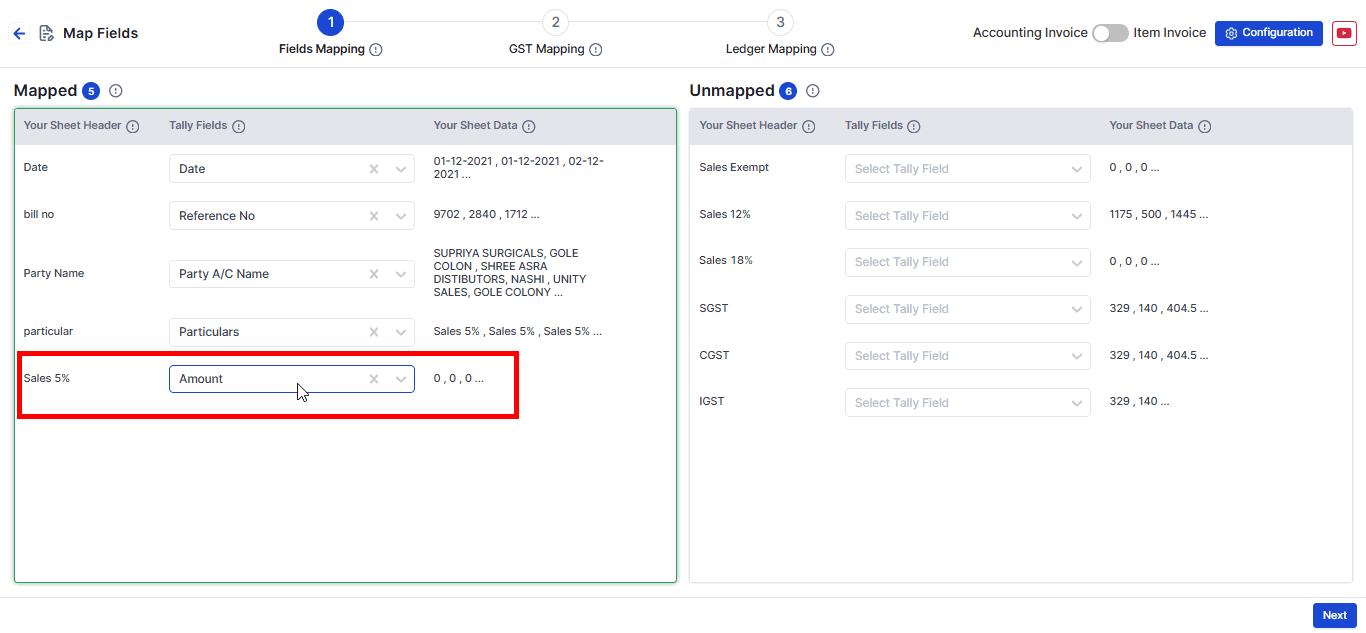

Horizontal Sheet Multiple GST with Common tally tax ledger

Here we will guide you to map common tally tax ledgers in case where your data is of multiple GST rate applicability.

Horizontal Sheet with Multiple GST Rates and Common Tally Tax Ledger

If your sheet has multiple GST percentages in a horizontal format, follow these steps to map and post tax amounts into respective Tally tax ledgers.

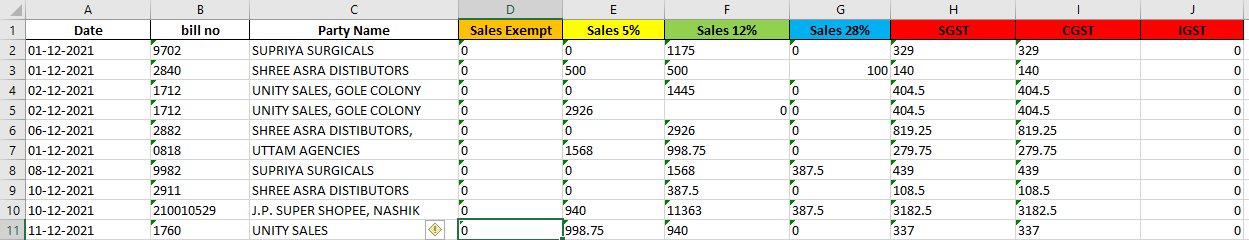

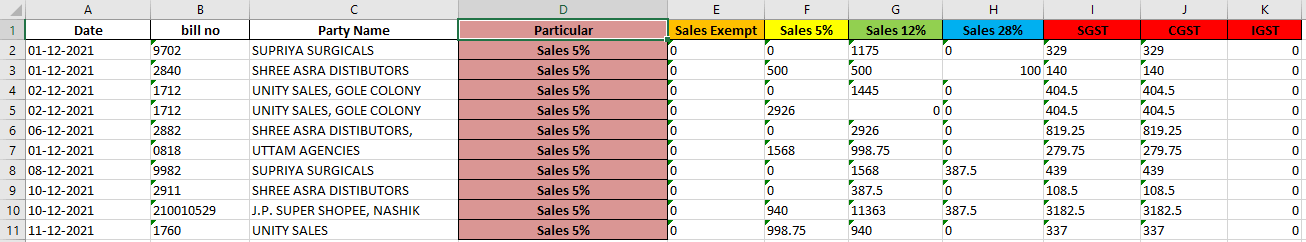

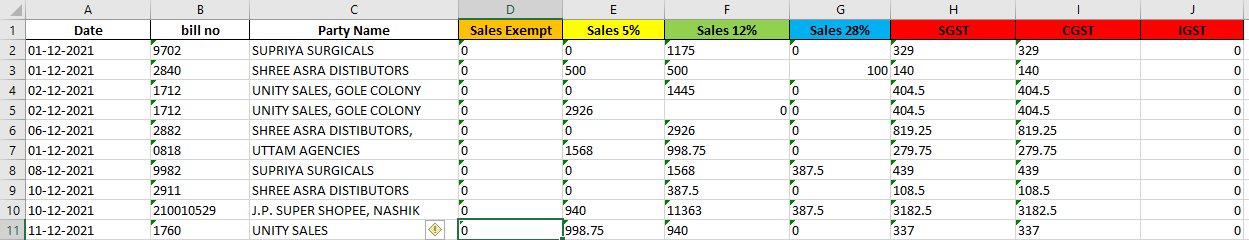

Step 1:Sheet Modifications

- Modify your sheet as shown in the image above.

- In the Particulars column, add one of the ledgers corresponding to the GST rates in your sheet.

- Example: If your sheet has Sales Exempt, Sales @ 5%, Sales @ 12%, Sales @ 18%, and Sales @ 28%, select Sales @ 5% for illustration.

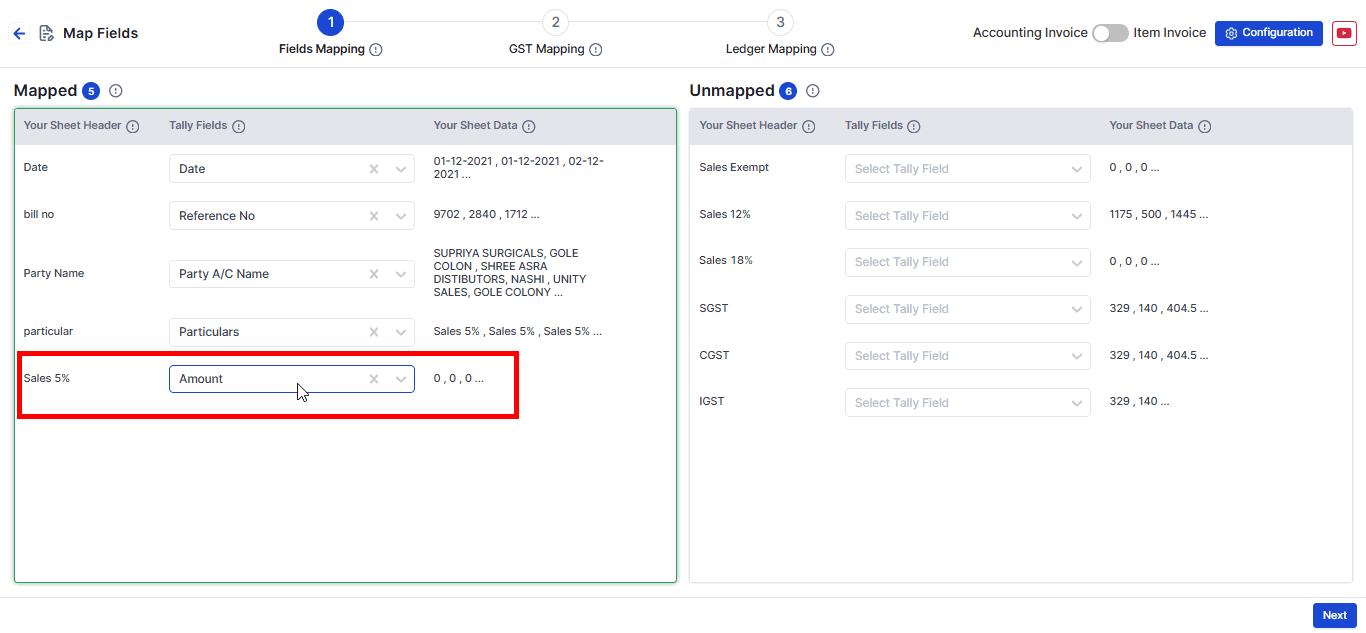

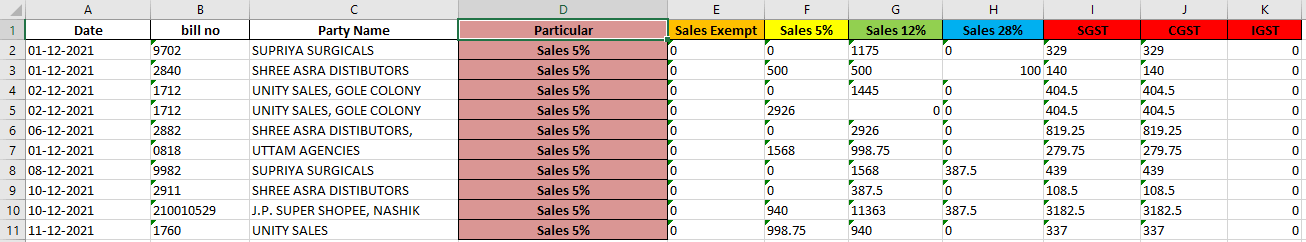

Step 2: Map Sales Account Amounts

- If there are multiple sales accounts, choose a specific one (e.g., Sales @ 5%) and map its amount to the Amount field in field mapping.

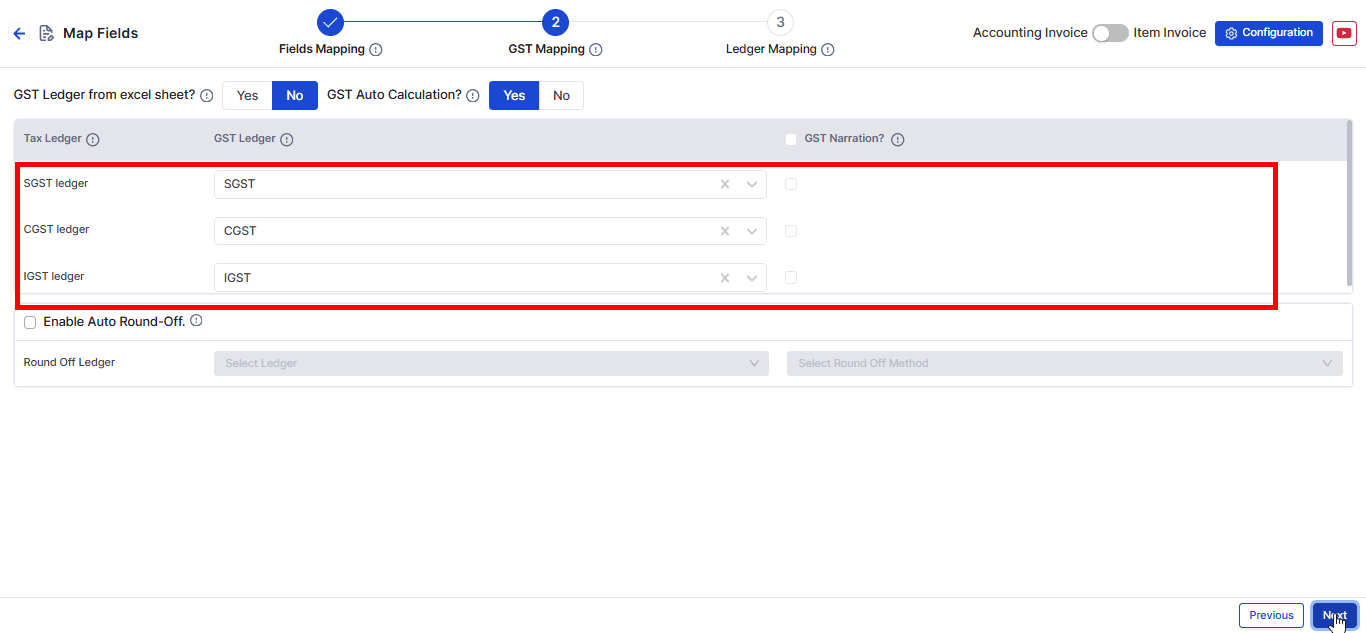

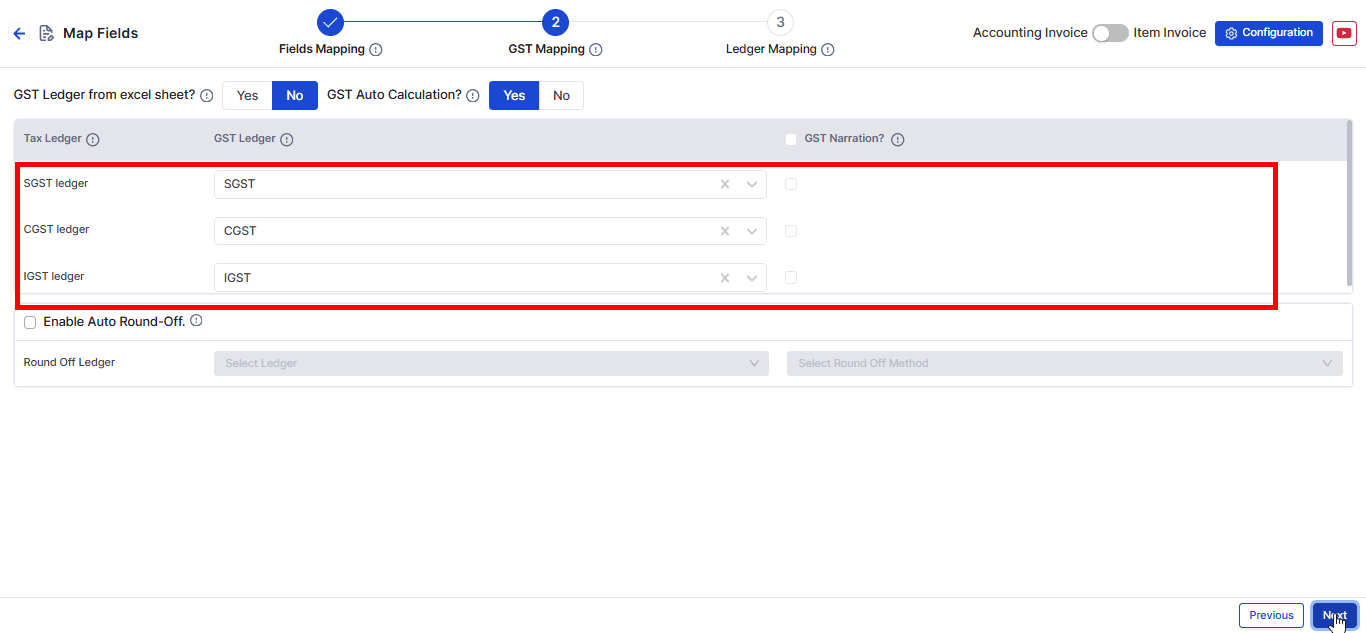

Step 3: Map GST Ledgers

- In the GST Ledger section, select the common tax ledgers used in Tally, such as SGST, CGST, and IGST.

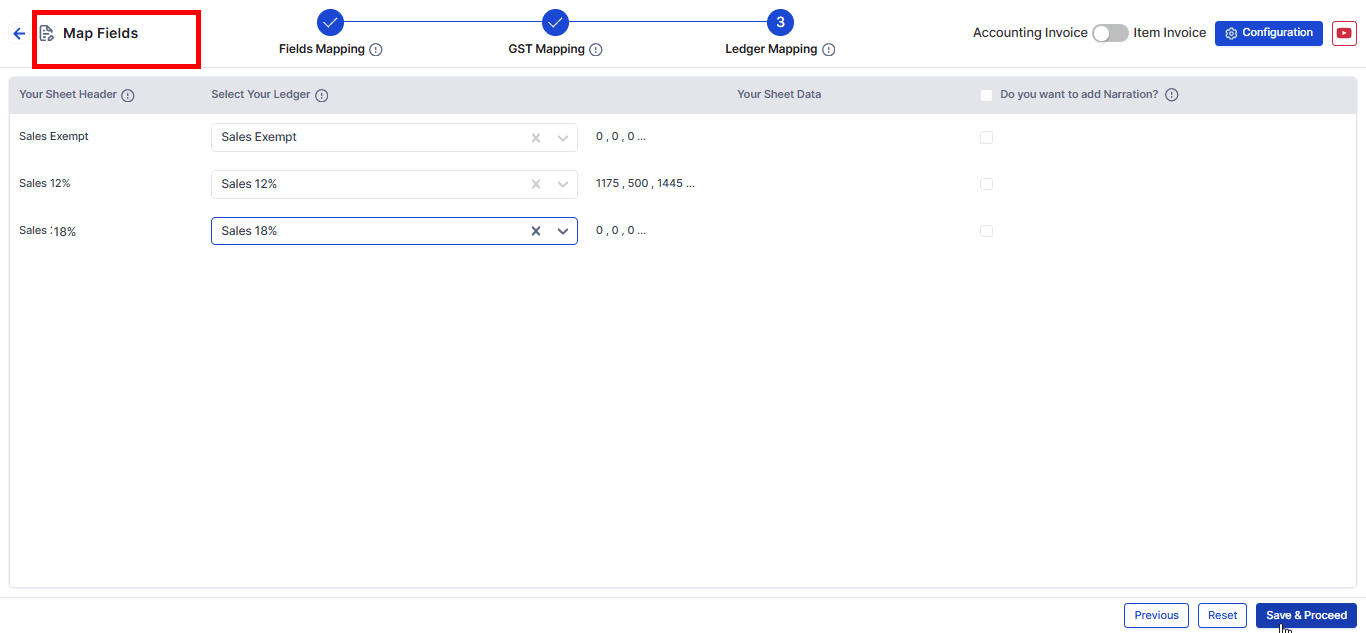

Step 4: Map Other GST Rates

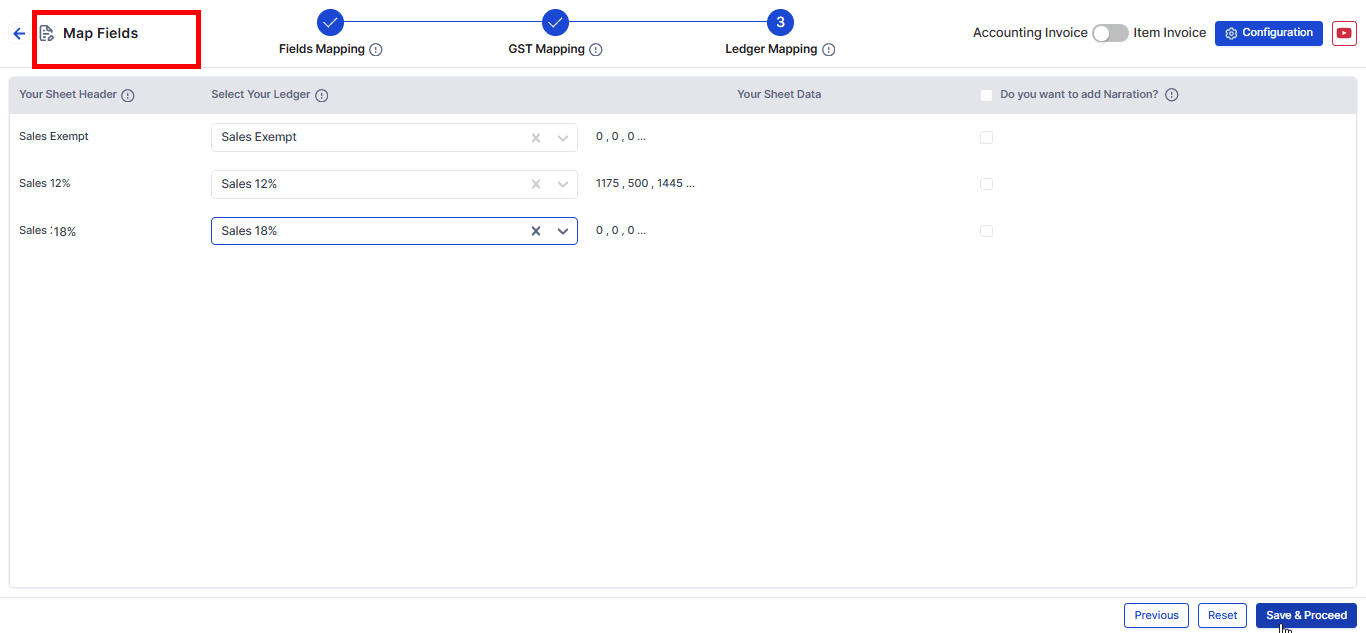

- For other GST rates like Sales @ 12%, Sales @ 18%, Sales @ 28%, and Sales Exempt, map them in the Ledger Mapping section.

- Under Your Sheet Header, find the corresponding headers from your uploaded sheet.

- Under Select Your Ledger, choose the respective tax ledgers available in Tally.

Summary ✍

- By mapping GST percentages and ledgers correctly, Suvit ensures that tax amounts are posted accurately into respective Tally tax ledgers.

You may find this helpful:

- For a detailed step-by-step guide on mapping horizontal tax rates and using common duties and taxes in Suvit, Learn more.