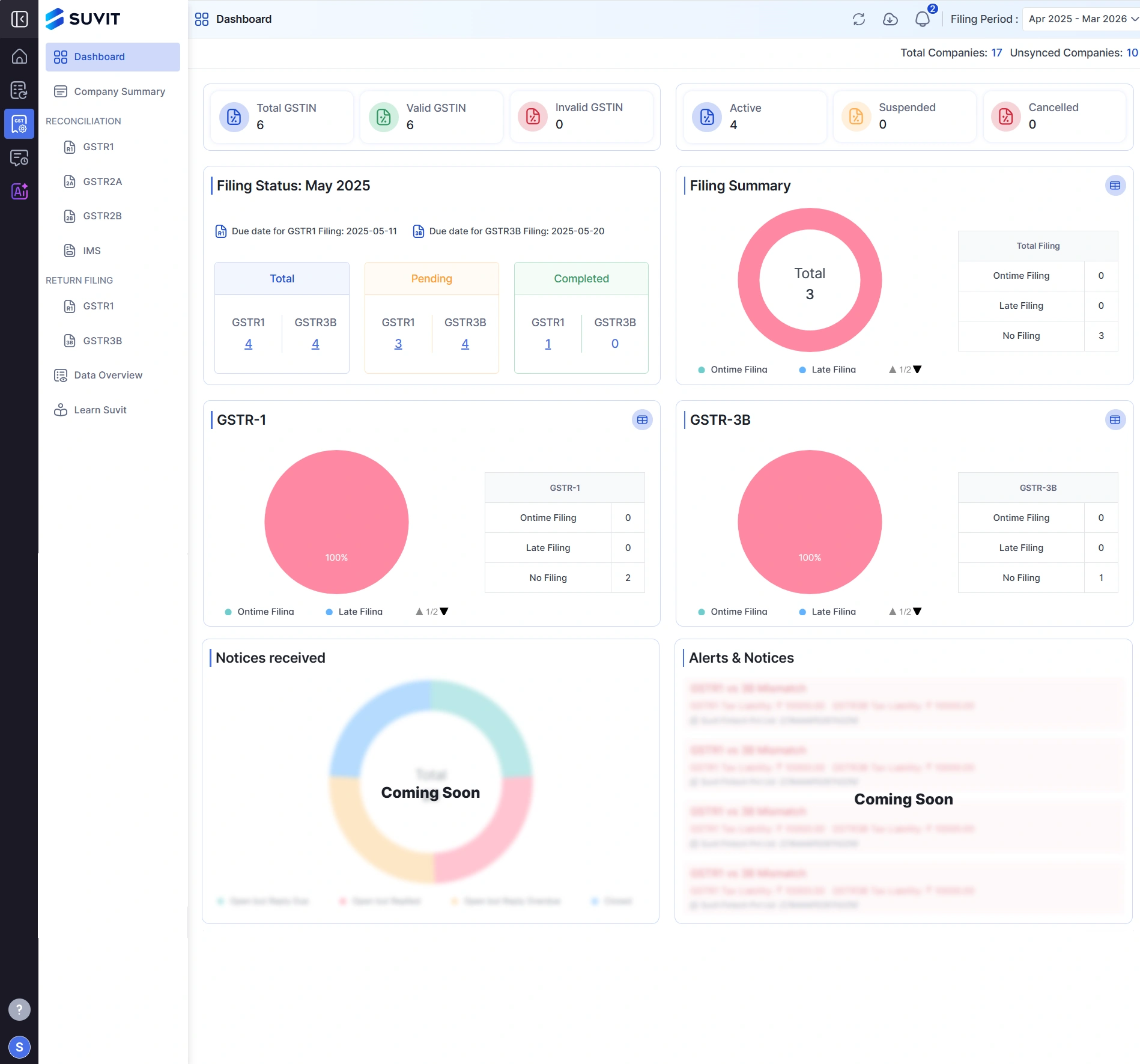

This dashboard is built for busy accountants and firms to quickly view compliance across all their clients, GSTINs, and filing timelines — in a single glance.

📊 Your Suvit Dashboard is your command center — it shows everything about your GSTINs, return status, deadlines, and filings in one place. Here's how to understand each section:

The top bar includes:

→ Dashboard label to show your current view

→ Filing Period selector (e.g., Apr 2025 – Mar 2026)

→ Company stats:

→ Total Companies: Number of registered companies

→ Unsynced Companies: Data needs syncing

You’ll see colored blocks with quick stats:

→ Total GSTIN – All GSTINs tracked

→ Valid GSTIN – GSTINs verified as active

→ Invalid GSTIN – Marked as incorrect

→ Active / Suspended / Cancelled – Status-wise GSTIN count

→ Helps you track GST registration health easily.

A clear table showing:

→ GSTR-1 & GSTR-3B returns

→ Number of returns:

→ **Total** to be filed

→ **Pending** (still due)

→ **Completed** (already filed)

→ It also reminds you of due dates:

→ Total Filings (e.g., 3 tracked returns)

→ Breakdown of:

→ ✅ OnTime Filing

→ ⚠️ Late Filing

These show return-wise filing:

→ For each return type:

→ Total GSTINs considered

→ Status: OnTime, Late, or Not Filed

→ Visual representation helps spot delay trends instantly.

Placeholder widgets indicating future updates for:

→ Notices Received

→ Filing Alerts & System Notices

→ Suvit is actively improving this section.

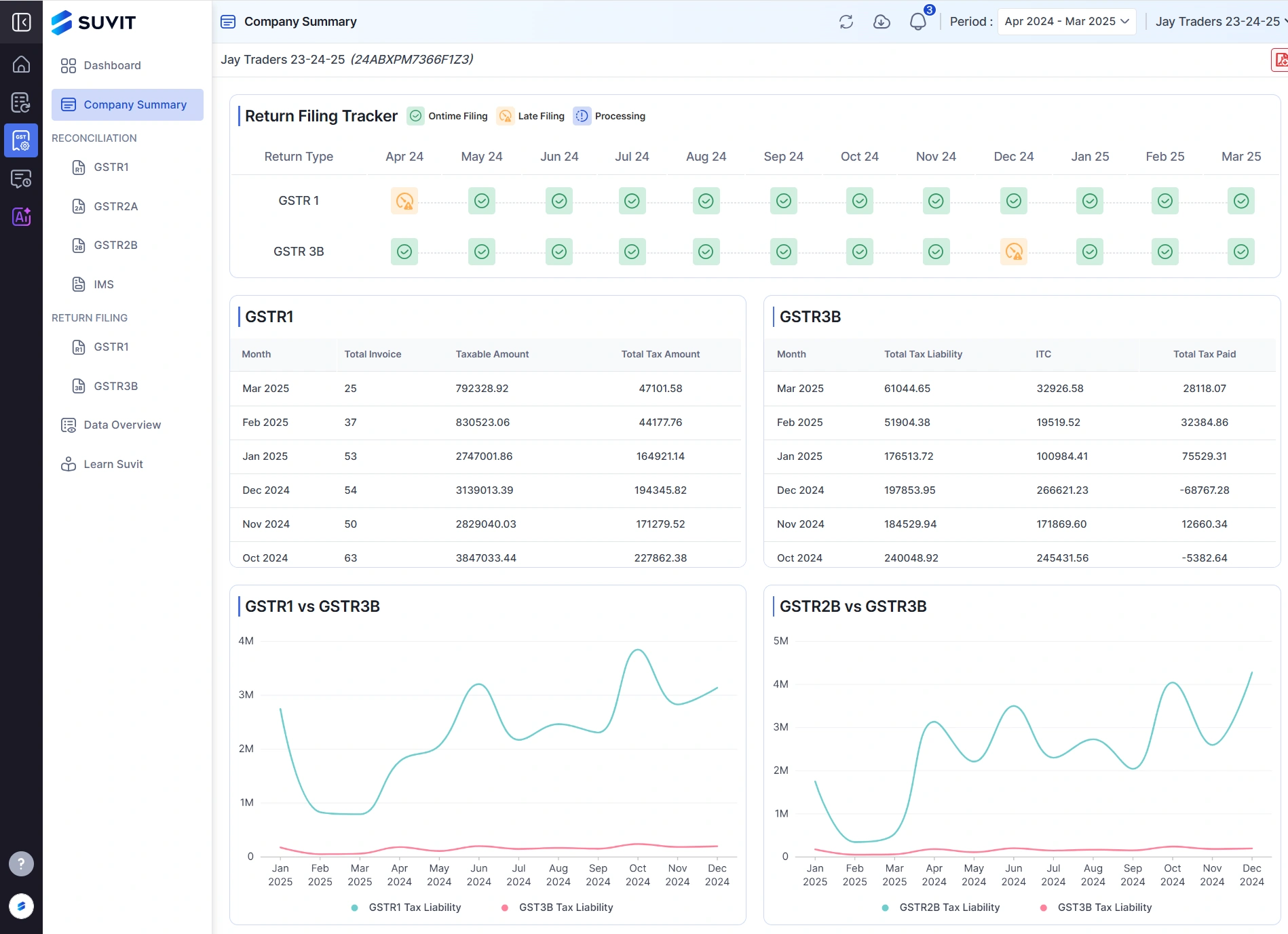

→ Company Name (e.g., Suvit) and GSTIN

→ Period Dropdown (Apr 2024 – Mar 2025) lets you pick the financial year you're viewing

Tracks both GSTR1 and GSTR3B for each month

→ Green Check ✔️ = On-time Filing

→ Orange Clock 🕓 = Late Filing

→ Blue Circular Arrows 🔄 = Processing

→ Dash (—) = No Filing or Not Applicable

→ Use this grid to check return compliance status across the year

Monthly summary of outward supplies:

→ Month: Filing month

→ Total Invoice: Number of invoices reported

→ Taxable Amount: Value before GST

→ Total Tax Amount: GST value (CGST + SGST + IGST)

Monthly summary of summary return:

→ Total Tax Liability: GST to be paid

→ ITC: Input Tax Credit claimed

→ Total Tax Paid: Actual payment done

Visual comparison of outward liability:

→ Line 1: GSTR1 Tax Liability (sales data)

→ Line 2: GSTR3B Tax Liability (actual filed)

→ Useful for spotting mismatch in reporting

Compare ITC vs filed liability:

→ Line 1: GSTR2B Tax Liability (vendor data)

→ Line 2: GSTR3B Tax Liability (filed amount)

→ Helpful for input credit tracking and under/over claiming alerts