If GST Auto Calculation is set to "Yes", Suvit uses the percentage from your Sales/Purchase Ledger. If not defined, auto calculation won't work. Learn more here.

Suvit enter the data into your system according to your Tally settings. So its mandatory to fill proper and complete data while creating any company, party name, sales account etc.

Kindly Check Few details and then sync the ledgers again:-

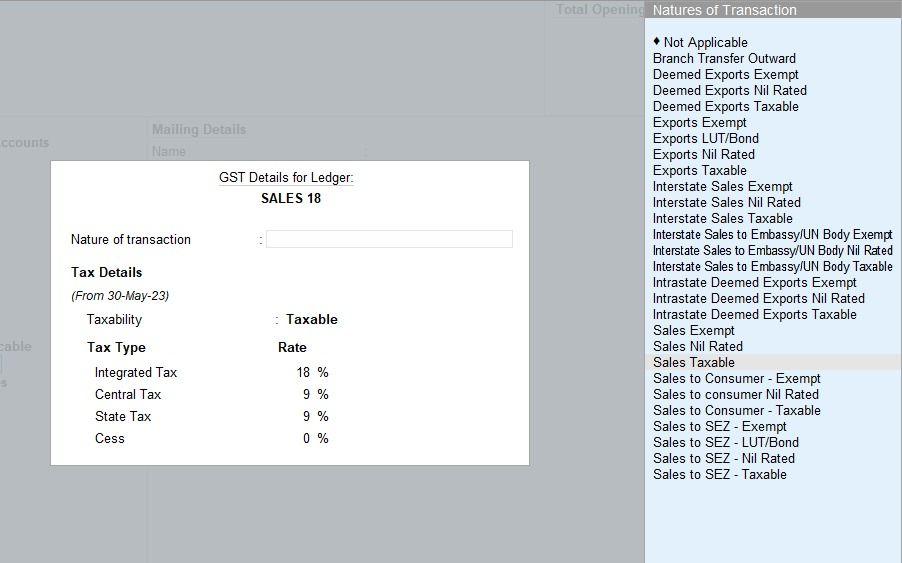

Step 1: Check if Sales account is defined properly in tally if not define it properly.

Below is a sample image:-

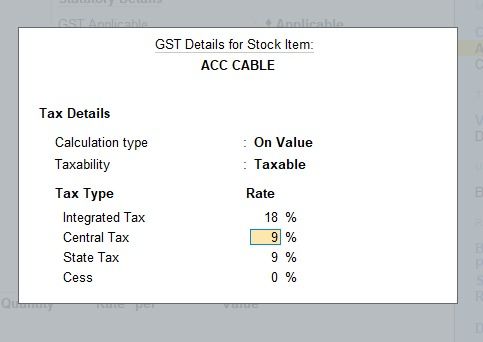

Step 2: If you are Doing work on data with Stock items. One can also check Stock Item where GST rate is defined or not.

Below is a sample image:-

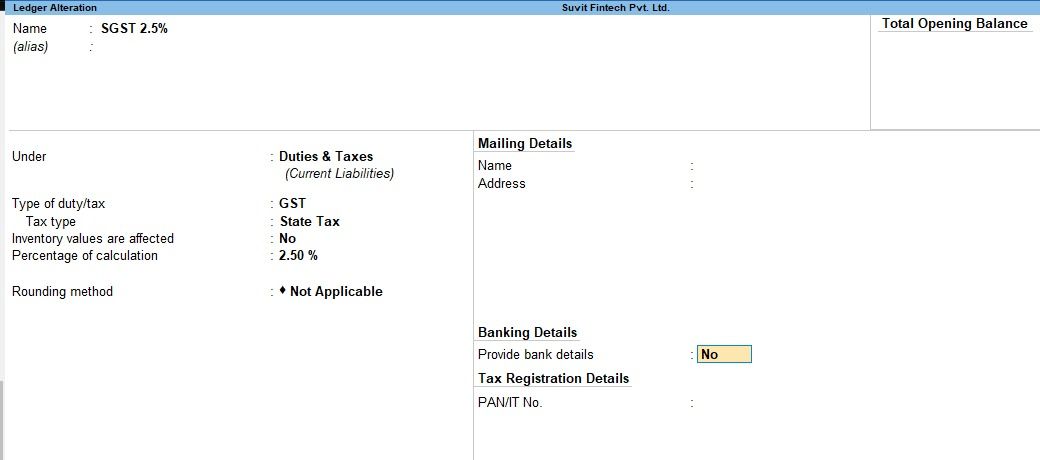

Step 3: If you are calculating your GST through tax ledgers (Duties and taxes). Define GST rate on SGST, CGST & IGST Ledgers.

Below is a sample image:-