🔄 IMS (Invoice Matching System) in Suvit – Simple Guide for Easy Reconciliation. IMS helps you compare GST Portal data with your Purchase Register (PR) to spot and fix mismatches. Here’s how to use it step-by-step with helpful visuals.

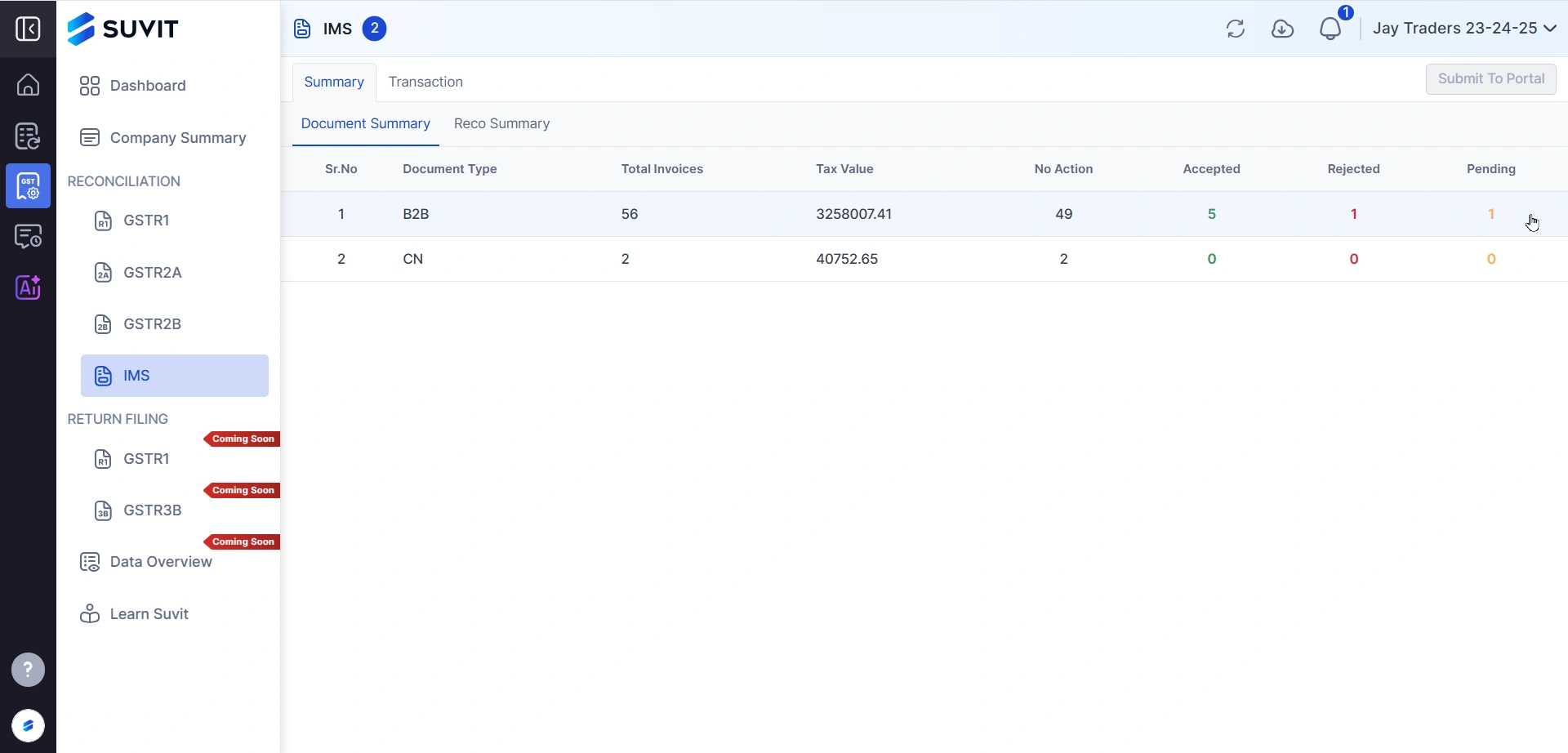

📋 IMS – Document Summary Tab (Your First Screen in IMS) This is the first view when you open IMS module in Suvit. It shows the summary of your documents — sorted by Document Type like B2B or CN (Credit Note).

This tab gives you a bird’s eye view of how many invoices are matched, pending, or need your action — document type wise.

→ Document Type: This shows the type of documents – like B2B or CN (Credit Note).

→ Document Type: This shows the type of documents – like B2B or CN (Credit Note).

→ Total Invoices: Total number of GST invoices available under each type.

→ Tax Value: The combined taxable value of all these invoices.

This is your starting point to check what's matched and what's not.

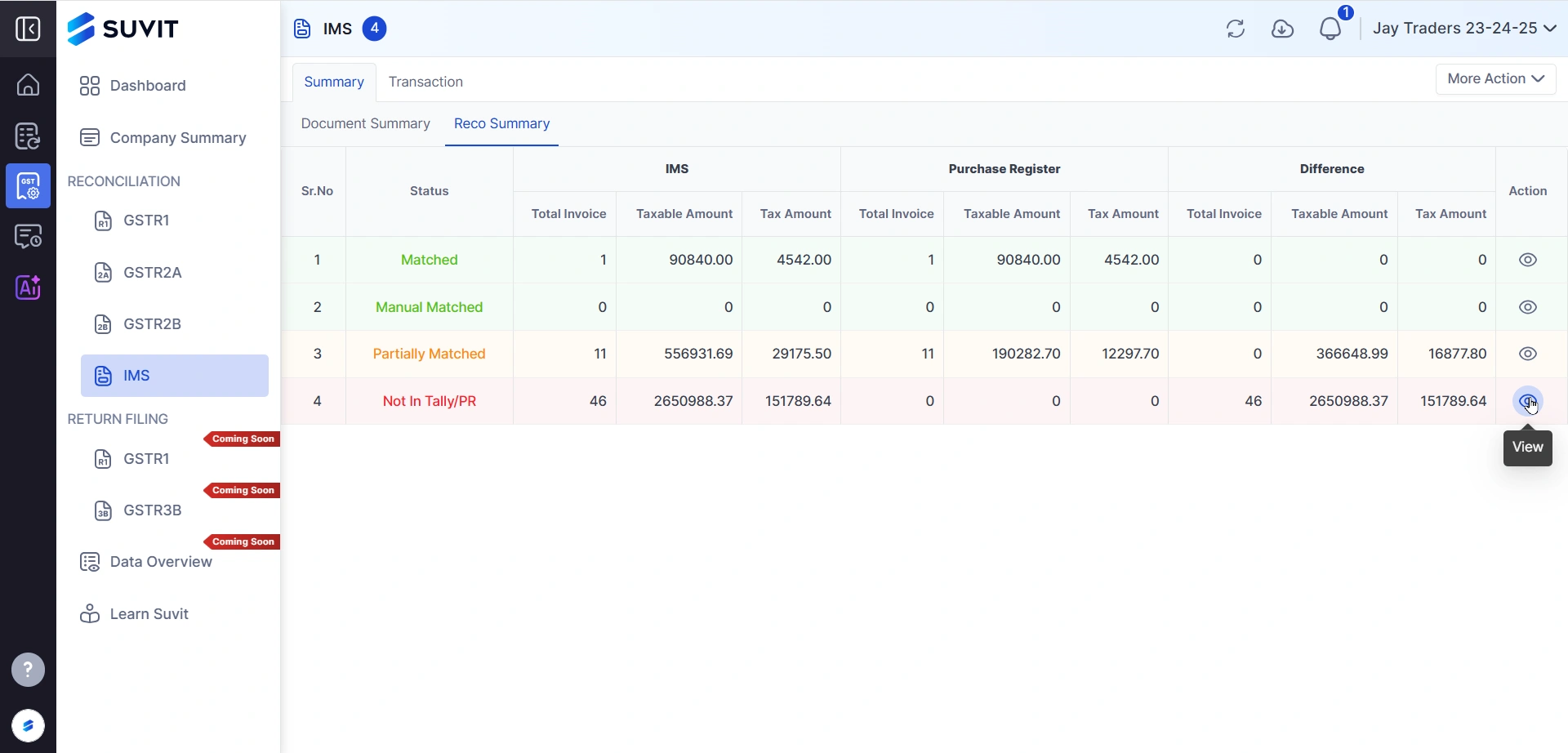

→ Matched – Data perfectly matches between GST and PR.

→ Manual Matched – You’ve manually linked the entries.

→ Partially Matched – Some values differ.

→ Not In Tally/PR – Missing in your Purchase Register or Tally data.

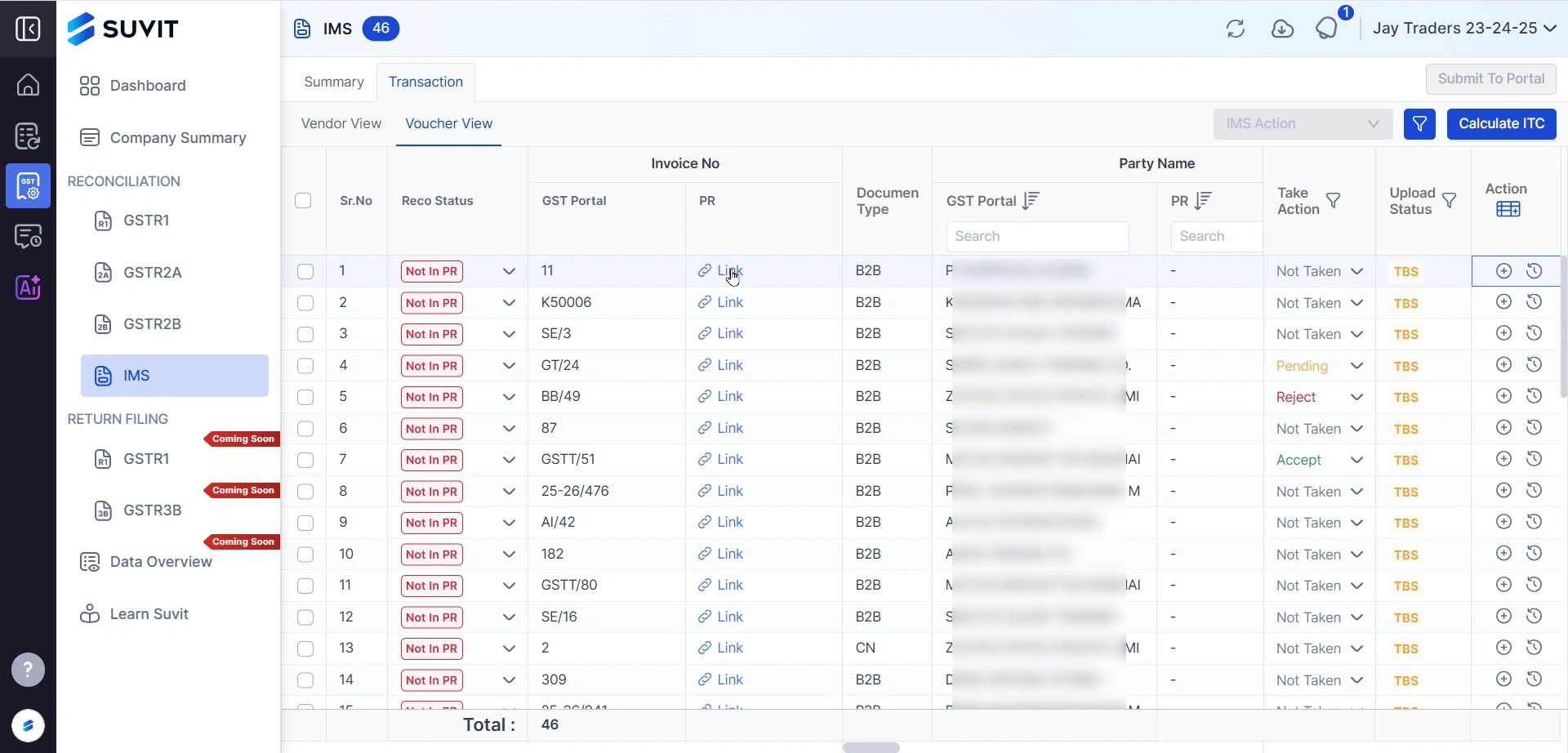

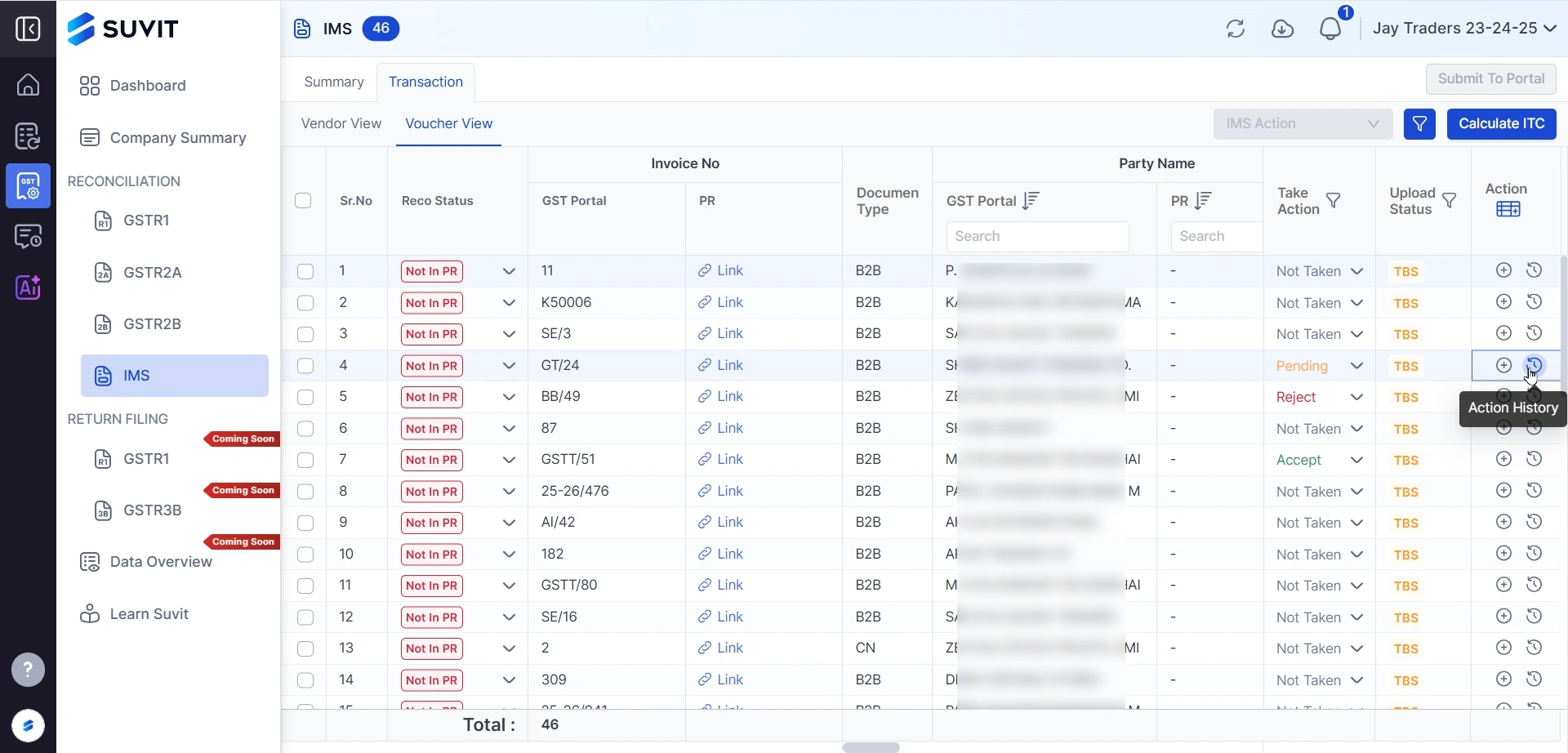

Voucher View shows invoice-level details under the Action tab.

→ Click the eye icon (👁️) to view full mismatch details.

To begin reconciliation:

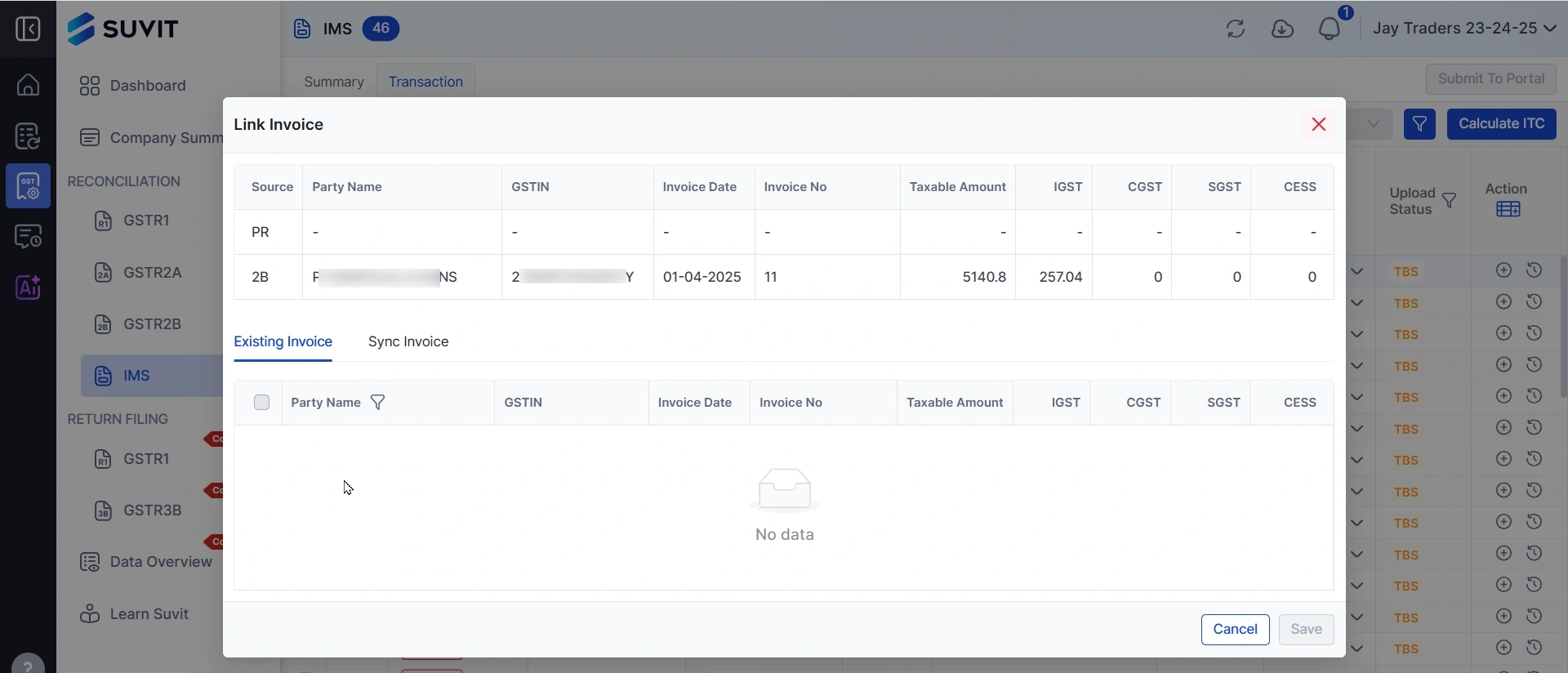

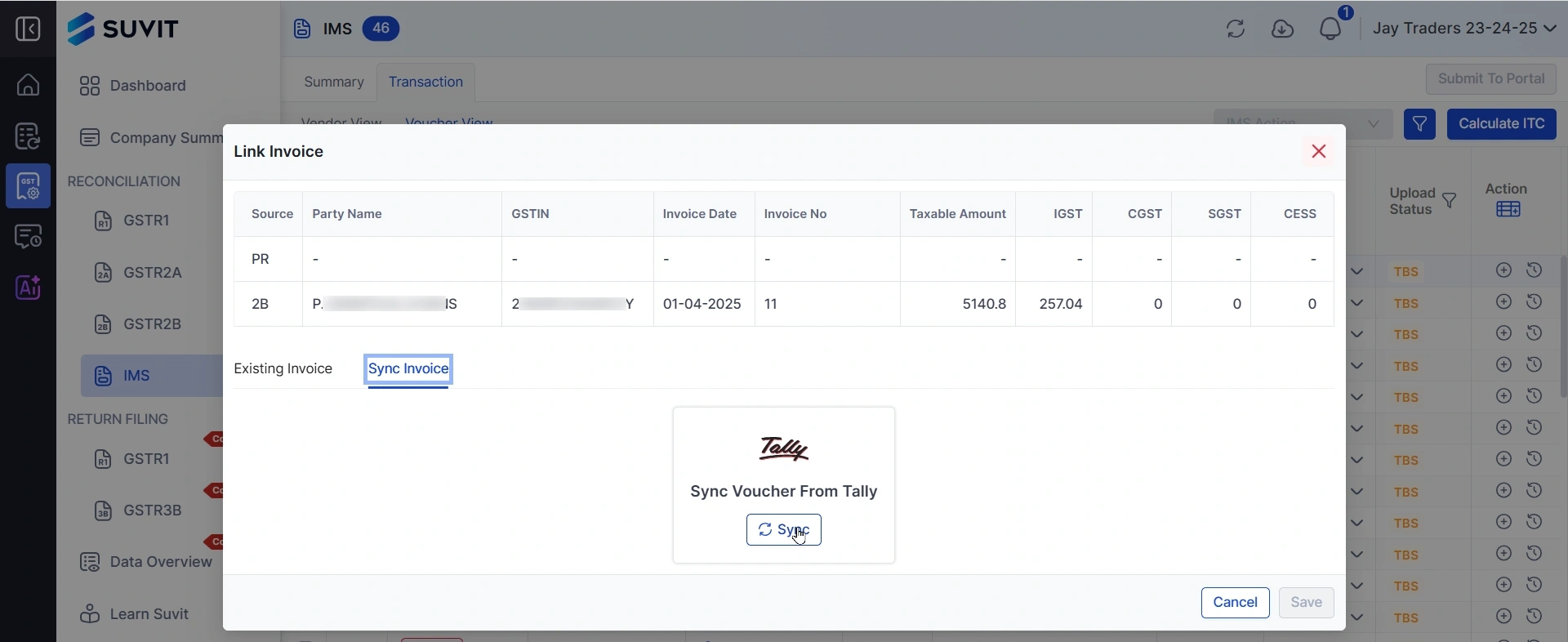

→ Click Link under the PR column for the mismatched row.

→ This opens a panel showing the GST invoice and lets you match it to an existing PR invoice.

Can’t find the invoice to link?

→ Go to the Sync Invoice tab

→ Click Sync to pull the latest data from Tally

Then try linking again.

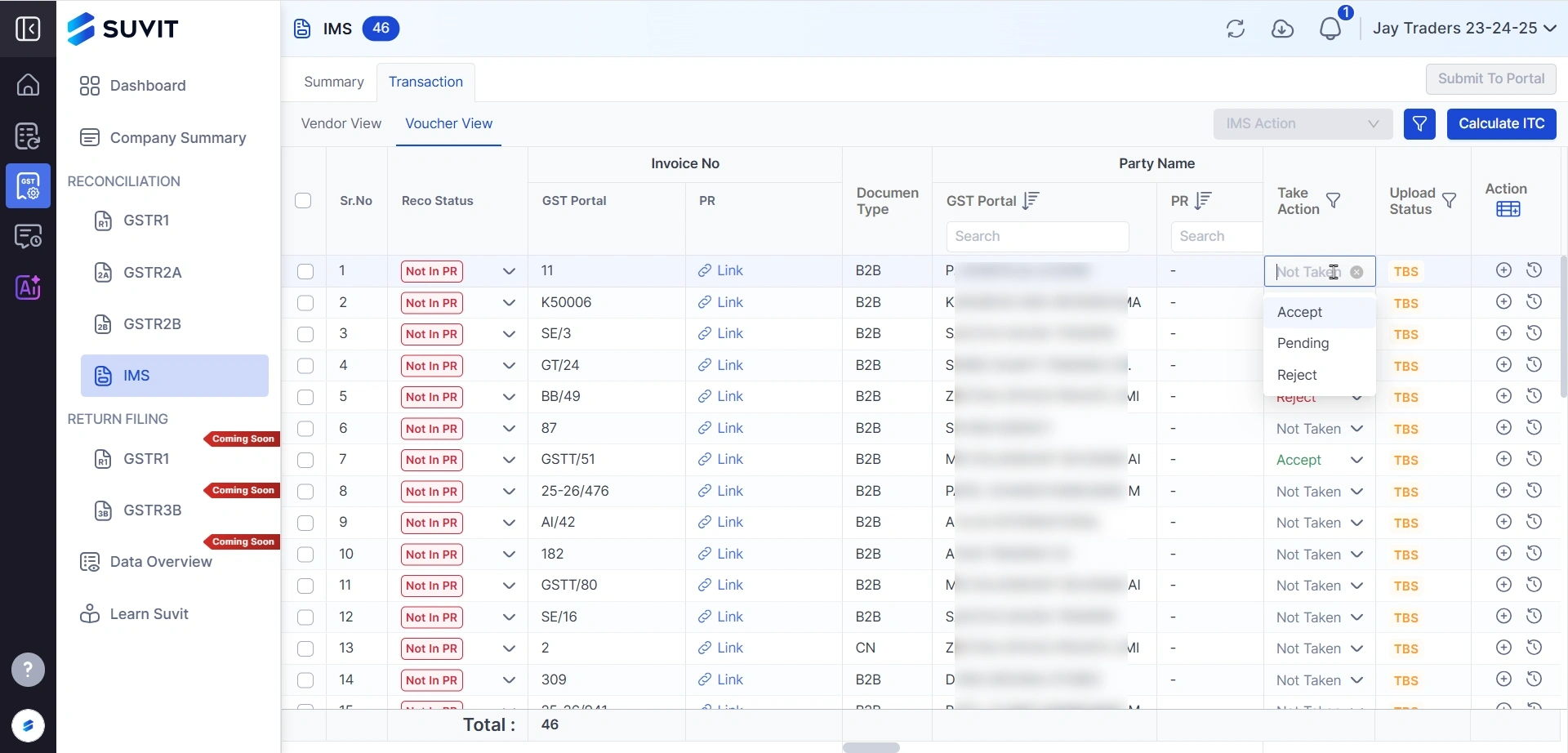

Use the Take Action dropdown:

→ Accept – Confirm the invoice is fine

→ Reject – Not acceptable due to mismatch

→ Pending – Yet to take action

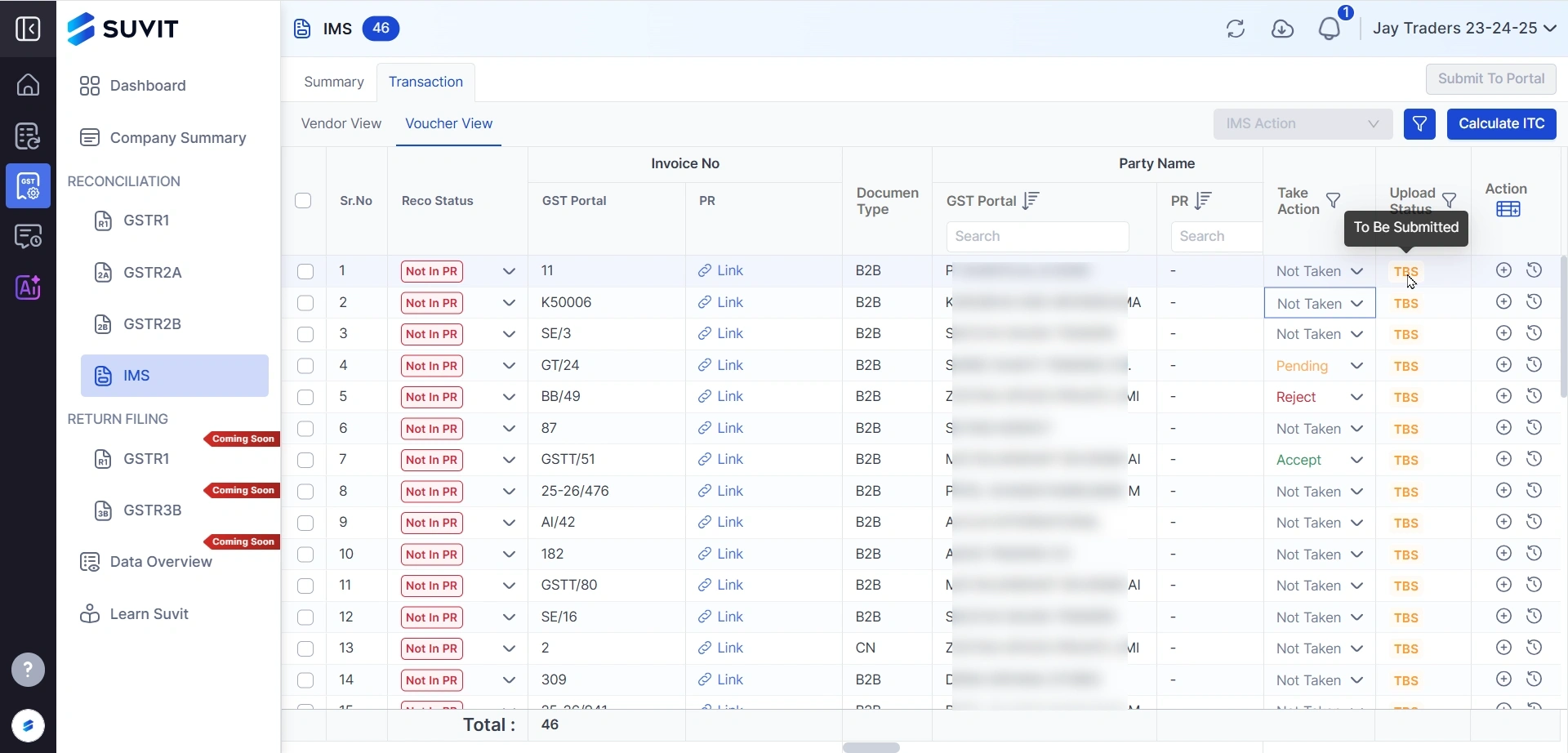

TBS = To Be Submitted

→ This tag appears after you’ve matched or accepted the invoice.

→ It signals that the invoice is ready for submission.

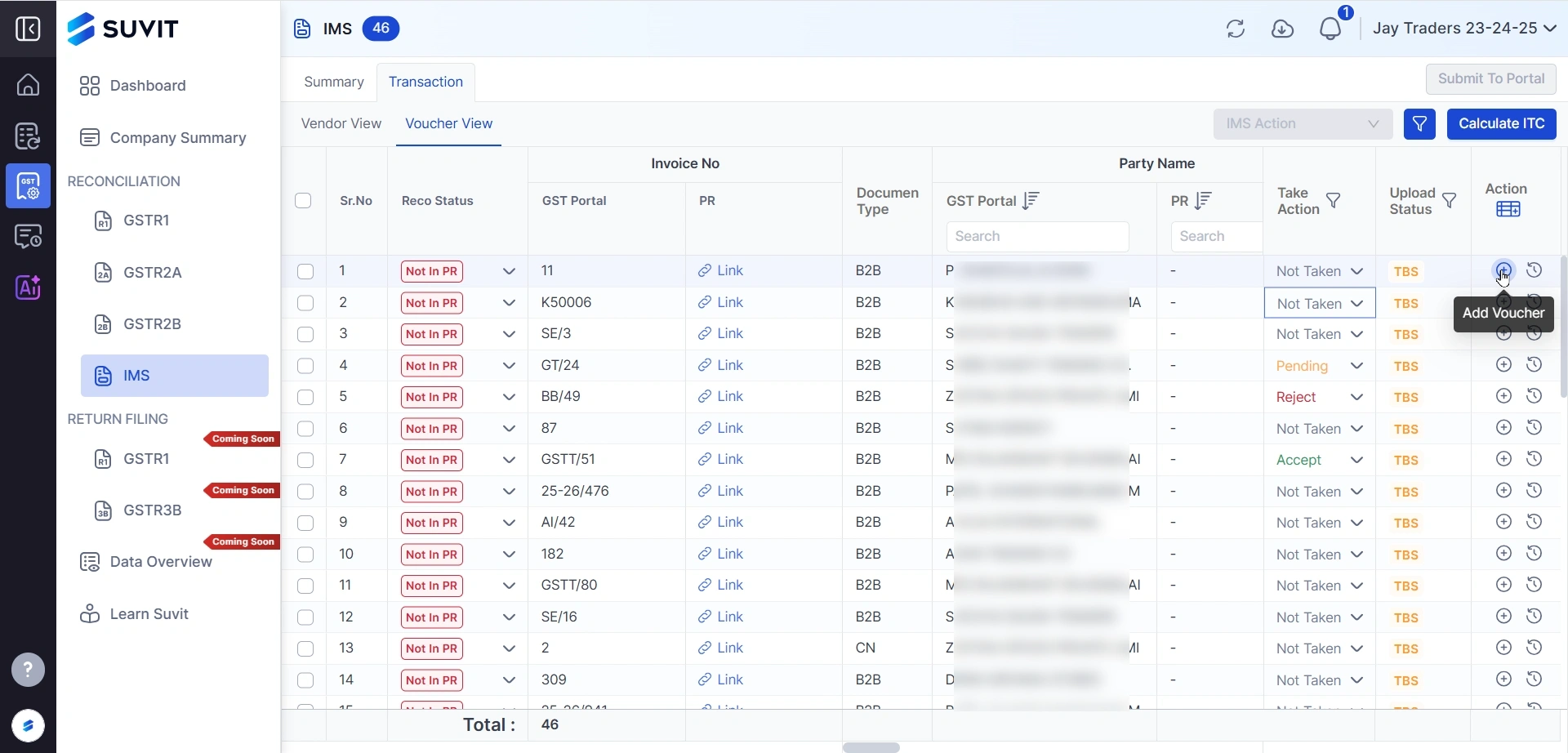

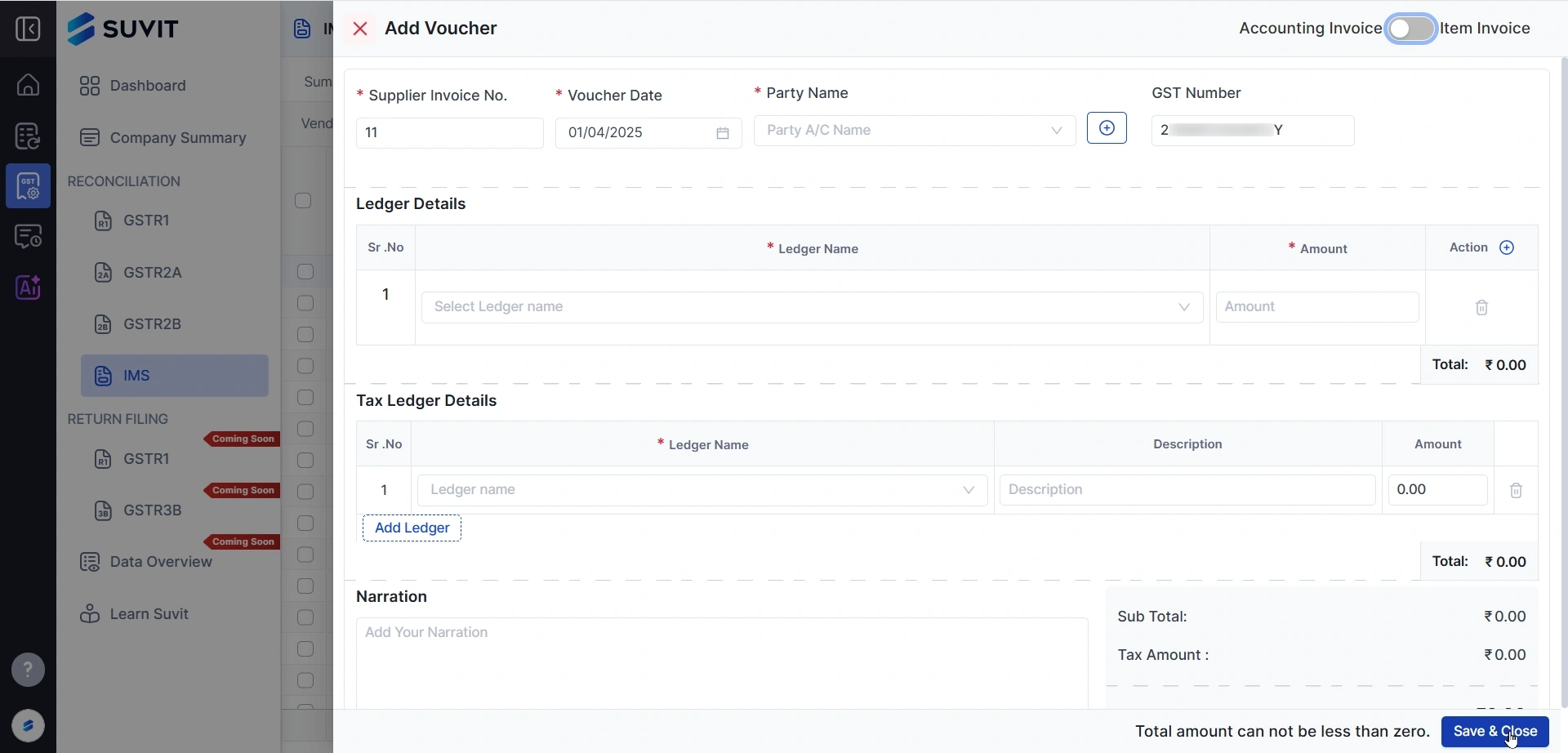

Some GST Portal invoices may not exist in your PR.

→ Click the plus (➕) icon and select Add Voucher

Add full voucher info:

→ Supplier Invoice No, Date, Party Name, GST No, etc.

→ Ledger Details & Tax Breakdown

→ Then click Save & Close

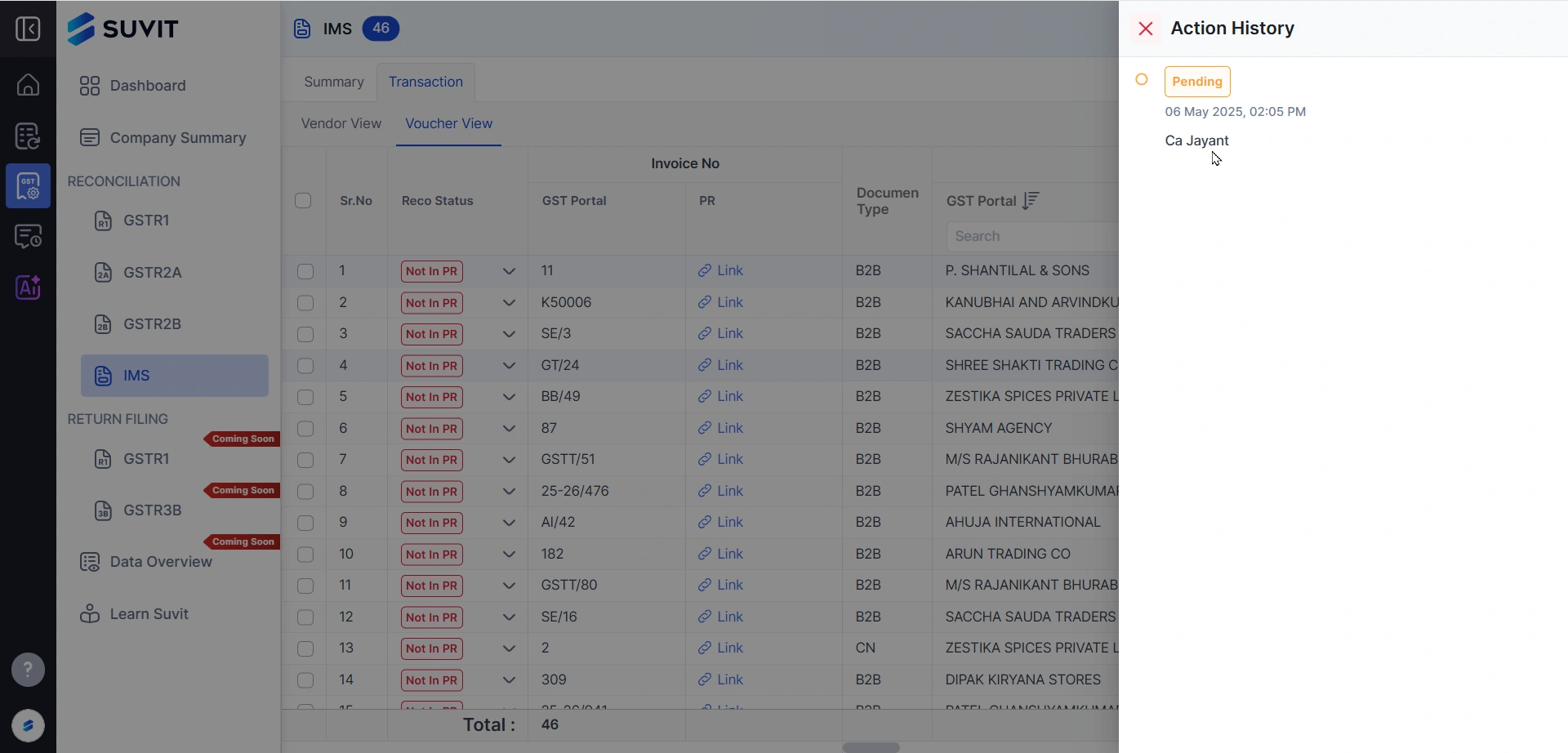

→ Click the clock icon under Action column

→ It shows who accepted/rejected the invoice and when

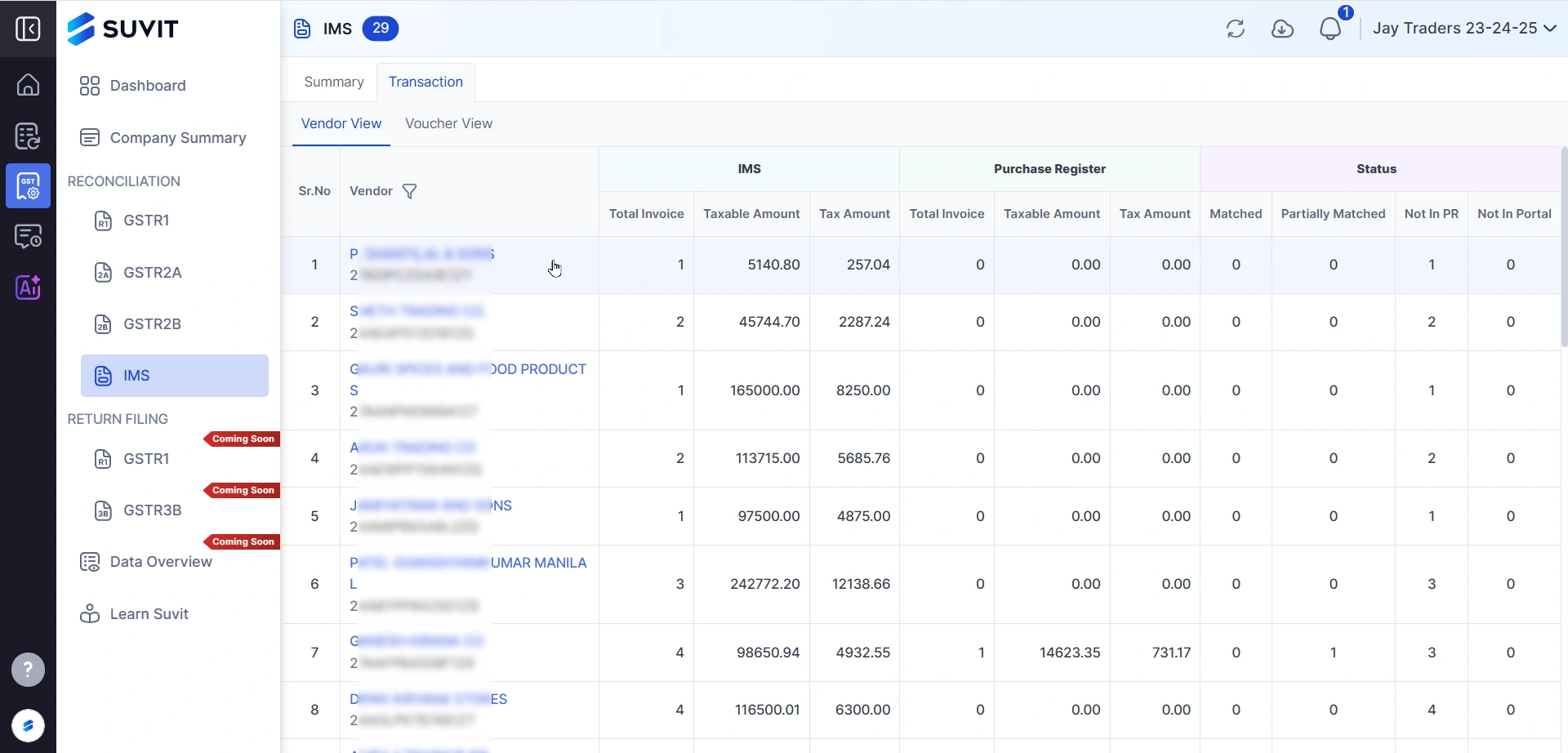

📇 IMS – Vendor View Screen (See Vendor-wise Mismatch) This view gives you a vendor-wise breakdown of how your GST Portal data matches with your Purchase Register (PR).

→ Vendor: Name of the supplier and their GSTIN

→ IMS Section: Shows how many invoices and how much tax value was found from GST portal

→ Purchase Register Section: Shows how many entries were found in your PR data

→ Status Columns:

- Matched – Entries match exactly

- Partially Matched – Some differences exist

- Not in PR – Data is missing in PR

- Not in Portal – Data is missing in GST portal

→ It lets you:

- Identify vendors with mismatches quickly

- Focus on those with “Not in PR” to take action

- See overall tax difference between IMS & PR

✅ Use Case Example: If vendor "DIPAK KIRYANA STORES" has 4 invoices “Not in PR”, that means invoices exist in GST portal but not in your purchase register — so you can now add missing vouchers or link existing ones.

Suvit IMS helps CAs and teams:

This keeps your GST records accurate and team actions transparent!