If single GST applies and common GST ledgers like SGST, CGST & IGST are used in Tally, follow this article to process such data correctly in Suvit.

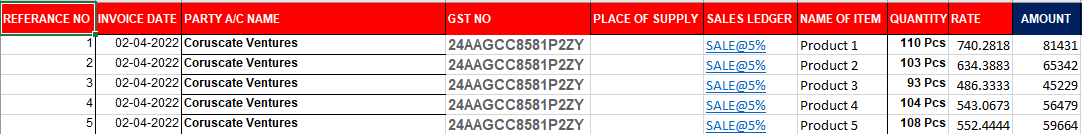

If you have the sheet containing data where single GST % is applicable. Like below Image:

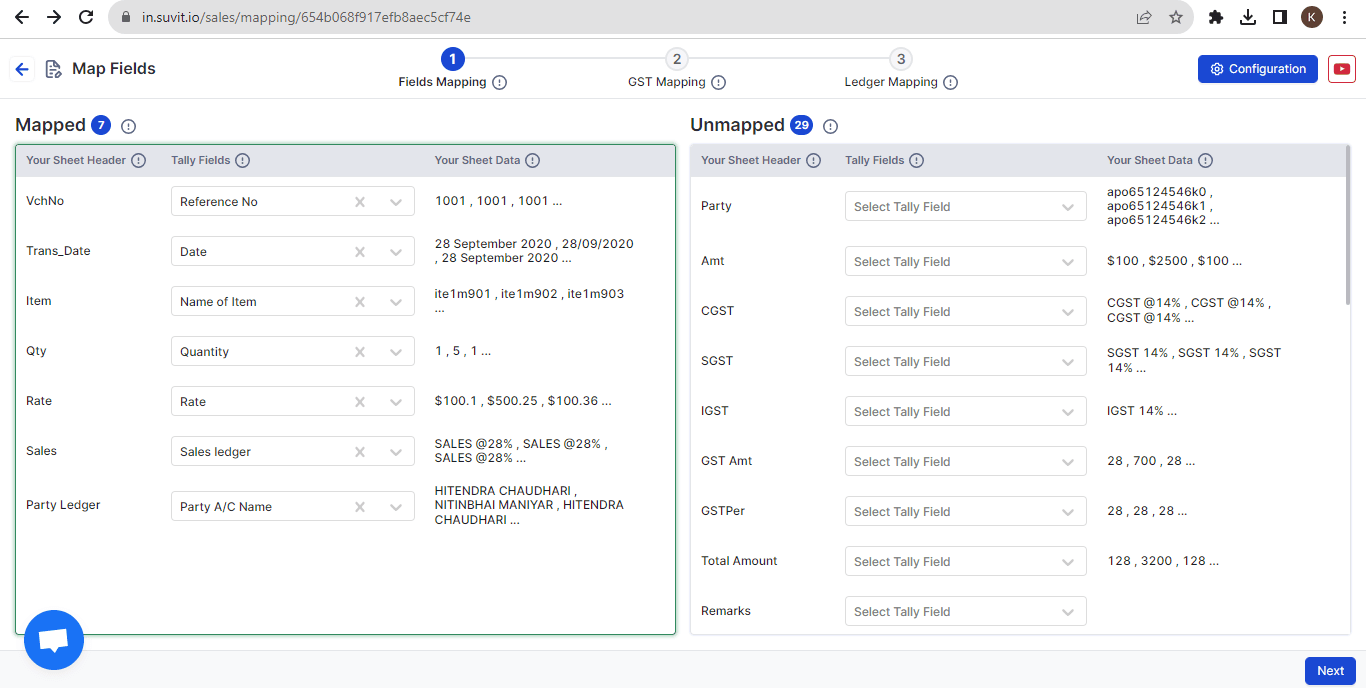

As you upload the sheet and click on "Complete", the following mapping screen will appear. Suvit will automatically map fields and rest will be shown in unmapped. You need to cross check once if the auto mapping was correctly done as per your need and make required changes.

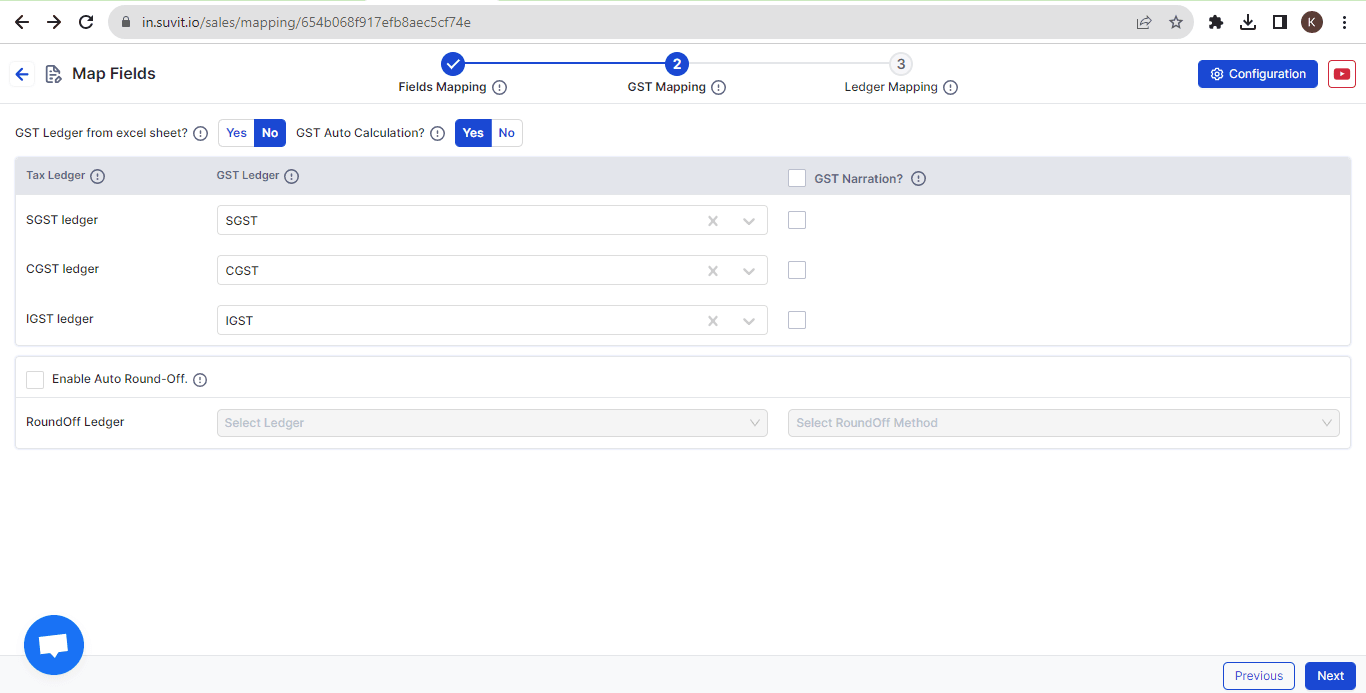

In GST mapping, you need to map the required tally GST ledgers as per your data available. Refer below Image in case you require the GST Calculation automatic. The GST % must be set in your Sales ledger or Stock item in tally, only then it will be automatically calculated on the amount you have selected in "Fields mapping".

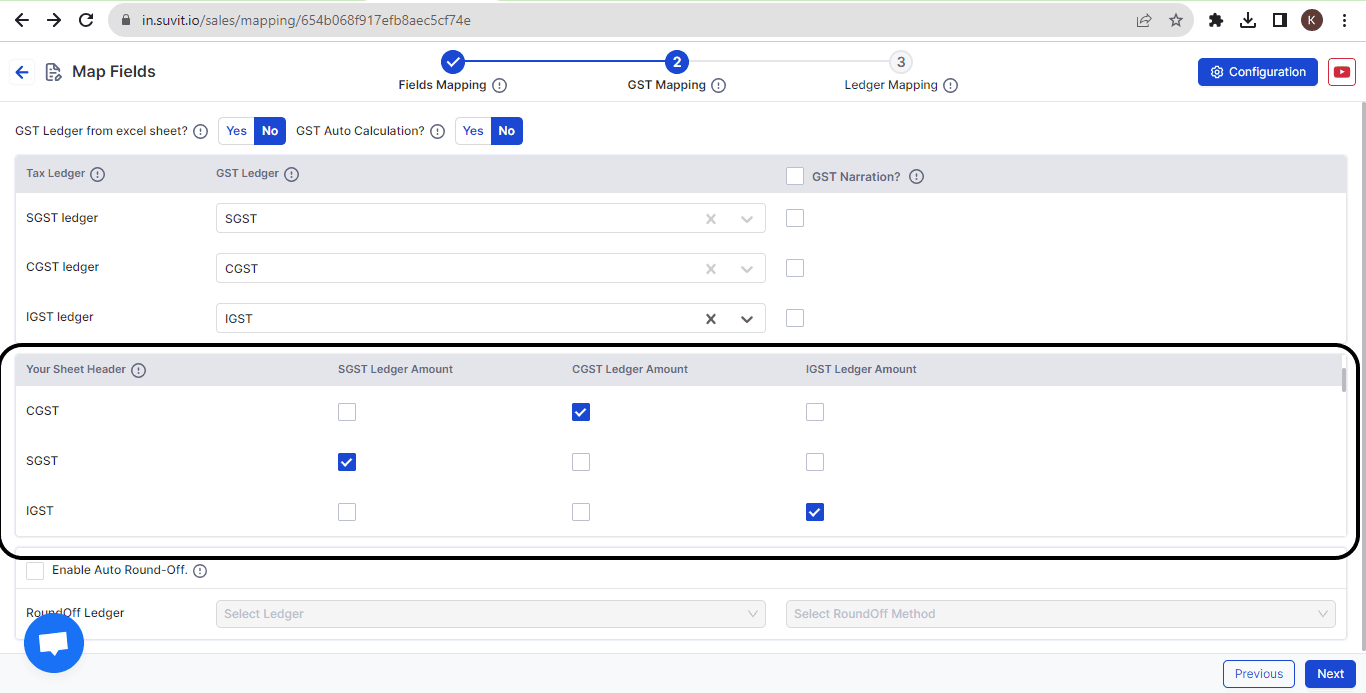

If you require GST amount as per mentioned in your excel sheet, please refer below screenshot, the "GST Auto Calculation" must be selected as NO and a new section will get open as highlighted in below image:

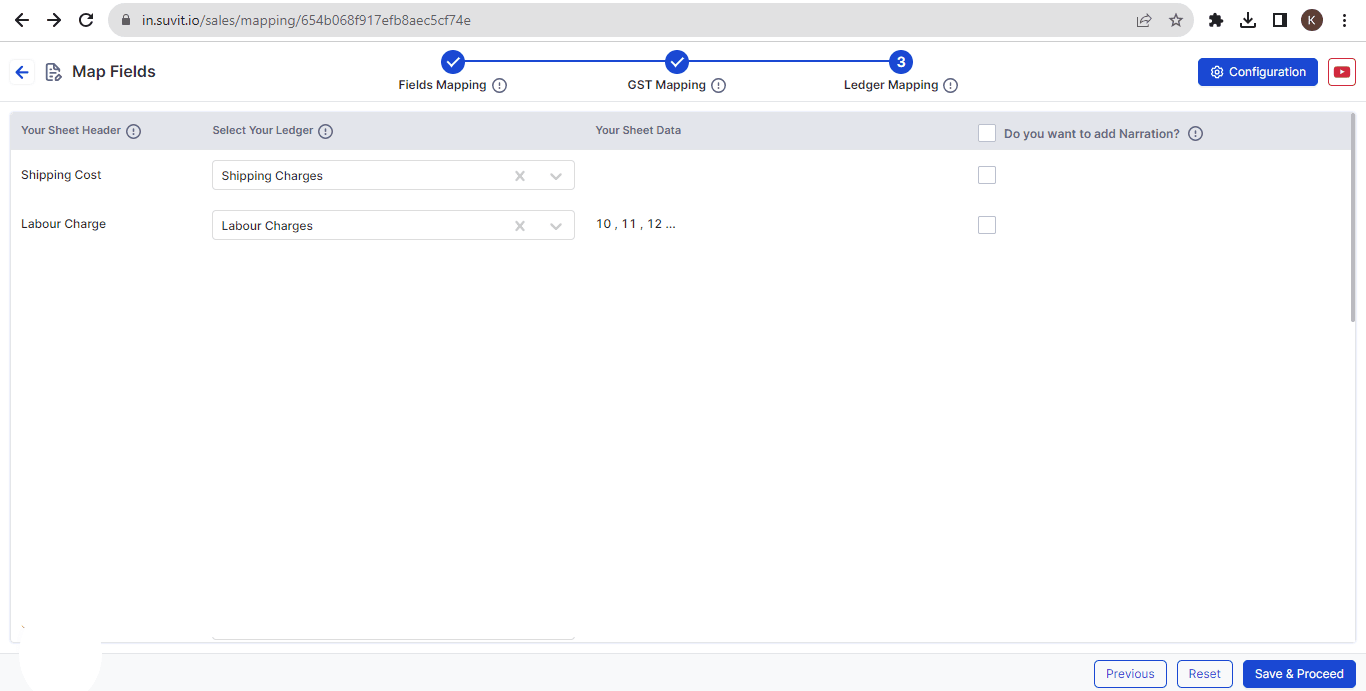

As you click on Next, the "Ledger Mapping" section will open and if you have any additional ledgers to be mapped apart from the GST ledgers, kindly select it in here, refer below image for understanding:

After completing, click on "Save & Proceed", the transaction screen with your data will appear. See if there are any unselected fields, make changes accordingly and save the data records & send to tally.