The data of sales/purchase/credit note/debit note with multiple GST % applicable need to be mapped in common GST tally tax ledgers. This article is curated to learn how to map such excel sheet.

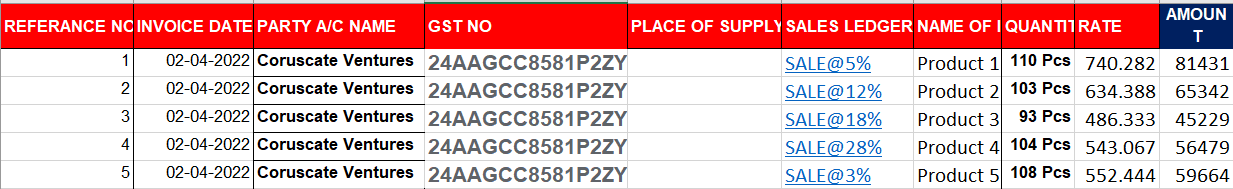

If you have the sheet containing data where multiple GST % is applicable. Like below Image:

The Sale/Purchase ledgers must have GST % set already in your tally if you want to automatically calculate the tax amount.

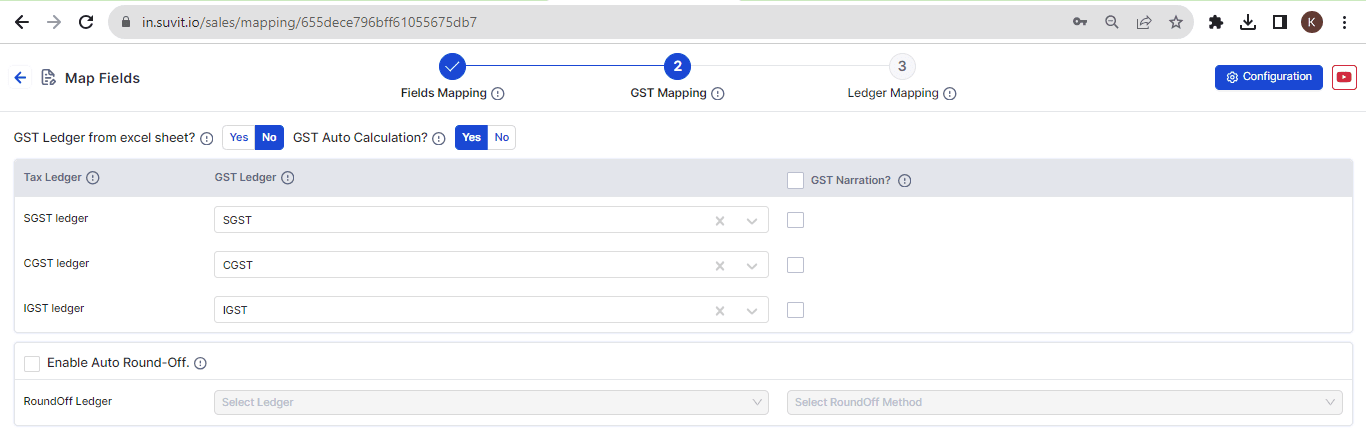

In tax ledger mapping, the "Select ledger" will allow you to select ledgers which are there in your tally. Refer image below where common "Sgst", "Cgst" & "Igst" are selected and mapped:

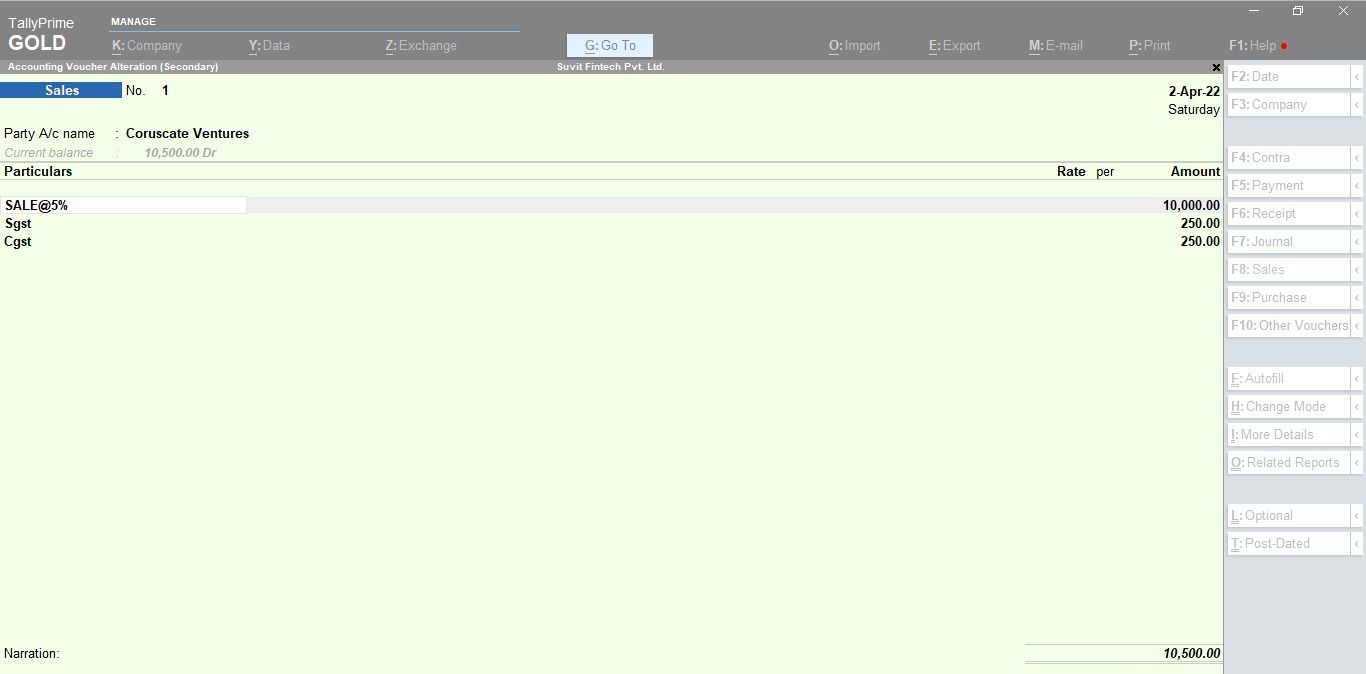

Your entry will look like in tally like this(Sample entry in tally).