Use Suvit’s GST Reconciliation to track returns, compare Eligible vs. Claimed ITC, and match GSTR-1 with your sales register using Tally data reports.

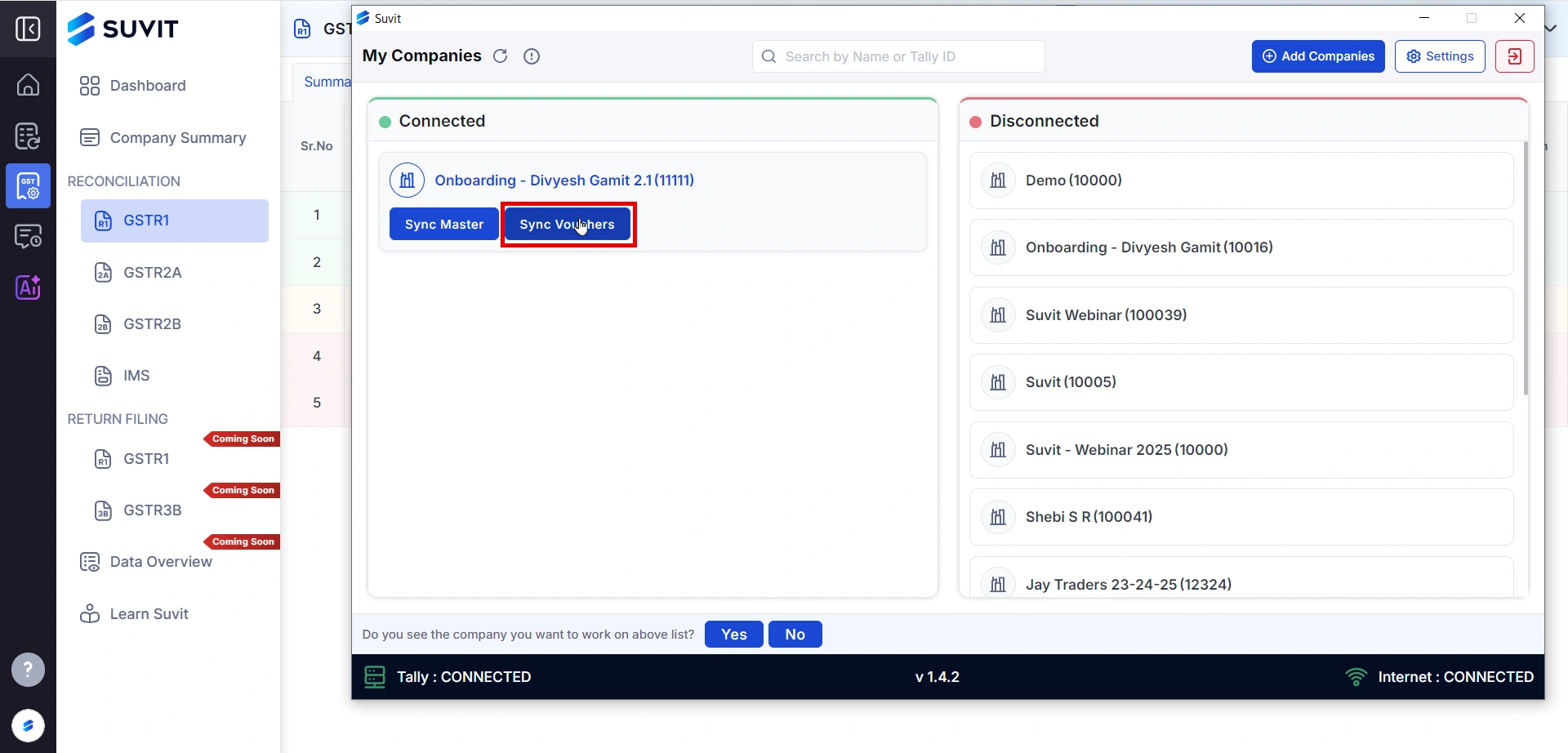

→ Choose your desired company from the top dropdown

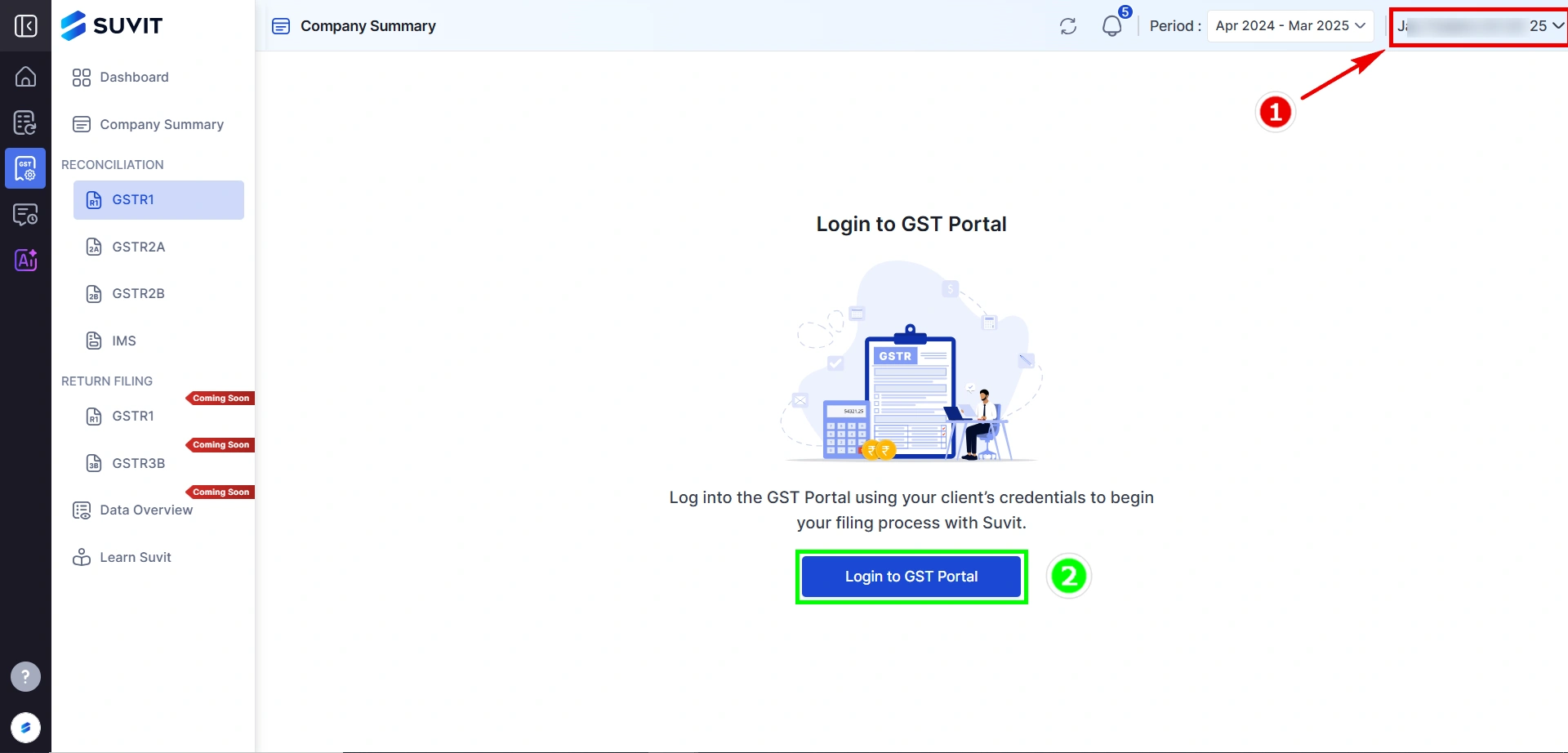

→ Select the financial year period (e.g., Apr 2024 – Mar 2025) to fetch data for the correct duration.

→ Click Login to GST Portal to connect Suvit with the GST portal using the client’s credentials.

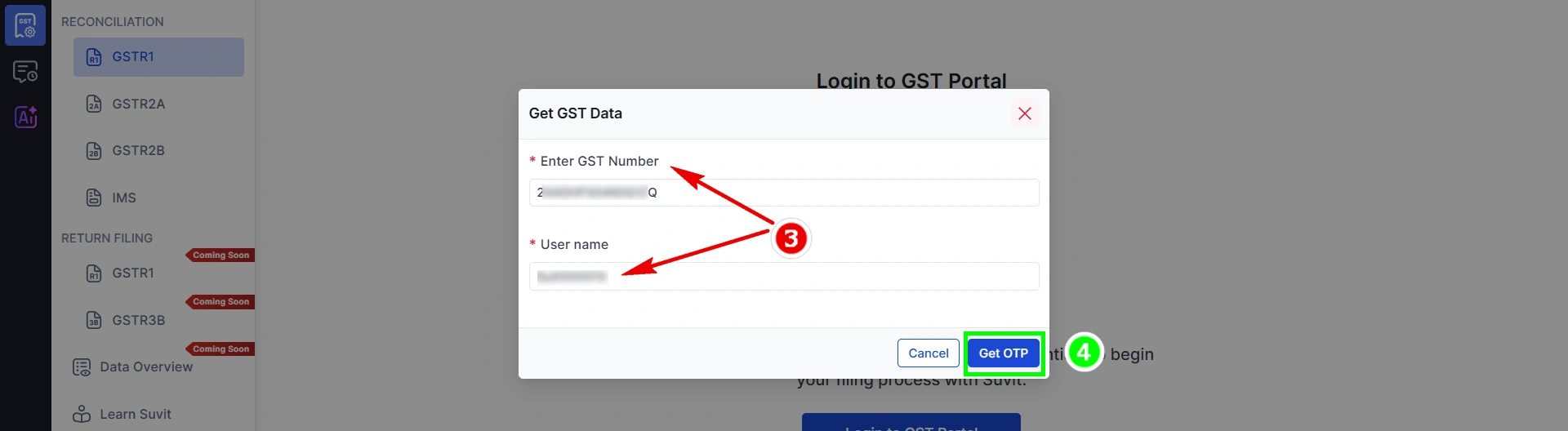

→ Fill in the GST Number and Username used for the portal login.

→ Click Get OTP to receive an authentication code.

→ This login is required to fetch return filing data securely.

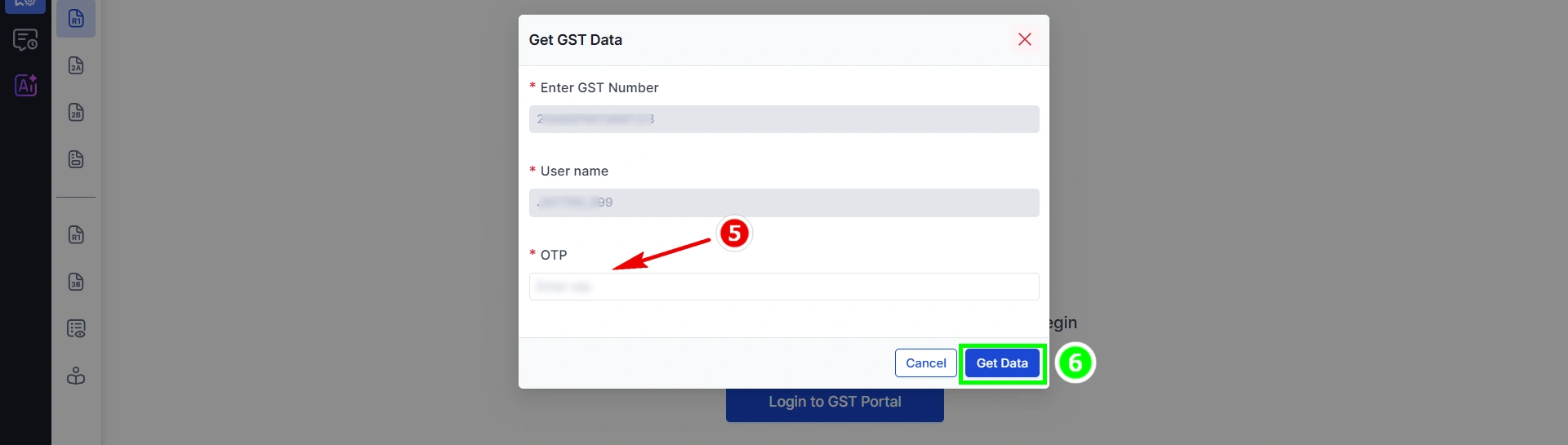

→ Enter the OTP received on the registered mobile/email.

→ Click Get Data to allow Suvit to fetch GST filings and sales details.

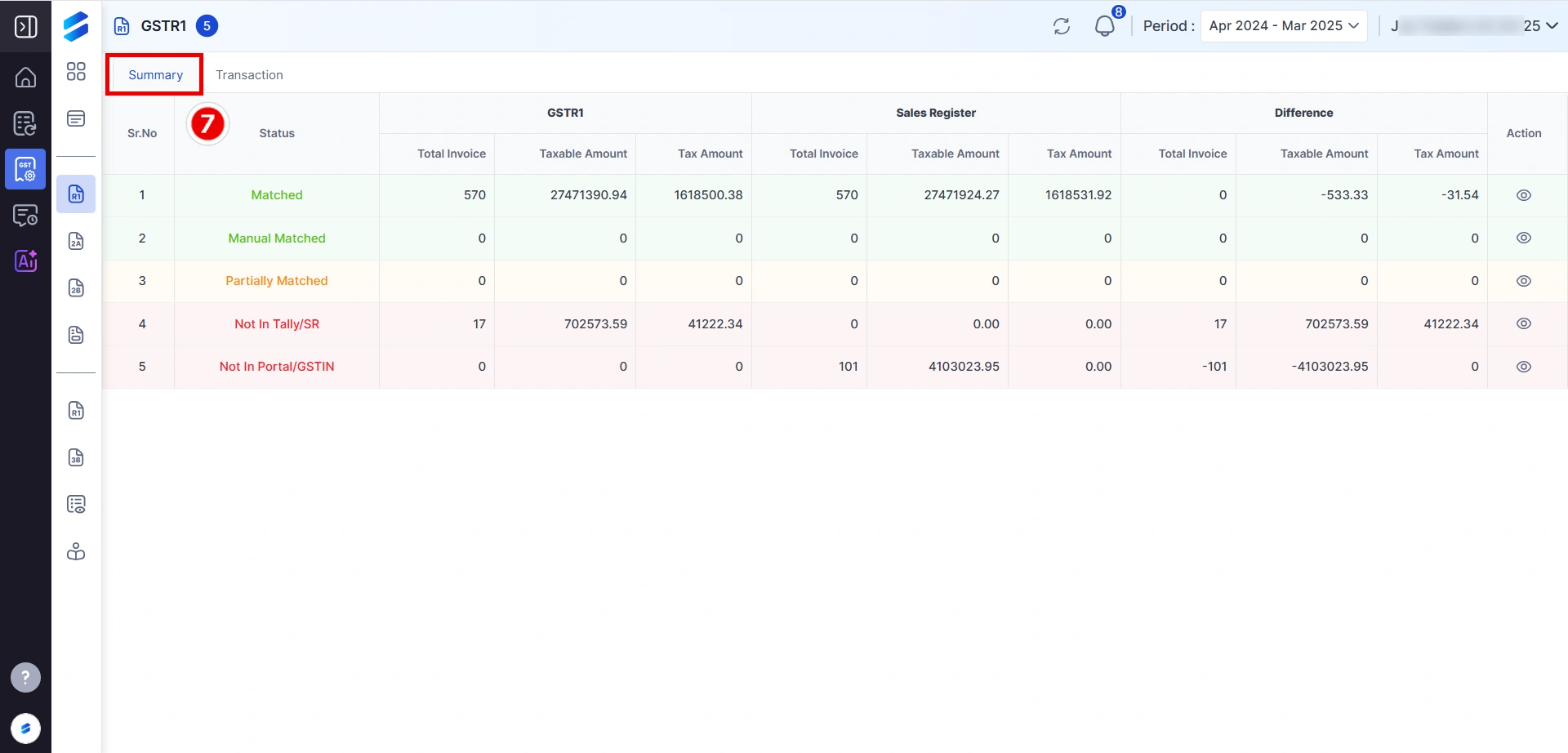

The Summary Tab gives you a bird’s eye view of matching status:

Categories include:

→ Matched – Entries perfectly match between portal & books

→ Manual Matched – Entries matched manually

→ Partially Matched – Partial data mismatch

→ Not in Tally/SR – Found in portal but missing in your books

→ Not in Portal/GSTIN – Present in your books but not on the portal

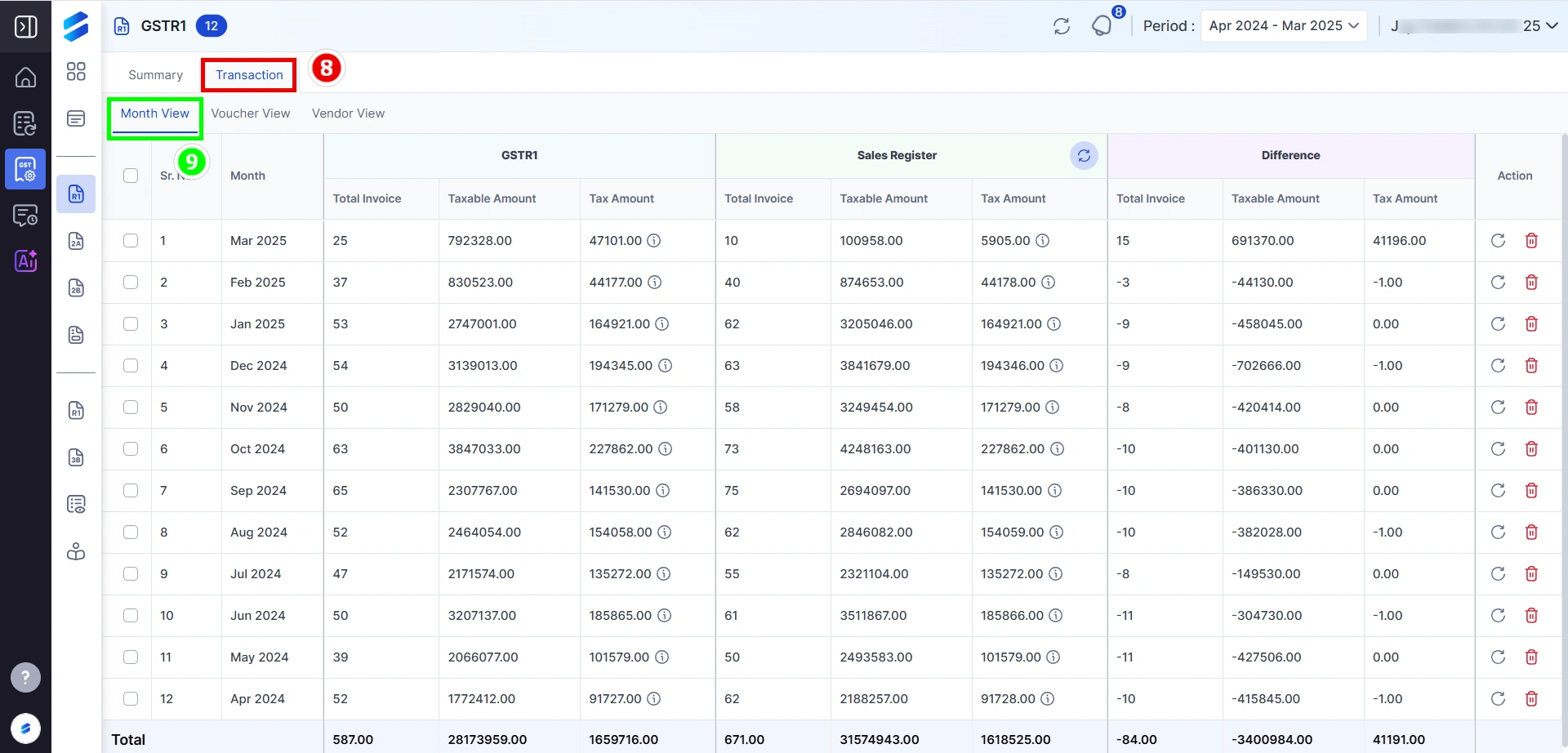

→ Navigate to the Transaction → Month View tab.

It compares monthly totals for:

→ GSTR-1: Invoice Count, Taxable Amount, Tax Amount

→ Sales Register: Invoice Count, Taxable Amount, Tax Amount

→ Difference is highlighted clearly in each row.

→ This helps detect month-wise mismatch in data.

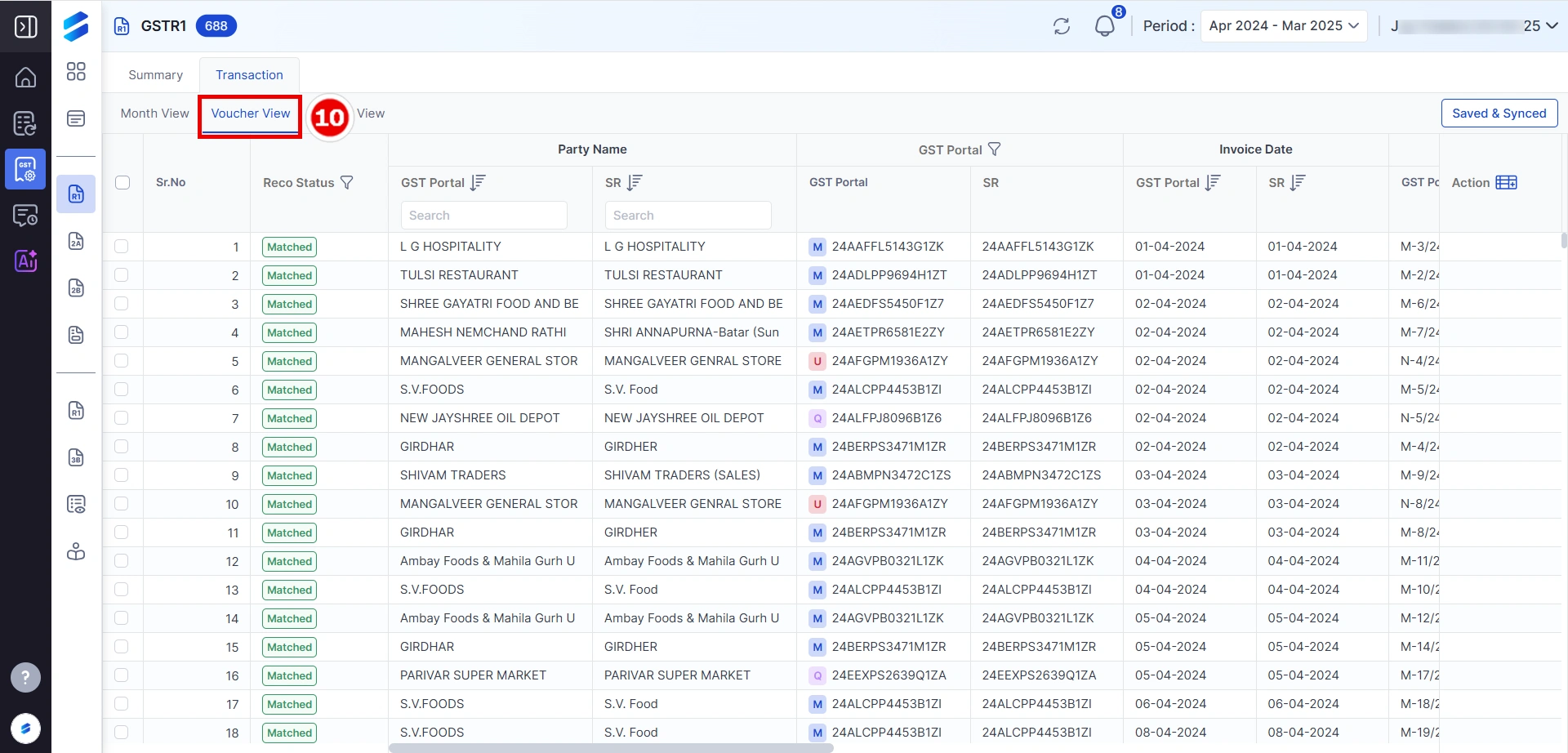

→ Go to the Transaction → Voucher View tab.

Each voucher entry is listed with:

→ Party name (as per GST Portal & Sales Register)

→ GSTIN match status

→ Invoice dates comparison

→ Use this view for verifying invoice-level entries line by line.

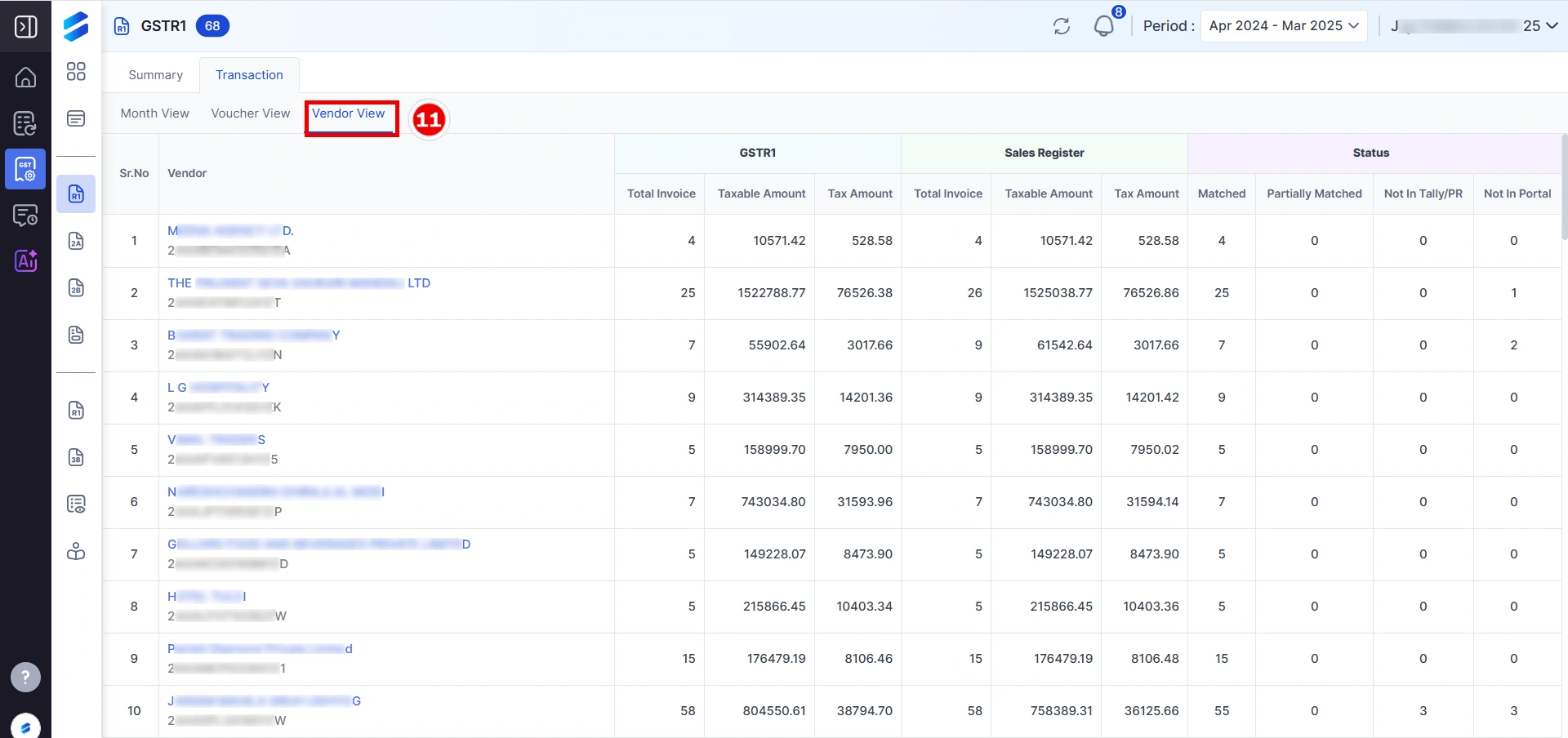

→ Use Vendor View to check reconciliation by vendor.

Shows GSTR-1 vs. Sales Register for each vendor:

→ Invoice Count

→ Taxable & Tax Amount

→ Status like Matched / Partially Matched / Not Found

→ Helps accountants quickly pinpoint vendor-specific mismatches.

This GSTR-1 Reconciliation module helps you:

→ Cross-verify GST Portal data with your Tally/Sales Register. → Match data by month, voucher, or vendor. → Highlight mismatches and resolve them with ease.