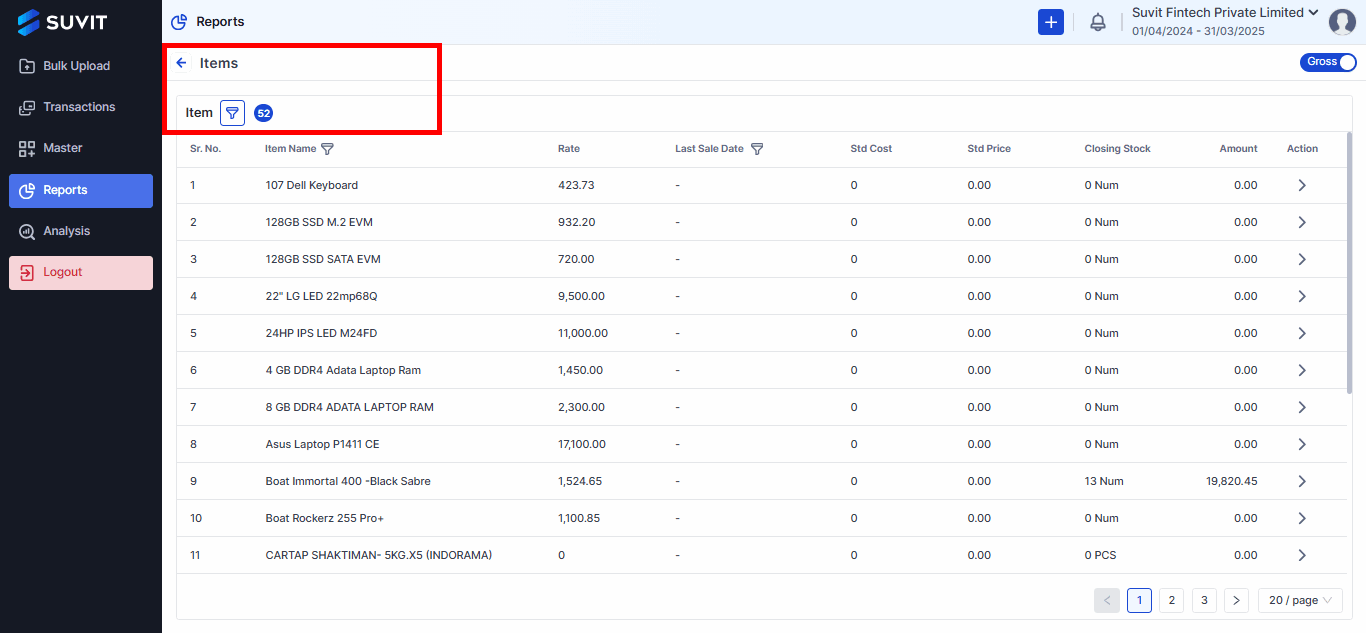

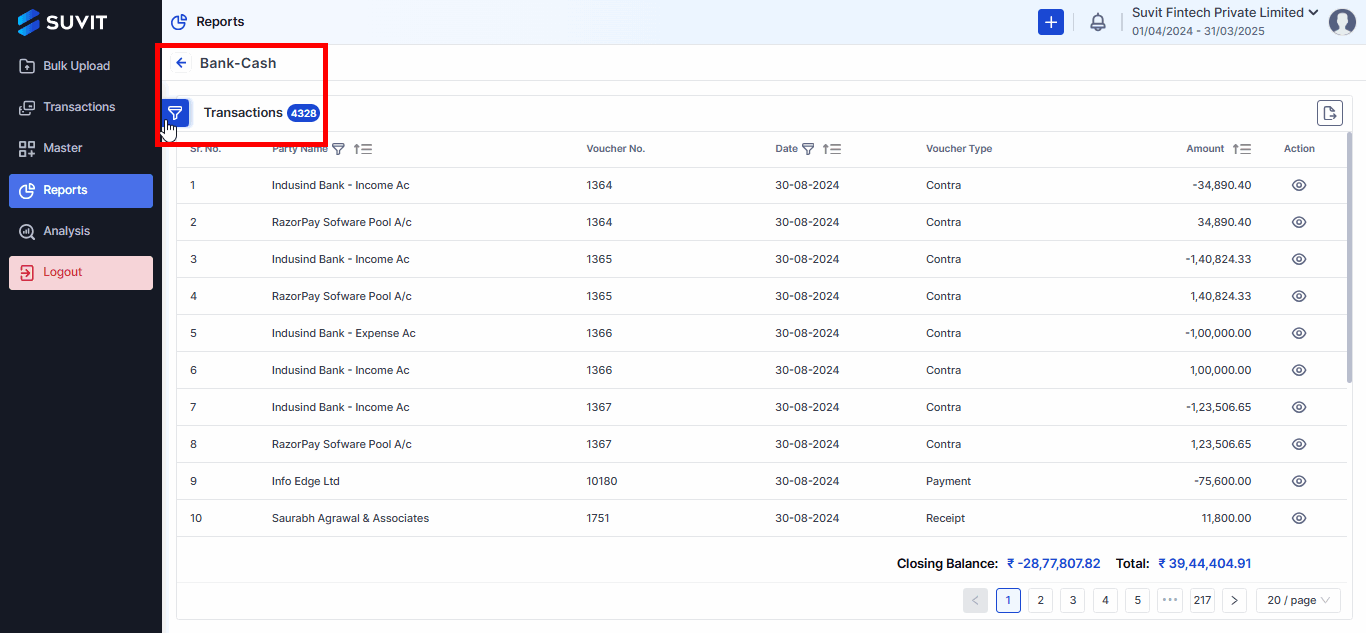

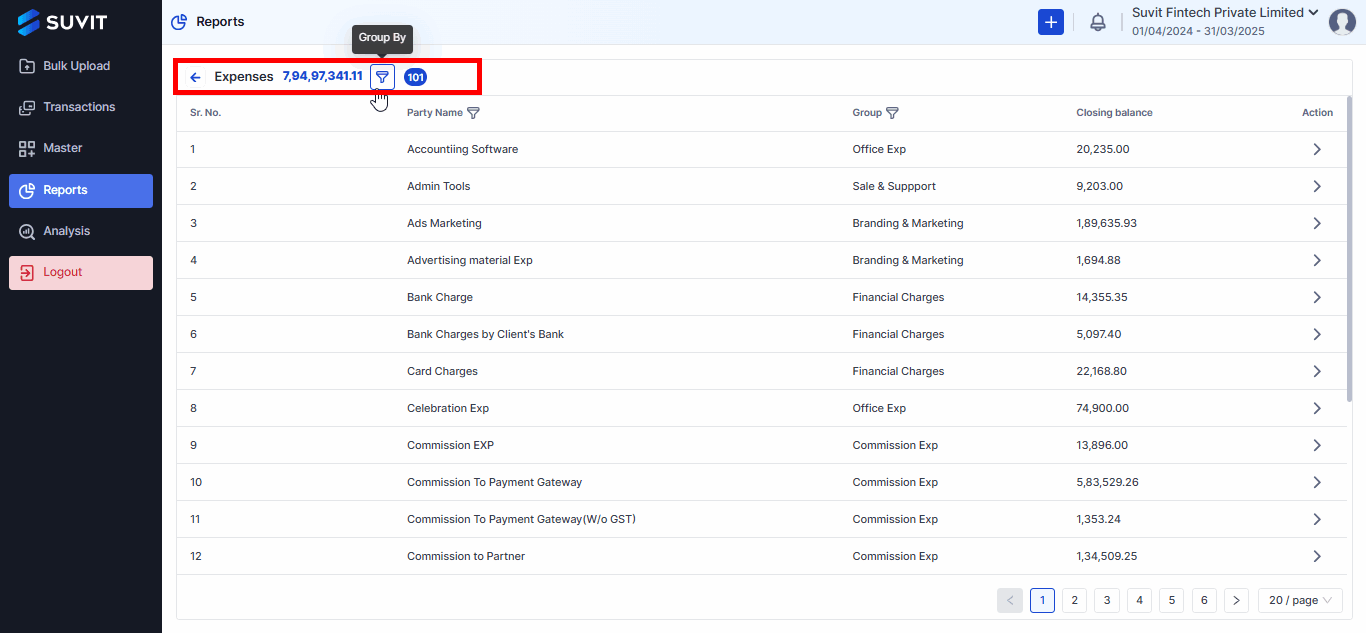

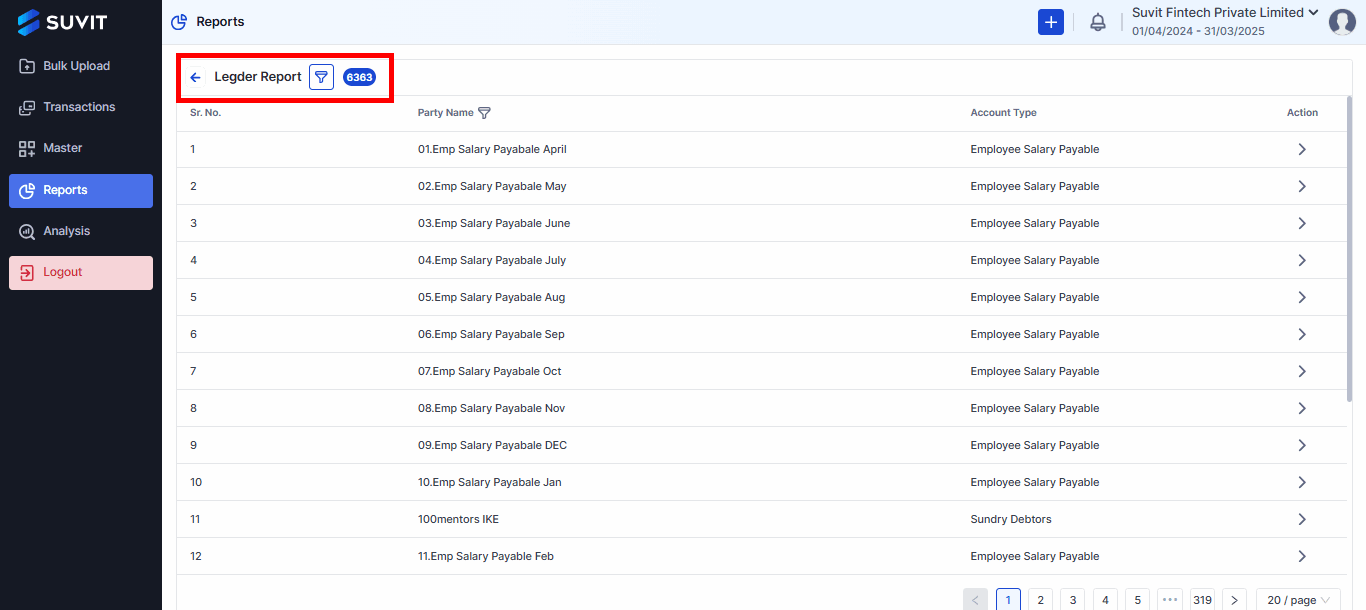

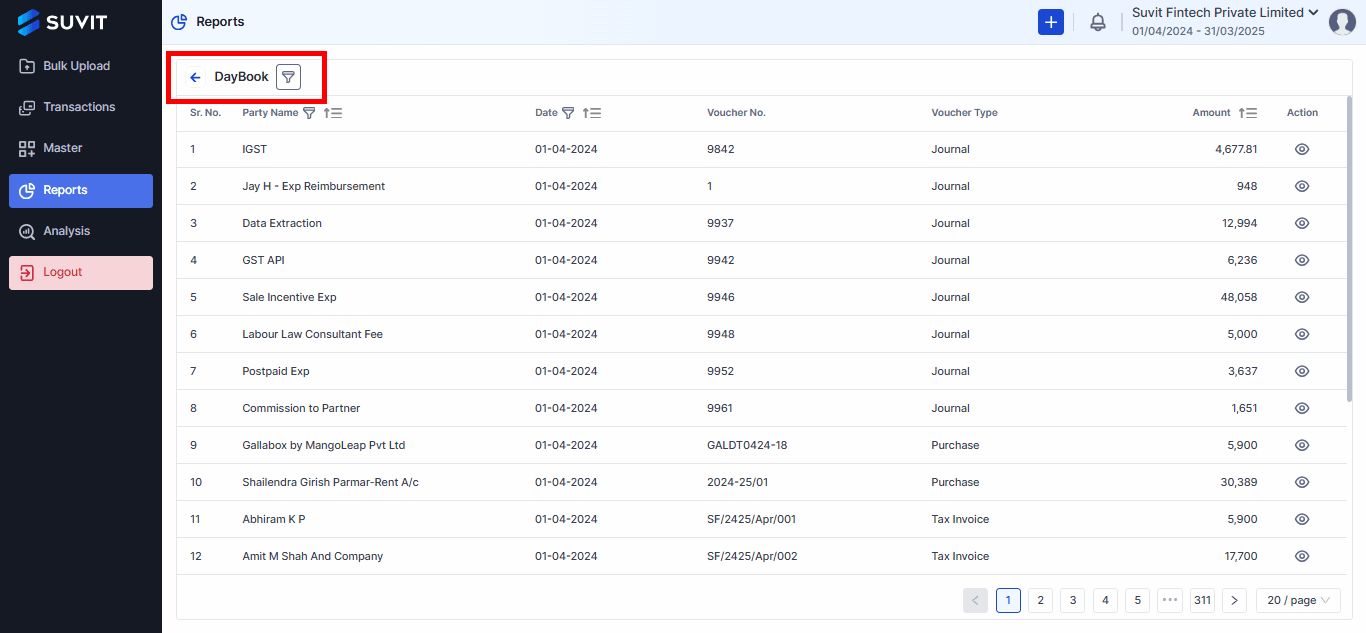

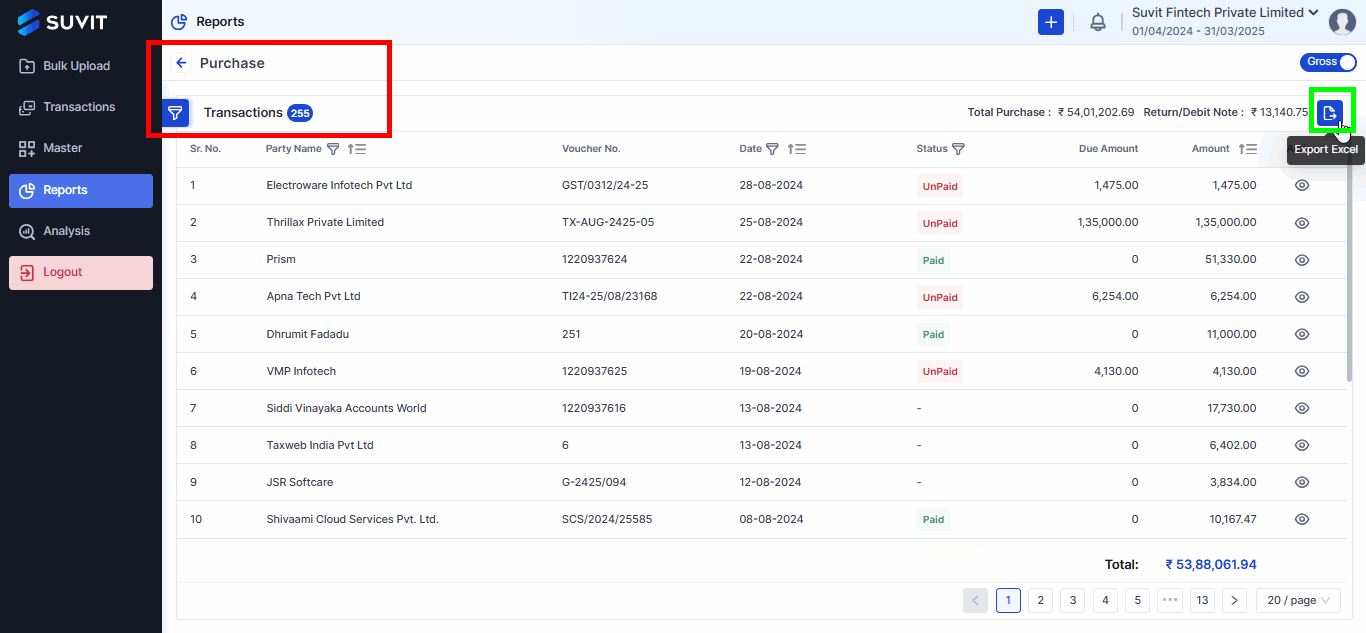

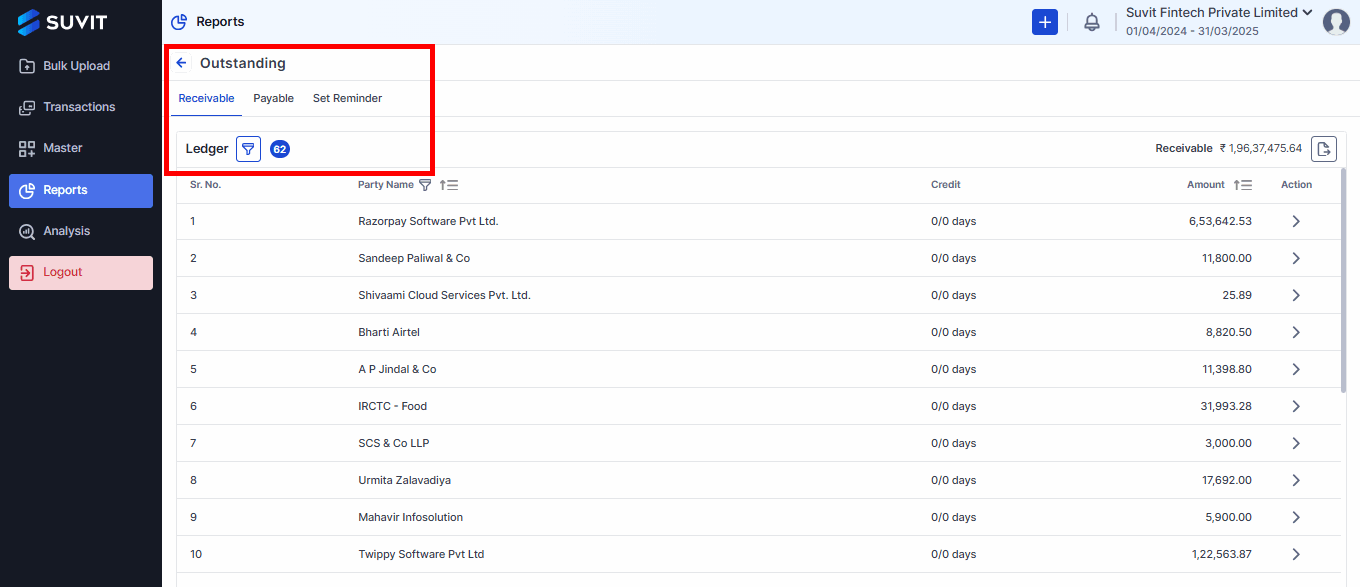

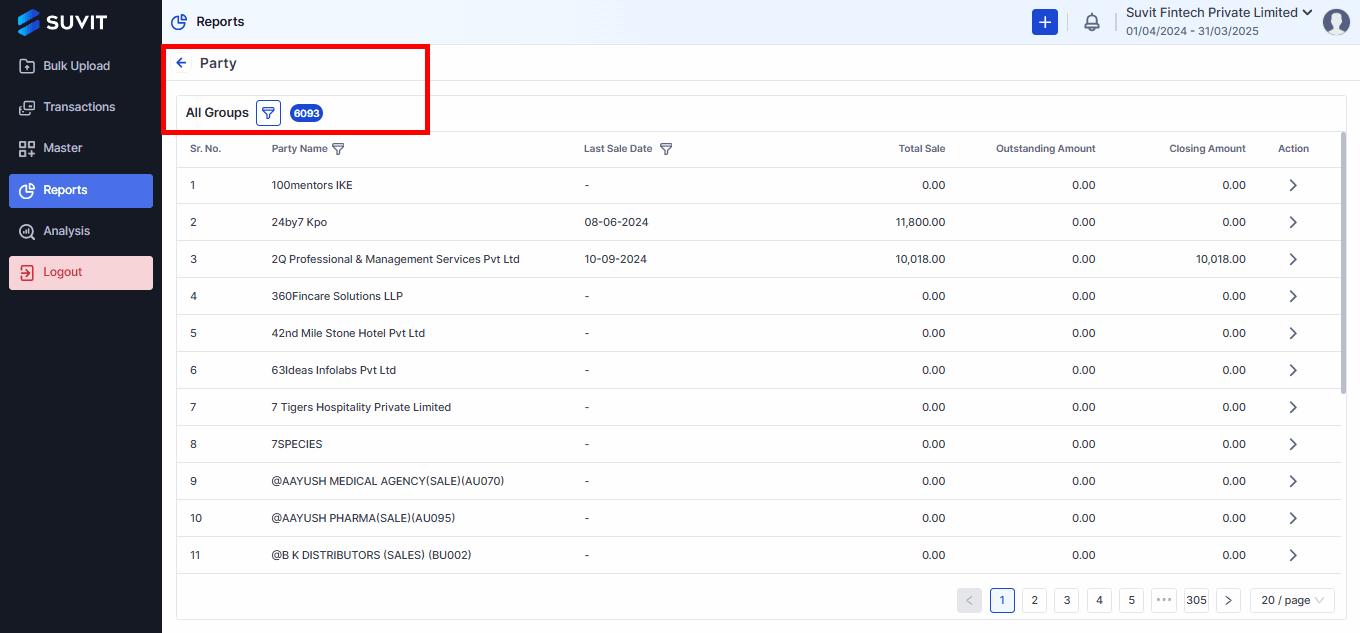

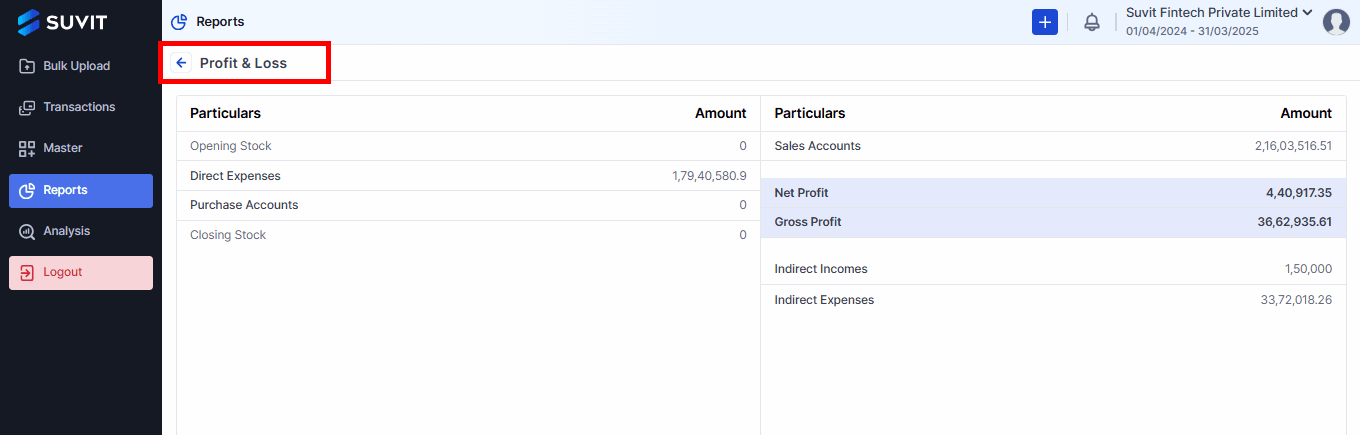

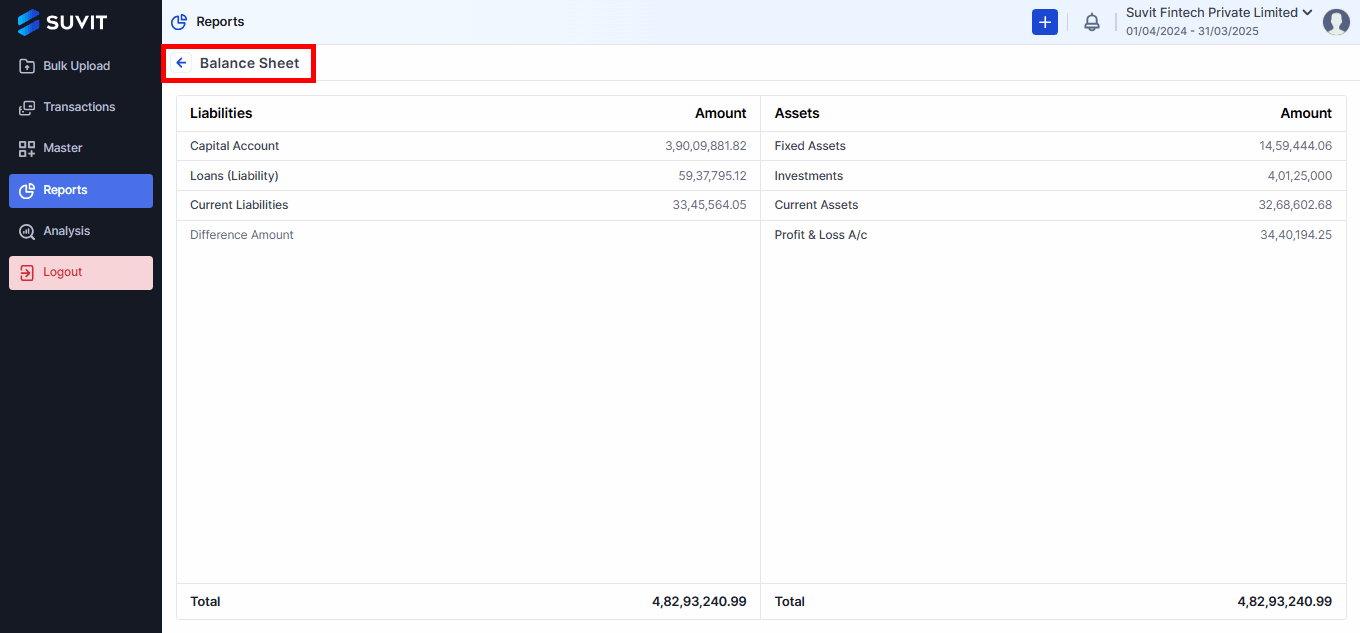

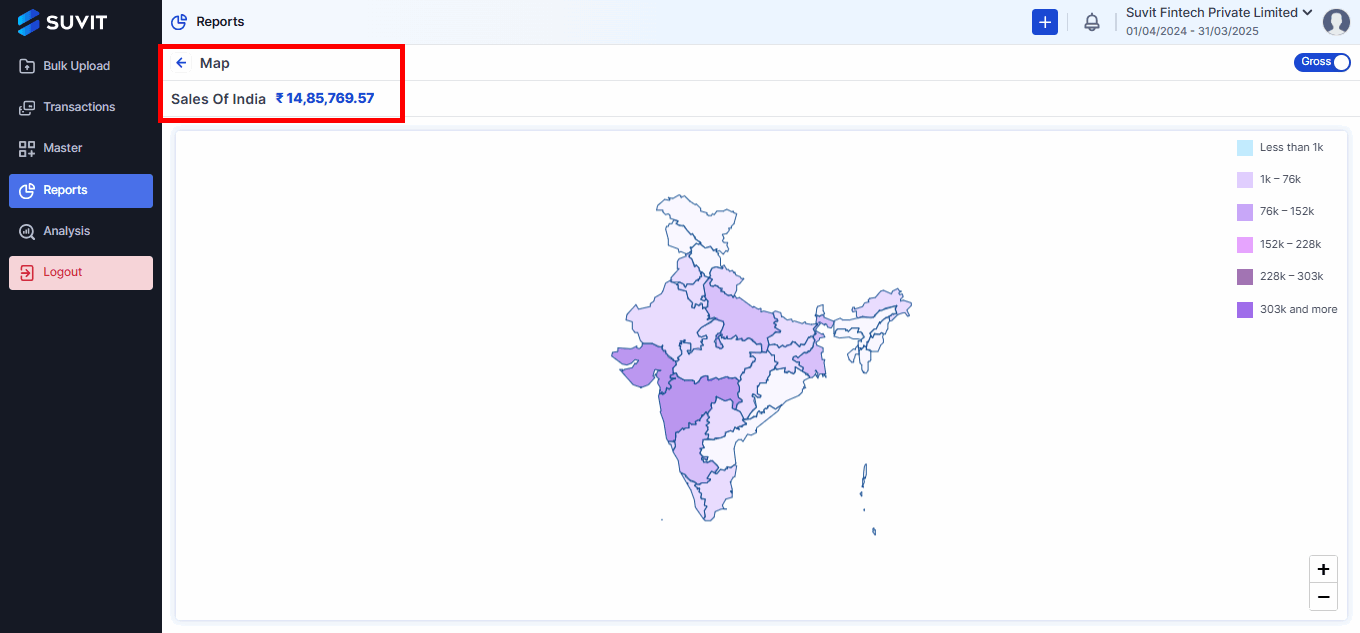

Track sales returns, purchase adjustments, cash flow, ledgers, profitability, balance sheets, outstanding payments, and expenses for smarter finances.