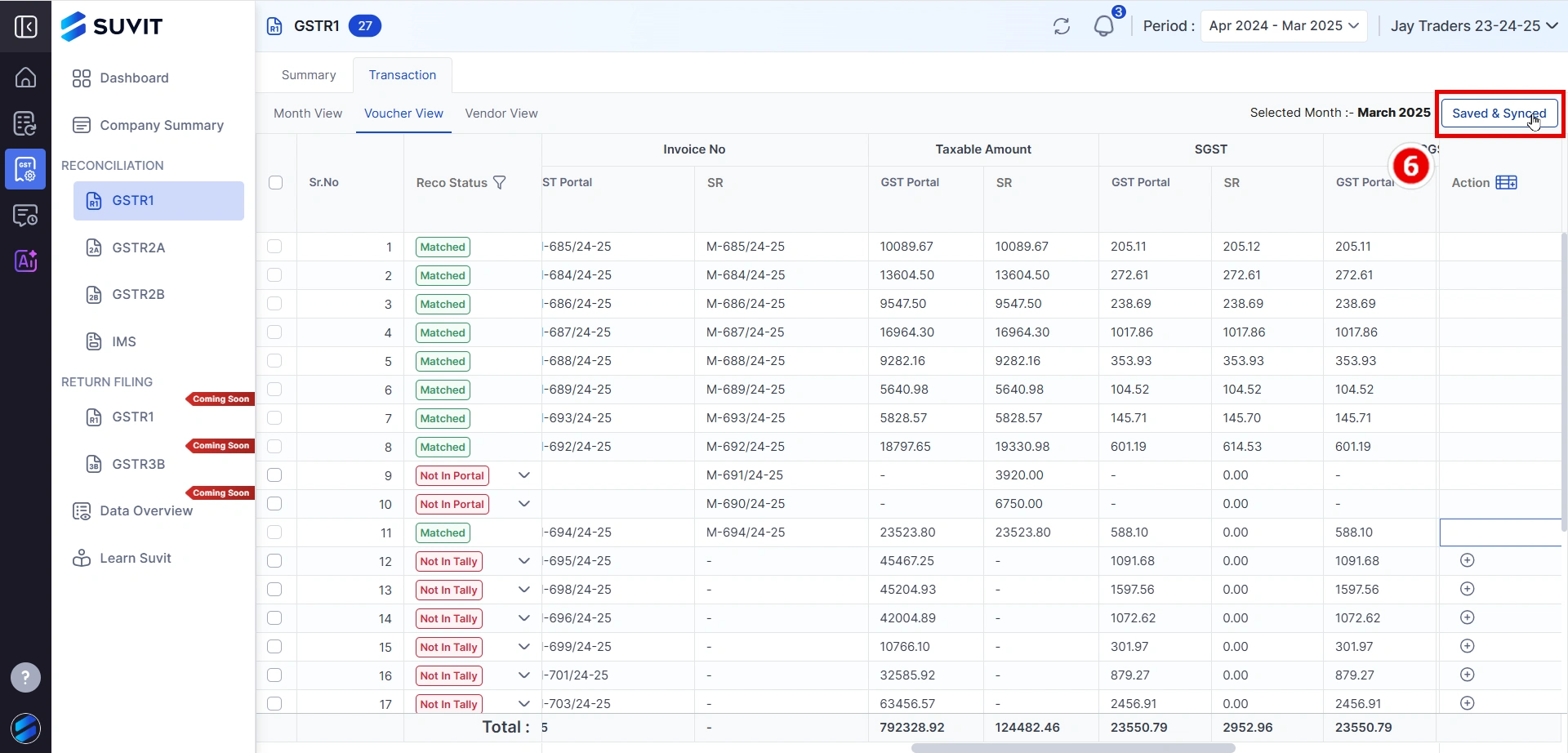

GSTR-1 Reconciliation & Voucher Entry (Simplified Guide). This guide explains how to check differences in GSTR-1 and Sales Register and how to fix mismatches by adding missing vouchers directly from Suvit.

Go to the Month View under GSTR1 > Transaction.

→ You’ll see differences in Total Invoice, Taxable Amount, and Tax Amount for each month.

→ This helps you quickly identify which months have mismatched or missing data.

→ Click on Desired Month to check the Transcation.

Use the Reco Status filter in Voucher View.

You can filter vouchers by:

→ Matched

→ Manual-Matched

→ Partially-Matched

→ Not In Tally

→ Not In Portal

Helps focus only on problematic entries.

→ This lets you manually create missing entries right inside Suvit.

A popup form will appear with the following:

→ Voucher No., Date, Party Name, GSTIN

→ Item Details:

→ Item Name, Ledger, HSN, Quantity, Rate

→ Ledger Details:

→ Add Sales Account & Tax Ledgers like SGST, CGST

→ Double-check all amounts before saving.

Click the Save & Close button at the bottom of the form.

→ This saves your entry and closes the popup.

→ Now the entry is matched and synced with your records.

→ This will update your match status from "Not in Tally" to "Matched".

→ Keep doing this for all missing records.

That’s it! You’ve now matched missing invoices by creating vouchers from within Suvit — no need to go to Tally manually.