A step by step guide to map the data where Single GST rate is applicable with respective GST ledgers defined in tally. Read on to know more about the process.

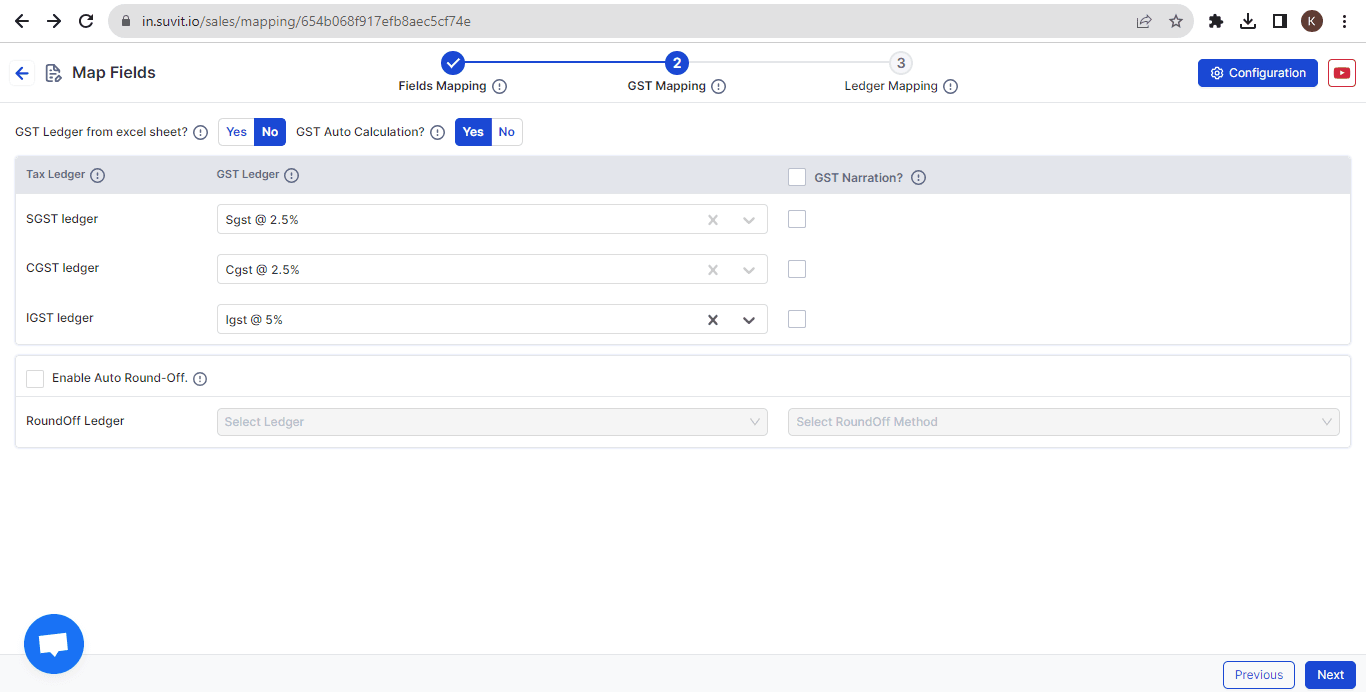

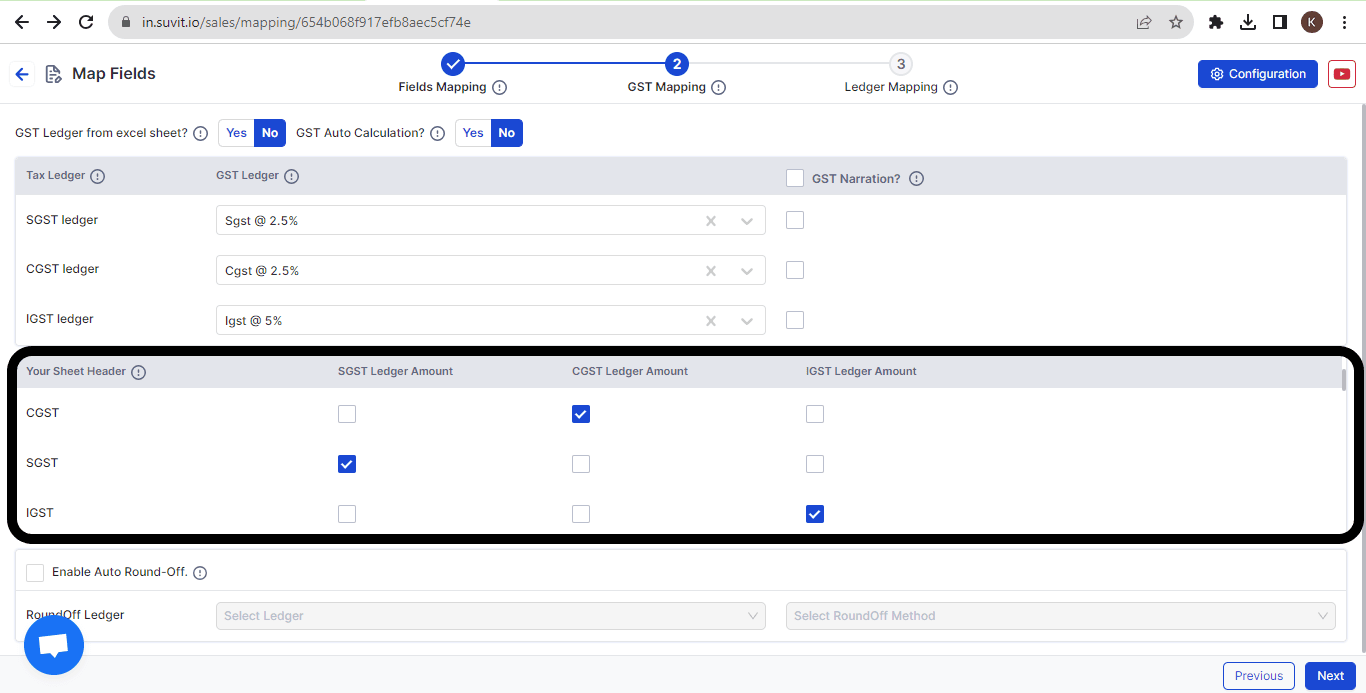

- If you require the GST amount as per mentioned in your Excel sheet, please refer to the below screenshot. The **"GST Auto Calculation"** must be selected as **NO**, and a new section will open as highlighted in the image below:

-After completing the ledger mapping, click on "Save & Proceed." The transaction screen with your data will appear. Review and ensure there are no unselected fields. Make any necessary changes and save the data records, then send them to Tally.

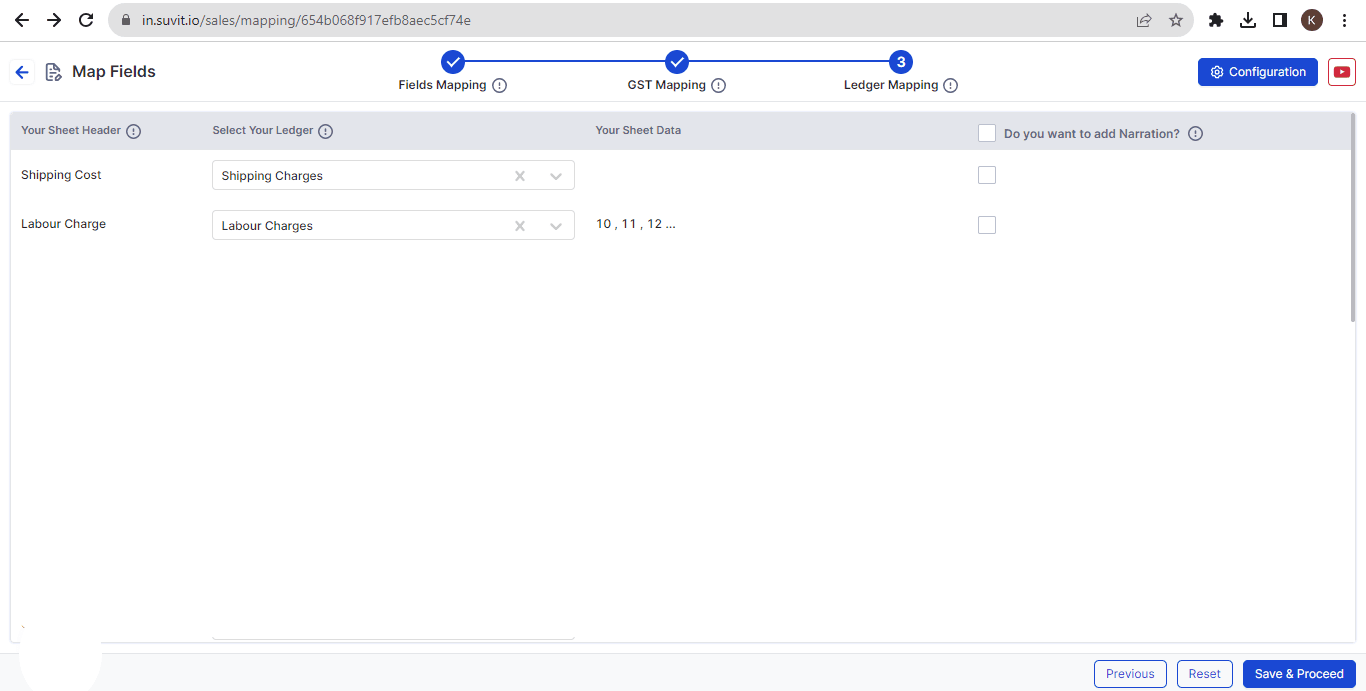

- As you click on **Next**, the "Ledger Mapping" section will open. If you have any additional ledgers to be mapped apart from the GST ledgers, kindly select them here. Refer to the image below for understanding:

![4As per sheet calc.png]

- After completing the ledger mapping, click on "Save & Proceed." The transaction screen with your data will appear. Review and ensure there are no unselected fields. Make any necessary changes and save the data records, then send them to Tally.