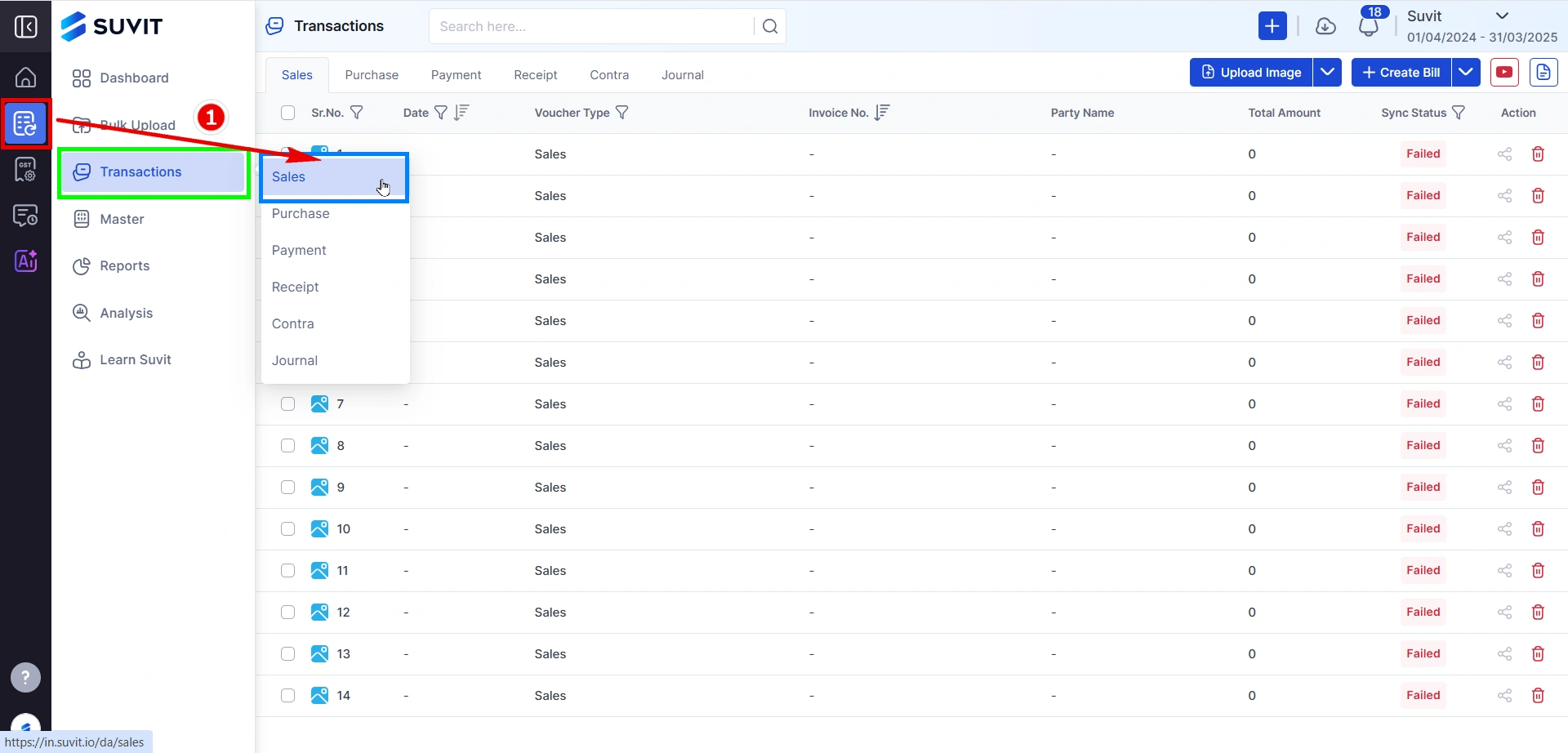

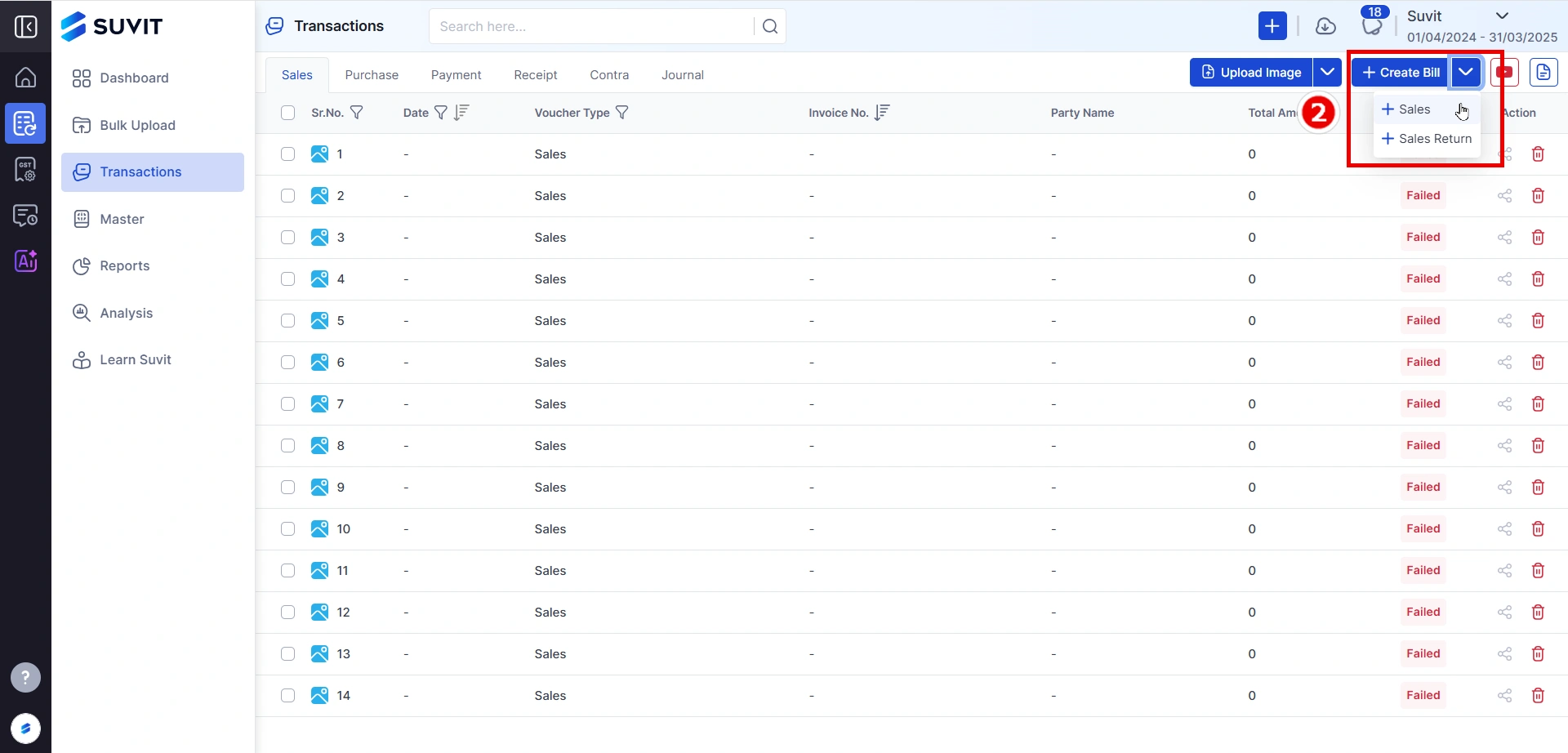

This guide helps you efficiently create Sales and Sales Return invoices in Suvit, ensuring accurate data entry and smooth integration with Tally.

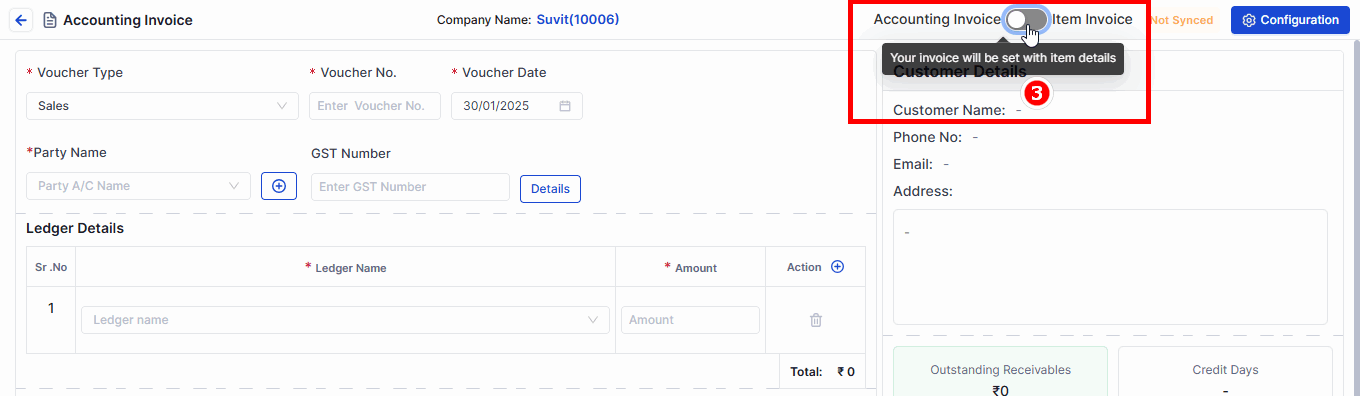

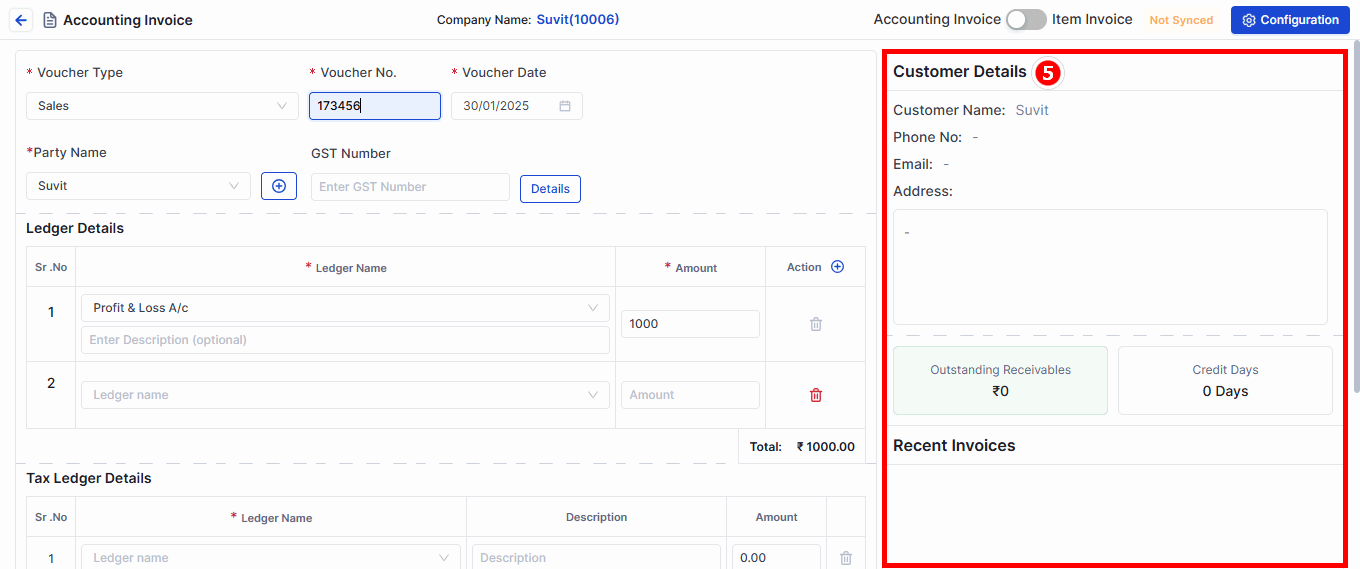

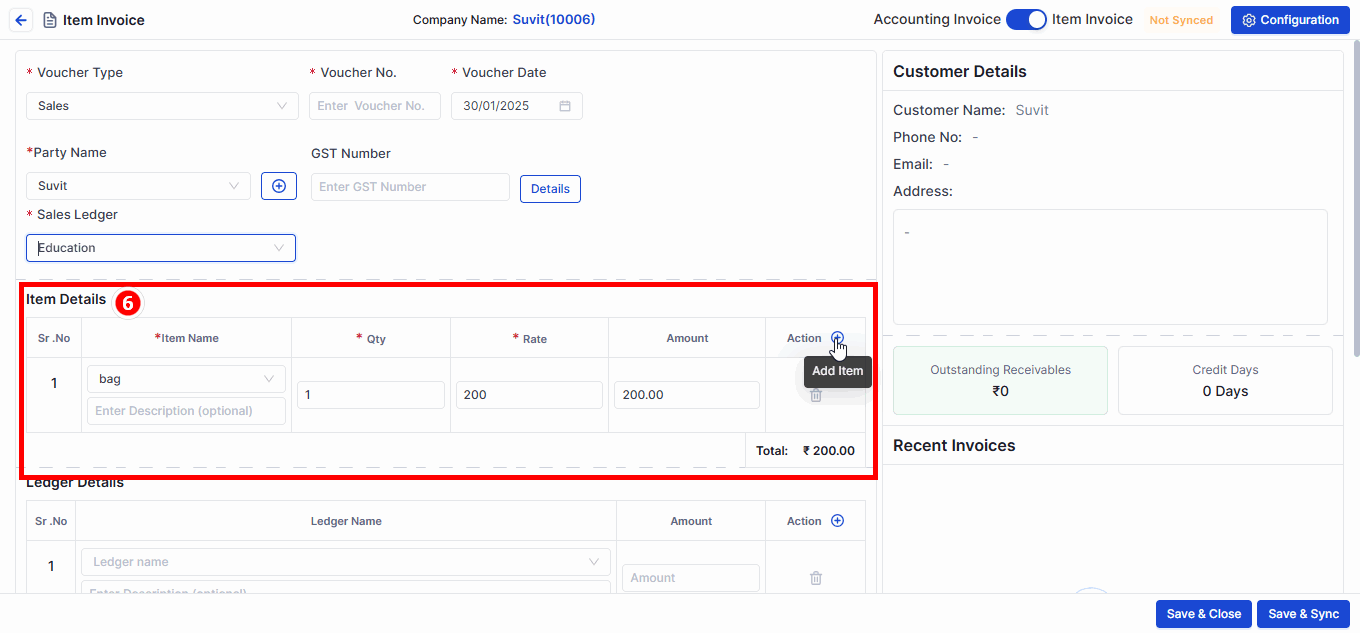

Pick one of the two:

→ Accounting Invoice = Without Stock Items

→ Item Invoice = With Stock Items (use this if you’re selling goods)

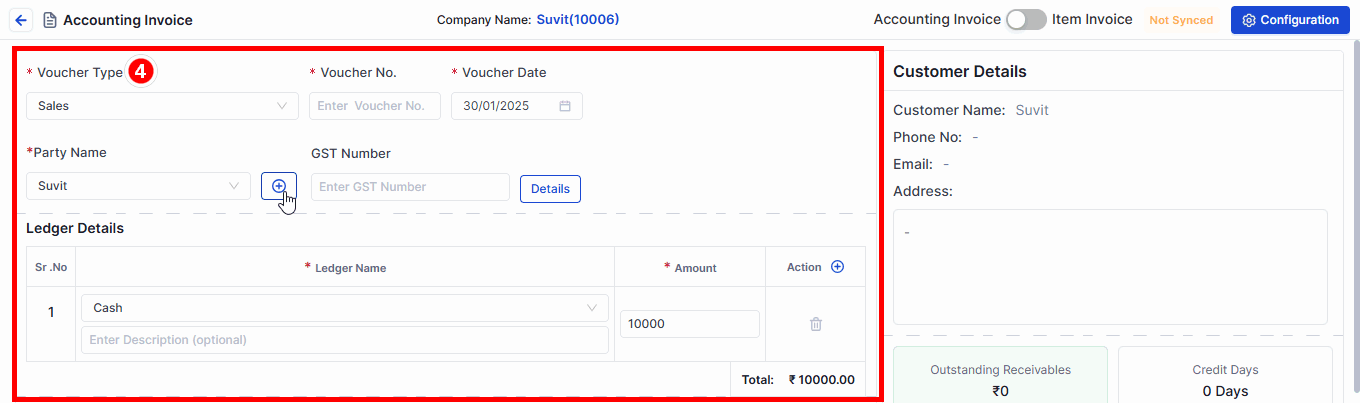

Choose the following:

→ Voucher Type (e.g. Sales)

→ Voucher No. (like invoice number)

→ Voucher Date (date of invoice)

→ Party Name (customer name)

→ GST Details will auto-fill from Tally

→ Ledger Name (like "Sales @ 18%")

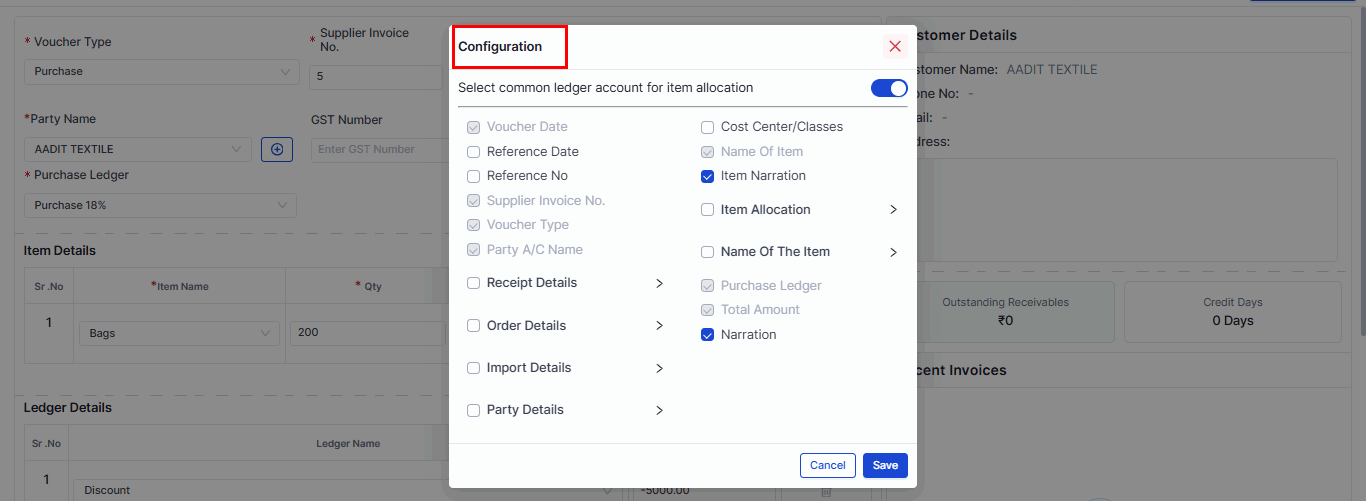

- Use the Configuration window to select the fields displayed during voucher entry.

- such as Voucher Date, Supplier Invoice No., Item Narration, etc. Save the changes once done.

💡 If you have multiple items, just keep adding them one by one!

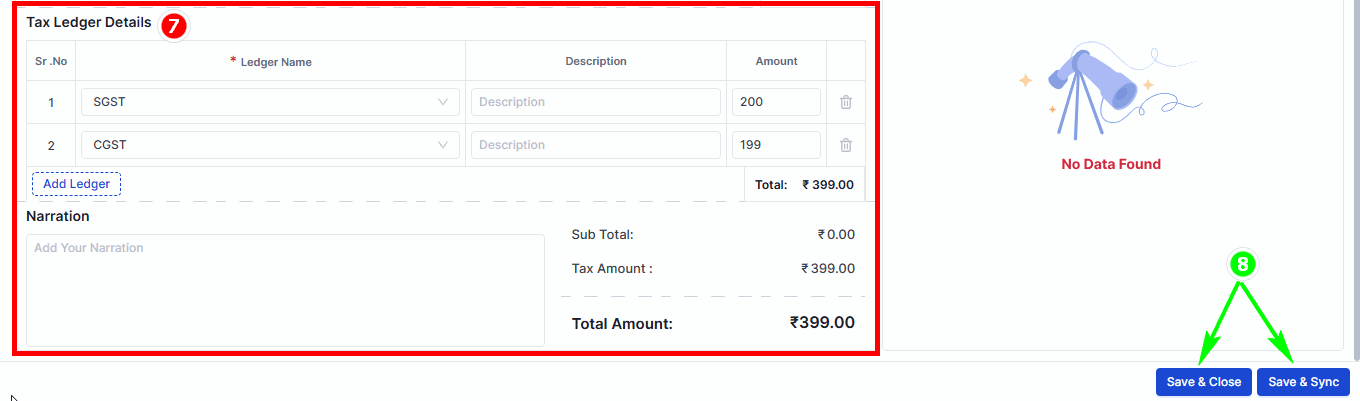

📌 Fields marked with "*" must be filled in — no skipping!

Want to upload Sales/Sales Return bills using images or PDFs?