Multiple Tax Rates with SGST/CGST/IGST in Purchase

Learn to map purchase bills with multiple tax rates using common Duties & Taxes ledgers in Suvit. Follow steps for Excel upload and GST ledger mapping.

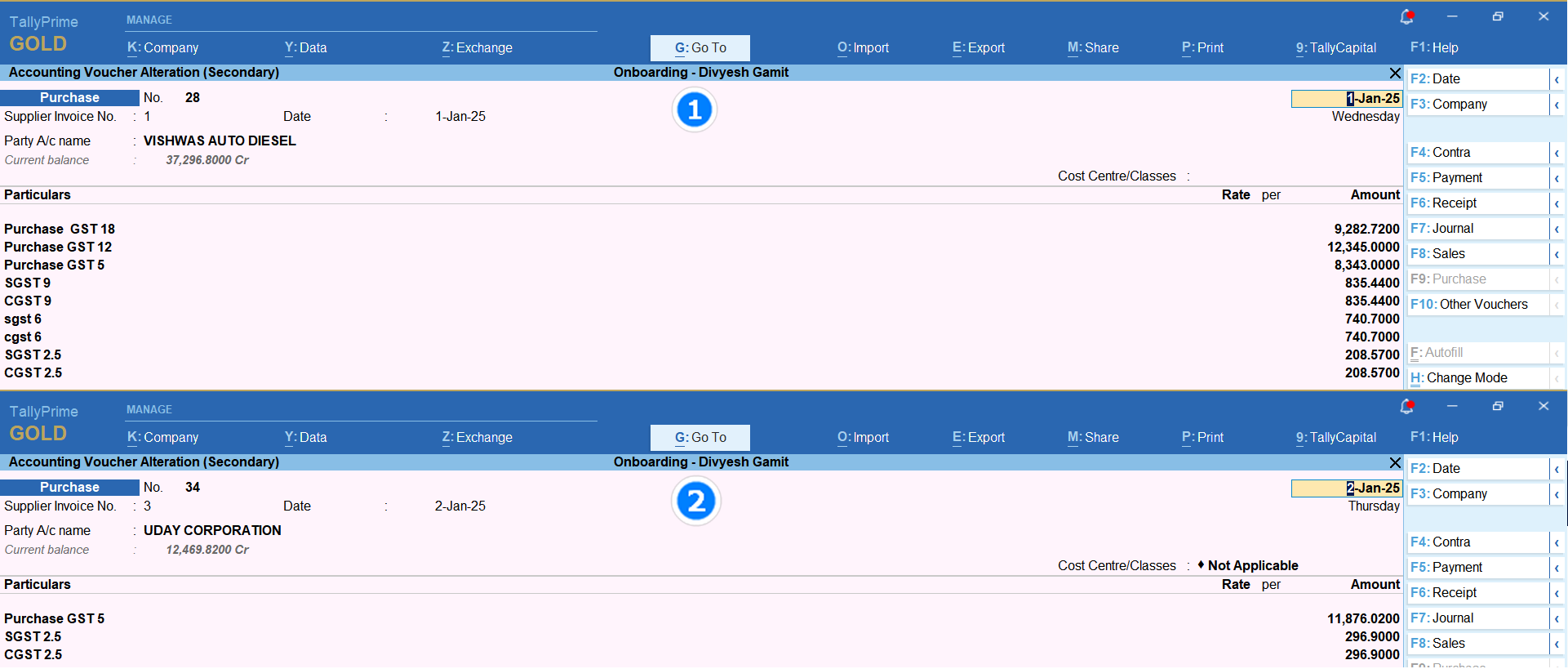

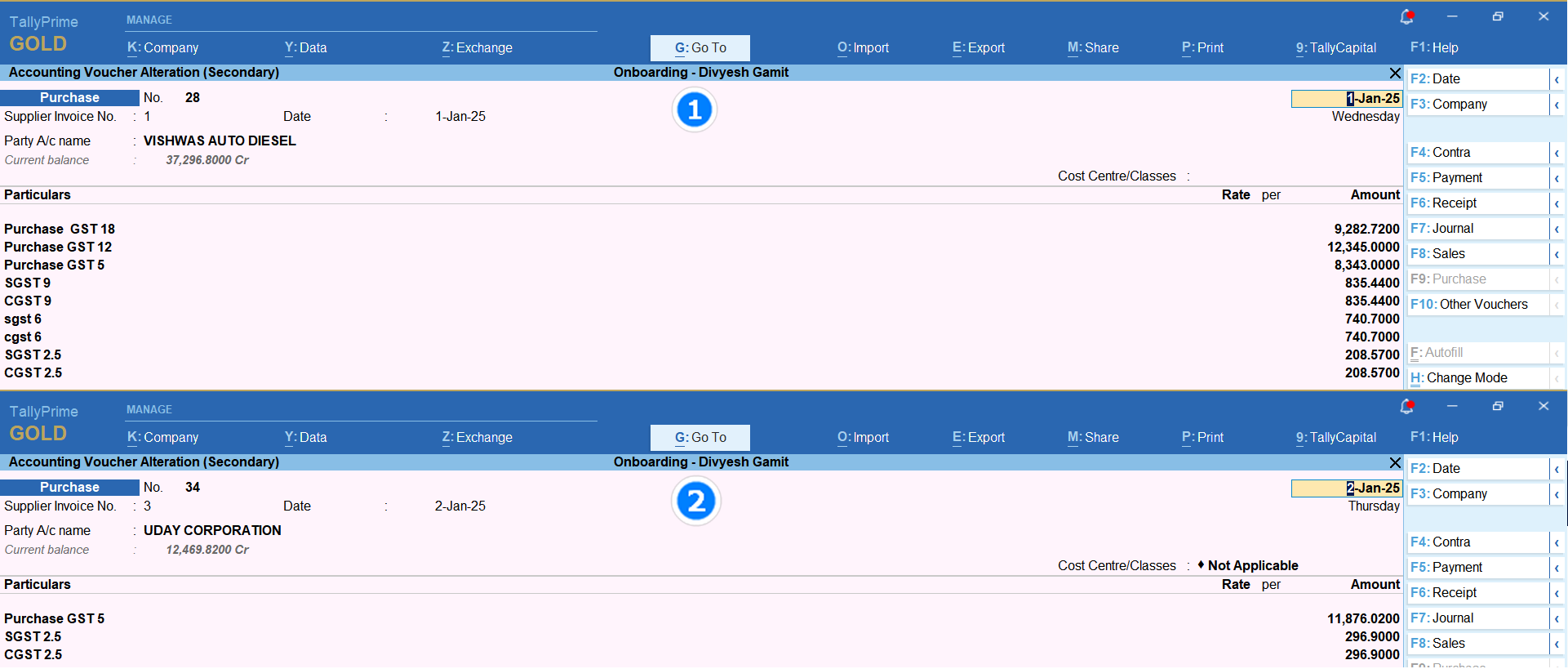

If your entry resembles the image below or you need to record similar entries where each Purchase bill includes multiple DUTIES & TAXES ledgers with multiple TAX RATES, follow this guide for accurate data management.

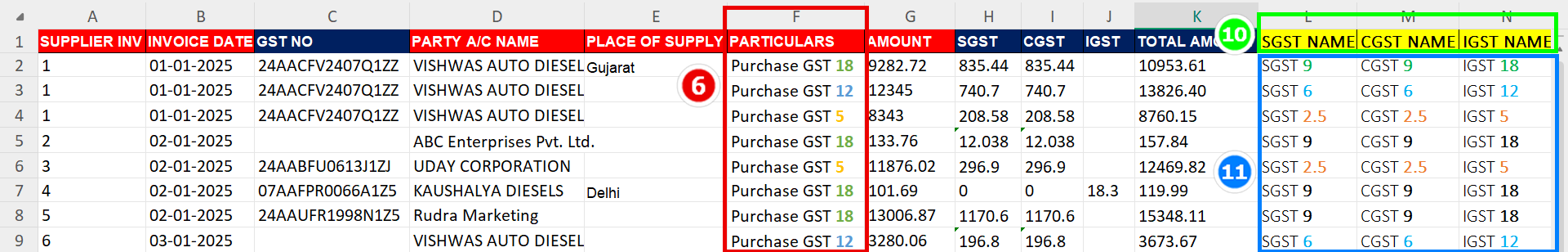

Data requirement for excel sheet

- 1. **Supplier Invoice Number** (A)

- 3. **GST number** (C) (Not Mandatory)

- 5. **Place of Supply** (E) (Not Mandatory)

- 6. **Particulars** (F) (Multiple Purchase Ledger Account Name)

- 7. **Taxable Amount** (G)

- 8. **SGST/CGST/IGST amount** (H,I,J) (Required for such type of sheet)

- 9. **Total Amount** for cross verification (K)

- 10. Need to create three additional rows in excel sheet and name them **SGST NAME**, **CGST NAME**, and **IGST NAME** respectively. (L,M,N))

- 11. By using filter in **GST TAX RATE** or in **Purchase Account name**, put **DUTIES & TAXES** name respectively as shown in the above image. (All three fields are compulsory; if IGST is not applicable, kindly create IGST in Tally.)

How to upload Excel sheet Click Here

Mapping

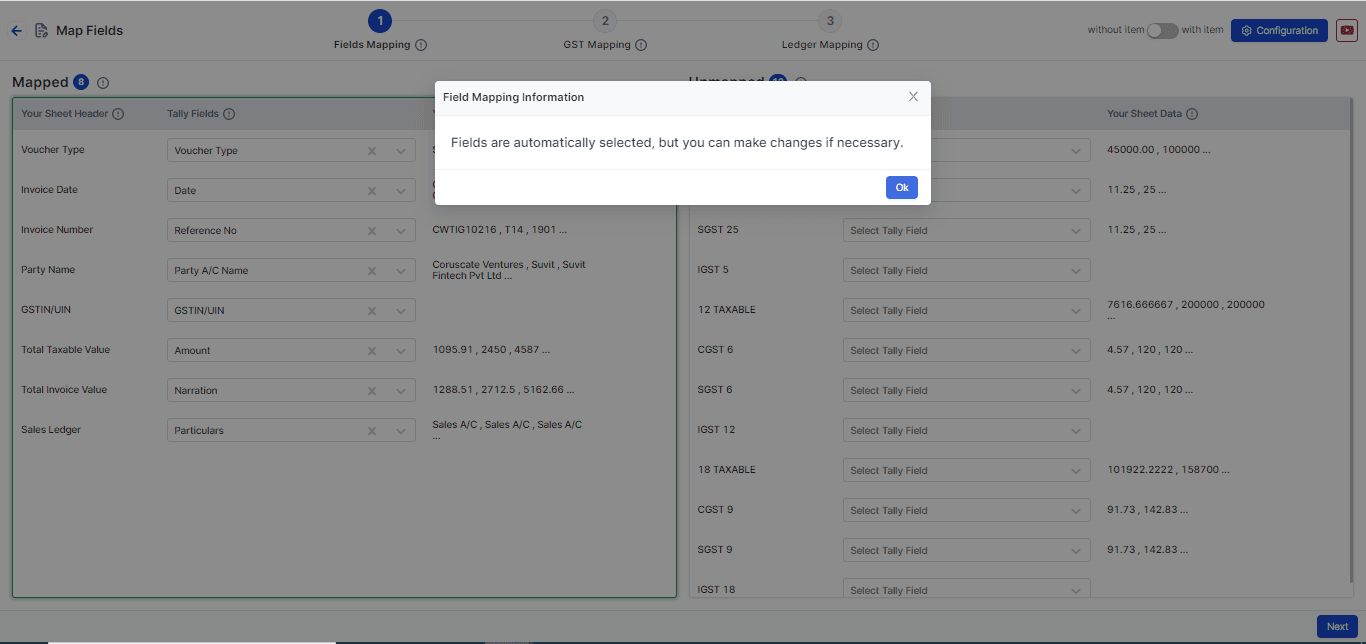

- Click on file to open Mapping Process

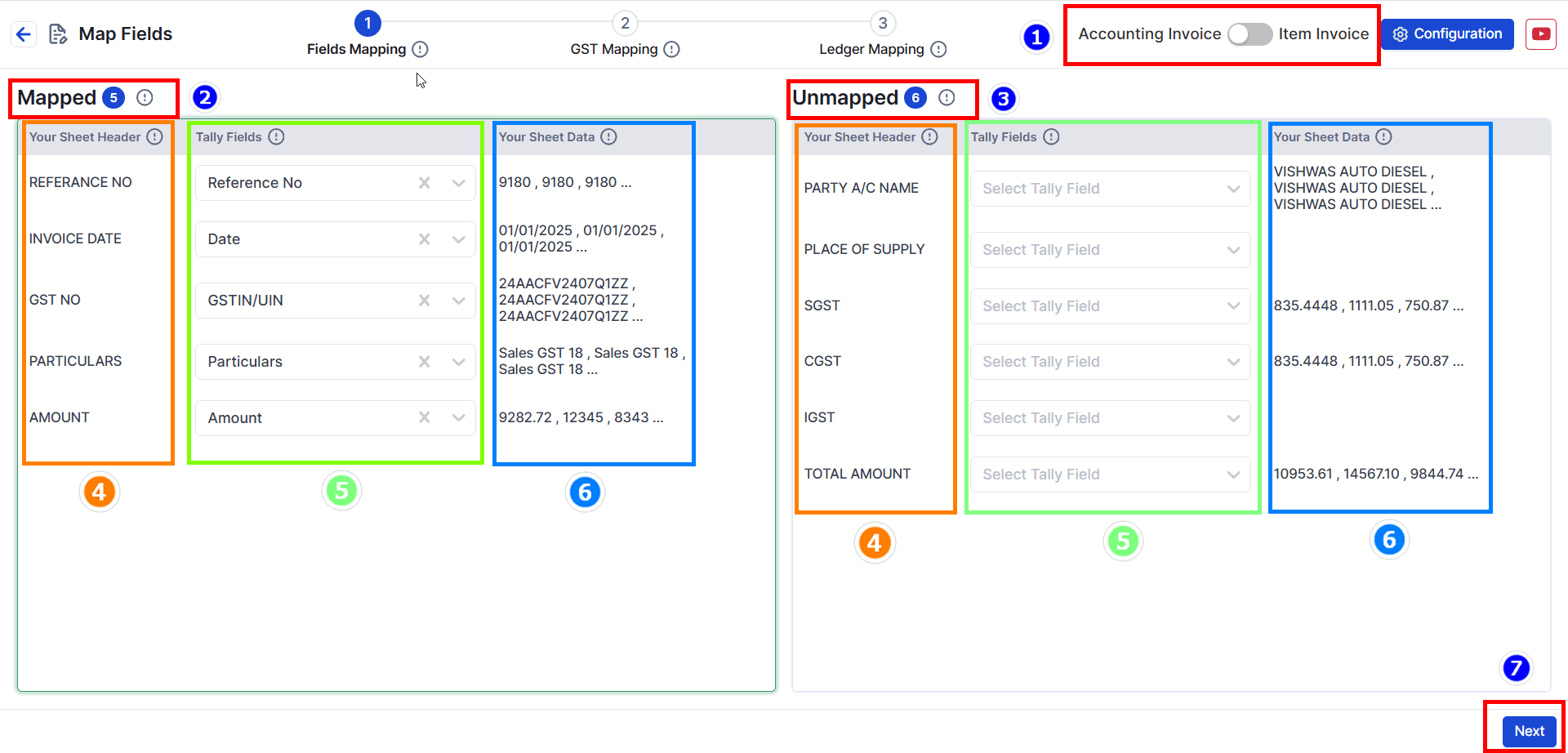

Step 1: Field Mapping

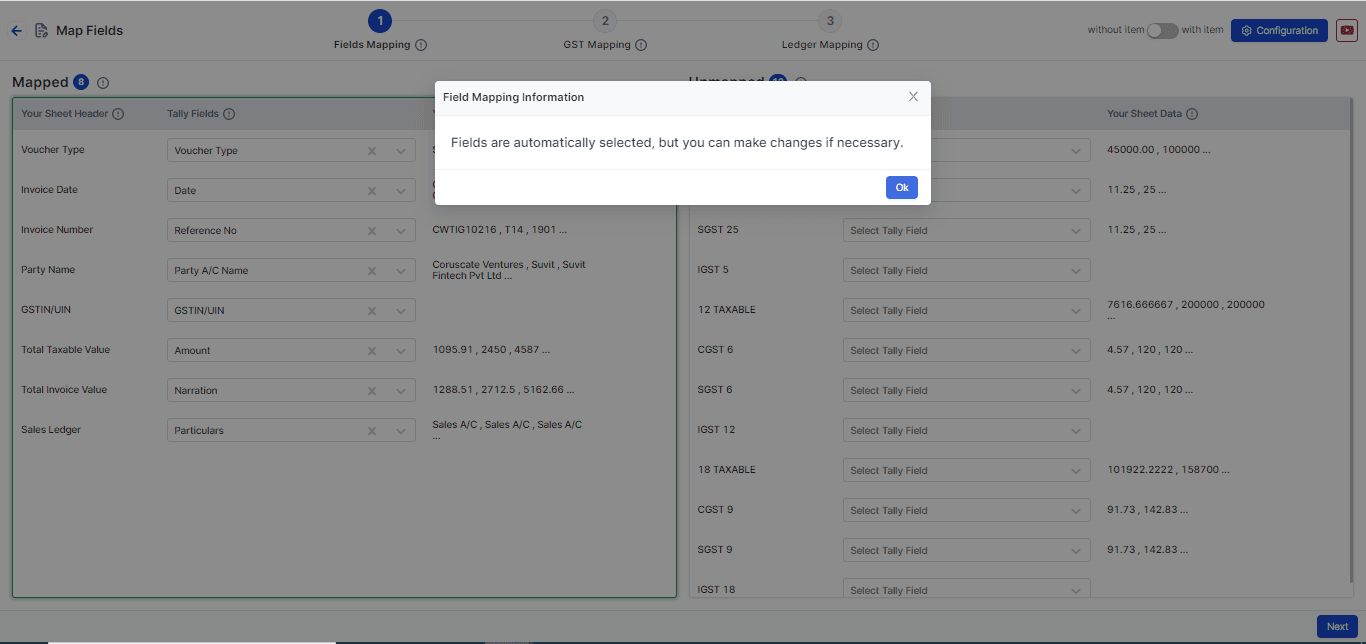

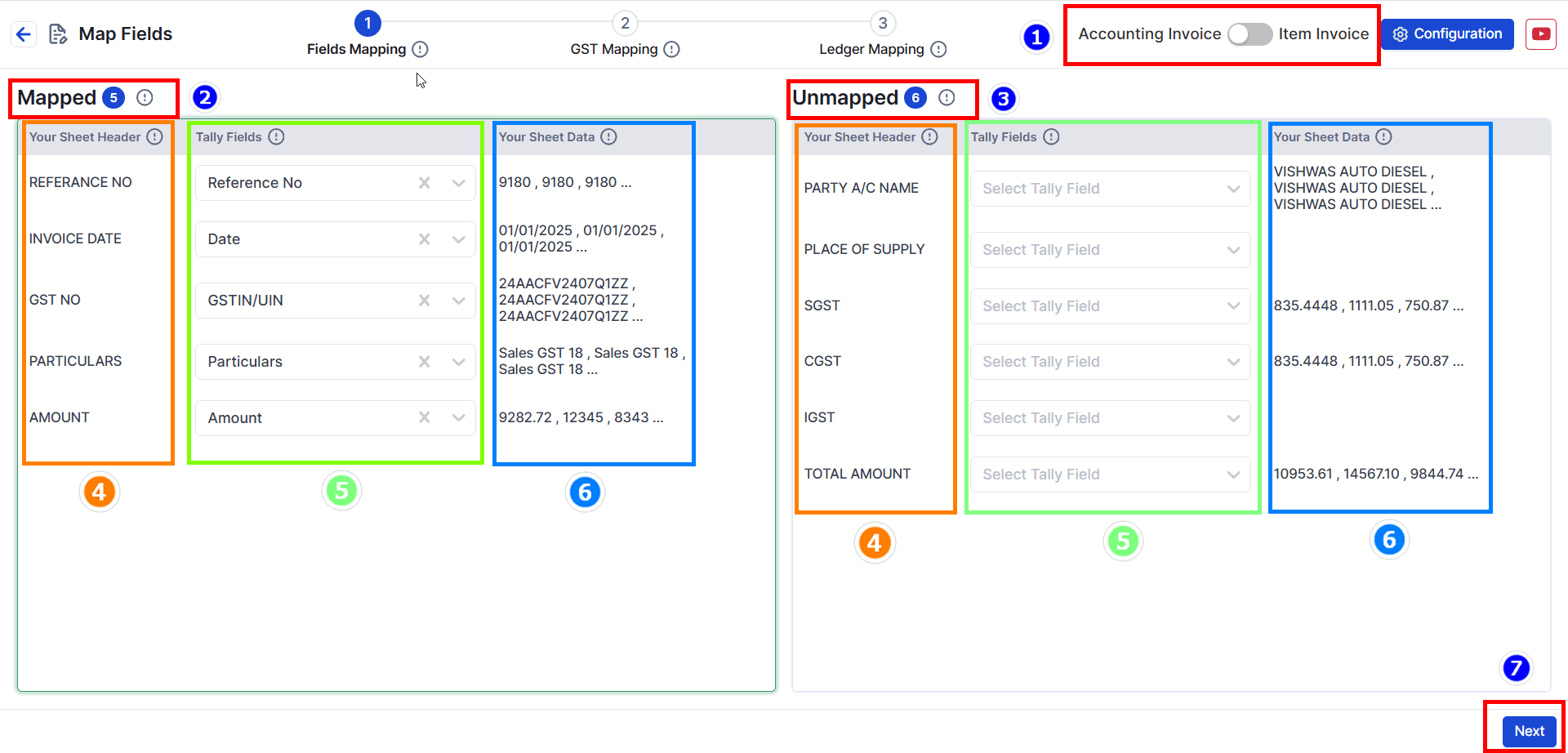

- Choose your data type: Decide if your data has items or no items. For this example, we will choose Without Item (see the image above).

- Mapped Fields: These are fields that the system has matched automatically from your uploaded data.

- Unmapped Fields: These are fields not matched yet. You need to select the right Tally fields for them. (Not all fields need to be matched.)

- Your Sheet Header: The headings from your Excel sheet will appear here. This helps you understand the data easily.

- Tally Fields: These are fields matched with Tally filed. You can change them if needed.

- Your Sheet Data: Shows the top 3 values from your Excel sheet to help you cross-check the data.

- Press Next to go to the GST Mapping step.

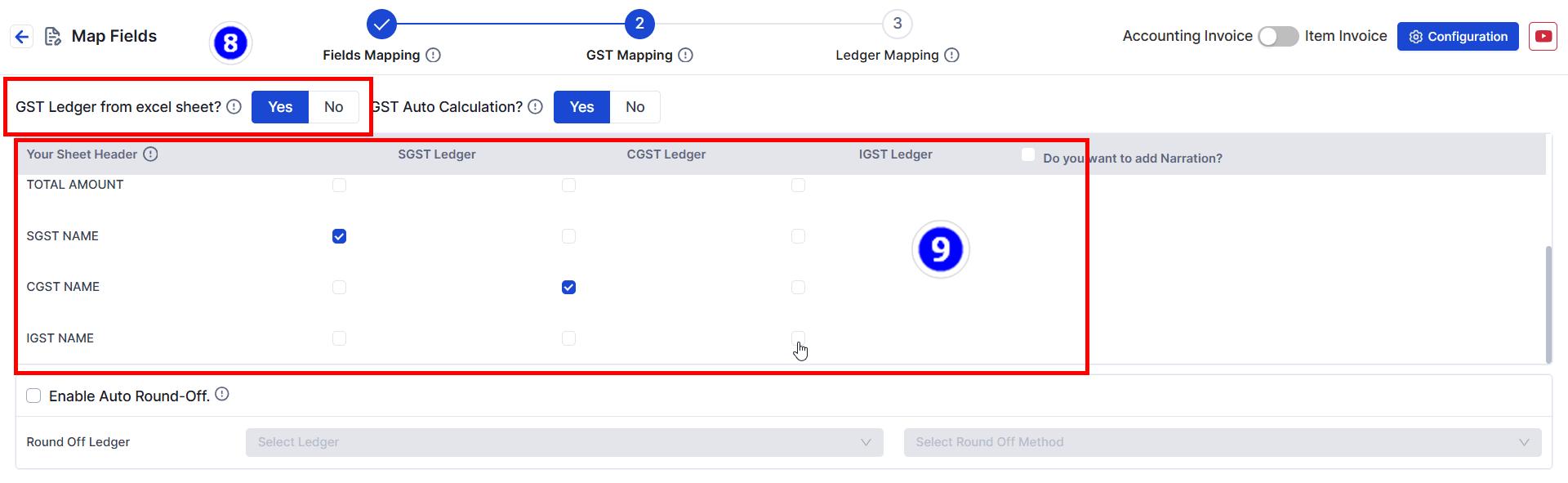

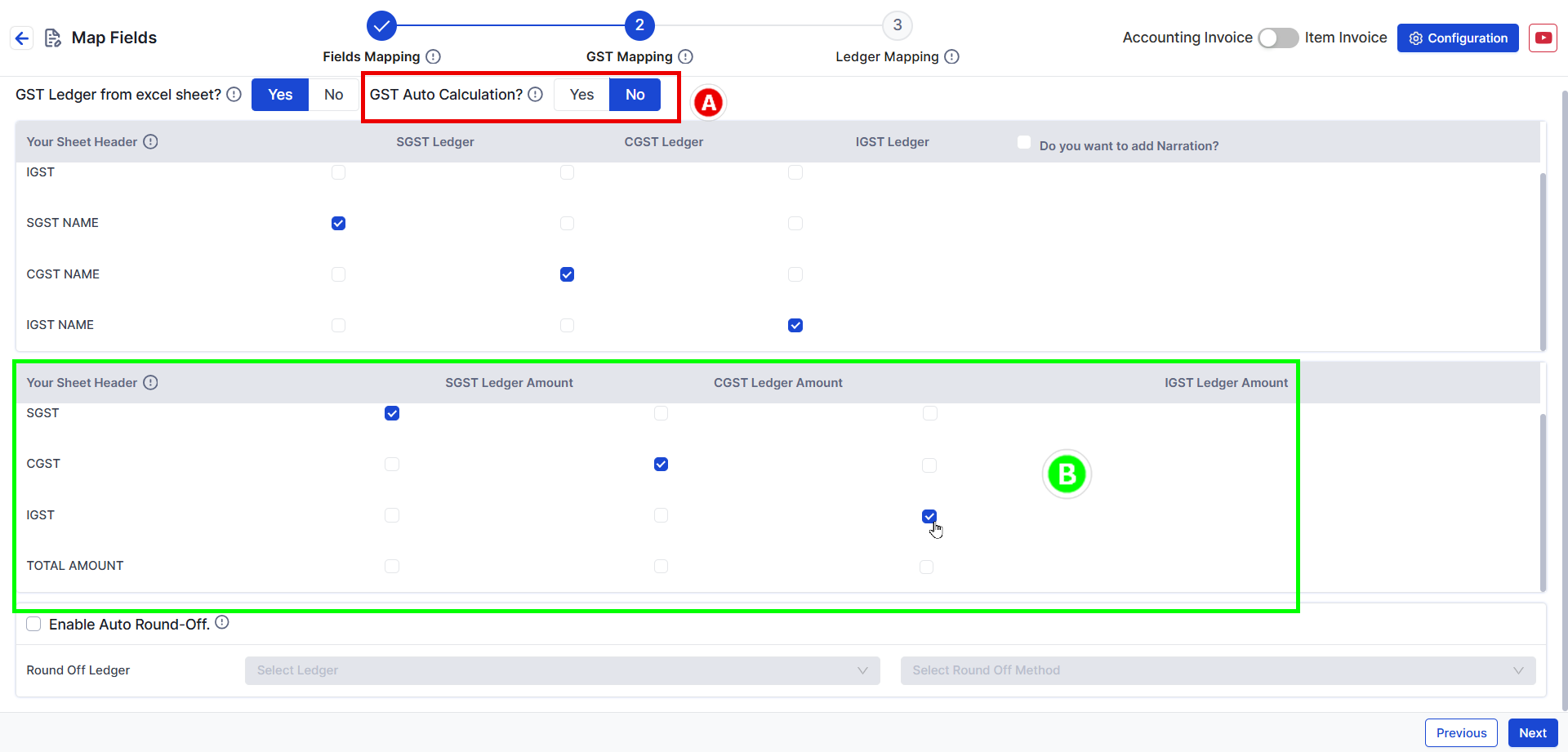

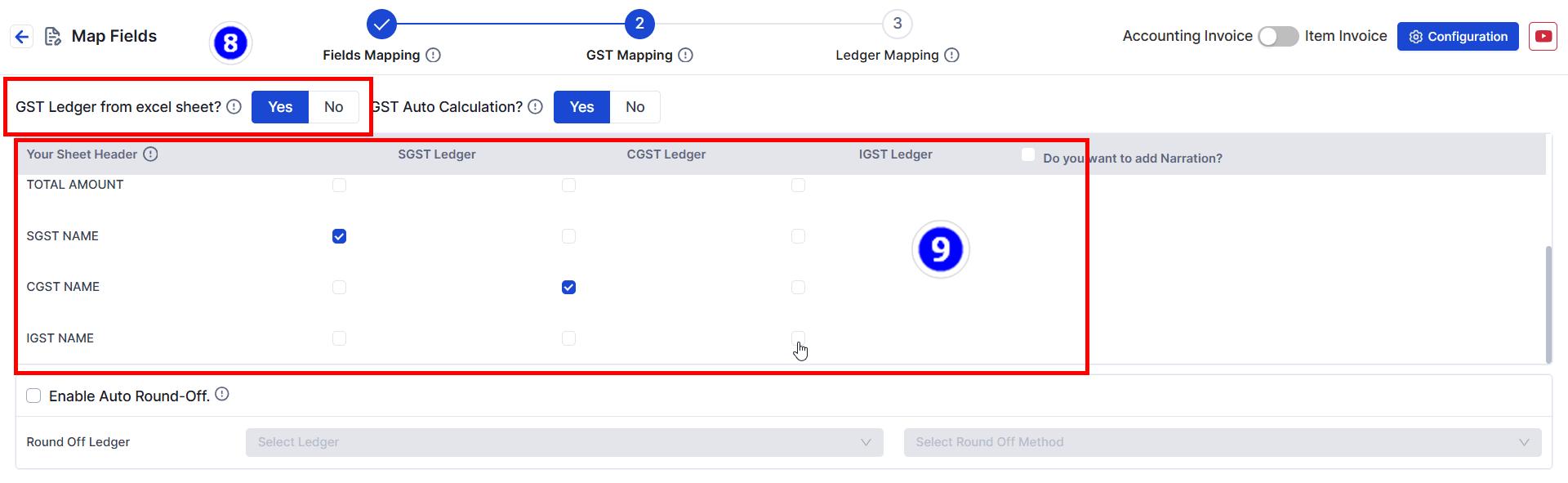

Step 2: GST Mapping (Map Your Tax Ledger).

- Here we will mapp the Duties & Taxes and its details

- GST Ledger from Excel Sheet : Click to YES ( it will open the new menu)

- Select SGST Ledger details in front of SGST NAME, Select CGST Ledger details in front of CGST NAME and Select IGST Ledger details in front of IGST NAME respectively

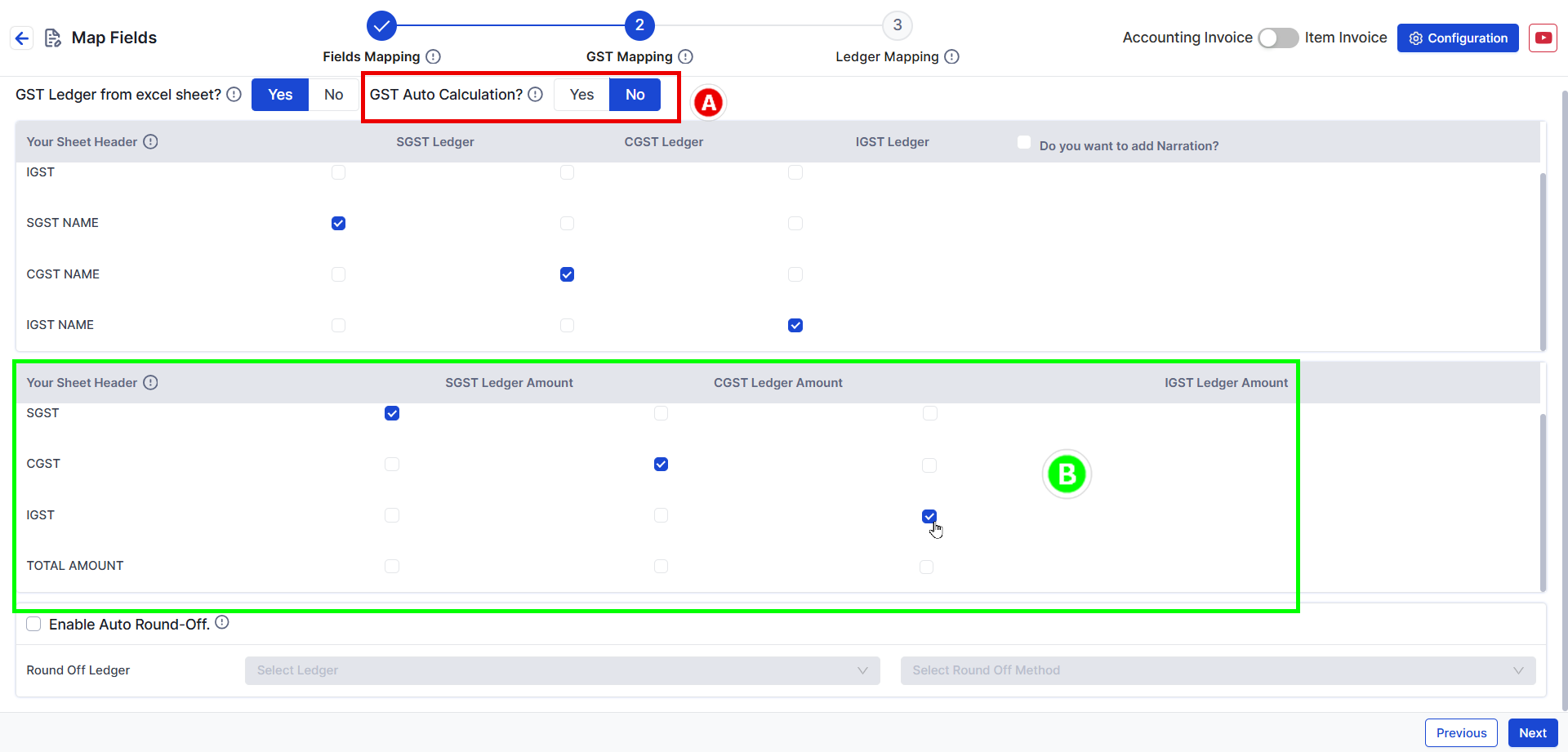

- Gst Auto Calculation: If you have Defined GST TAX Rate in Tally. Keep this setting as it is.

- A. Manual Calculation If You click NO. You can pick the Duties & taxes(SGST/CGST/IGST) Amount from the Excel Sheet

- B. You will have the option to tick mark the SGST, CGST & IGST tax amount from the excel sheet.

**Note**: SGST, CGST, and IGST Tax Ledgers are mandatory fields that must be mapped. You can also map the round-off ledger from below option.

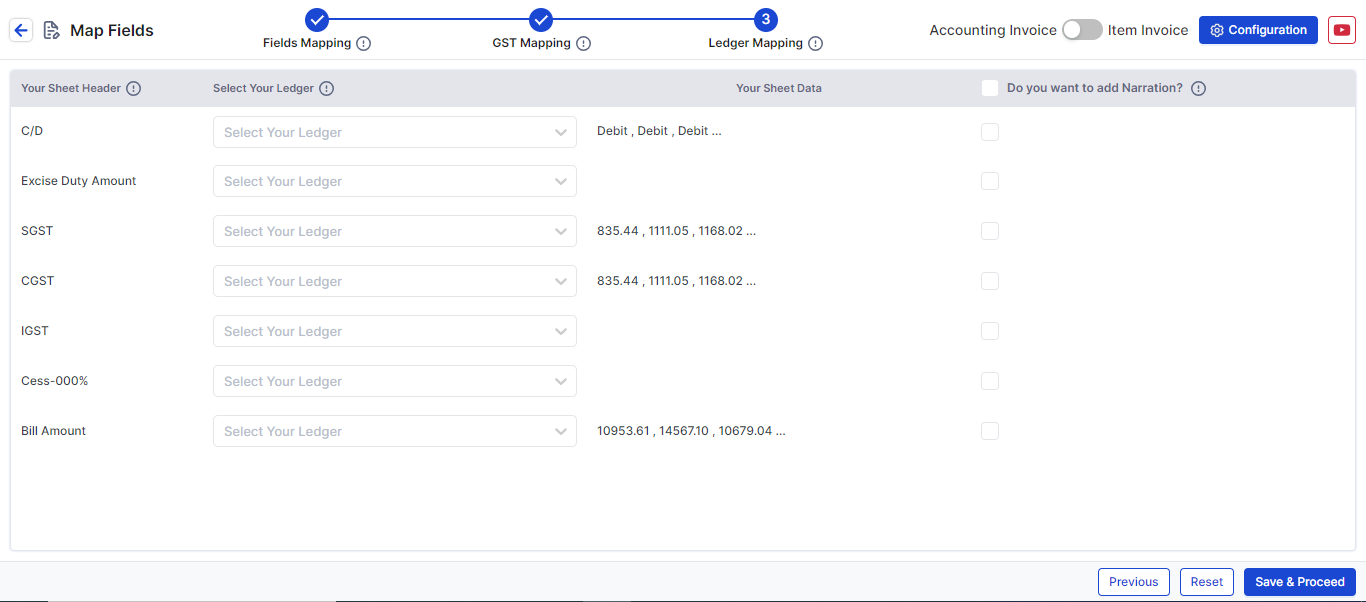

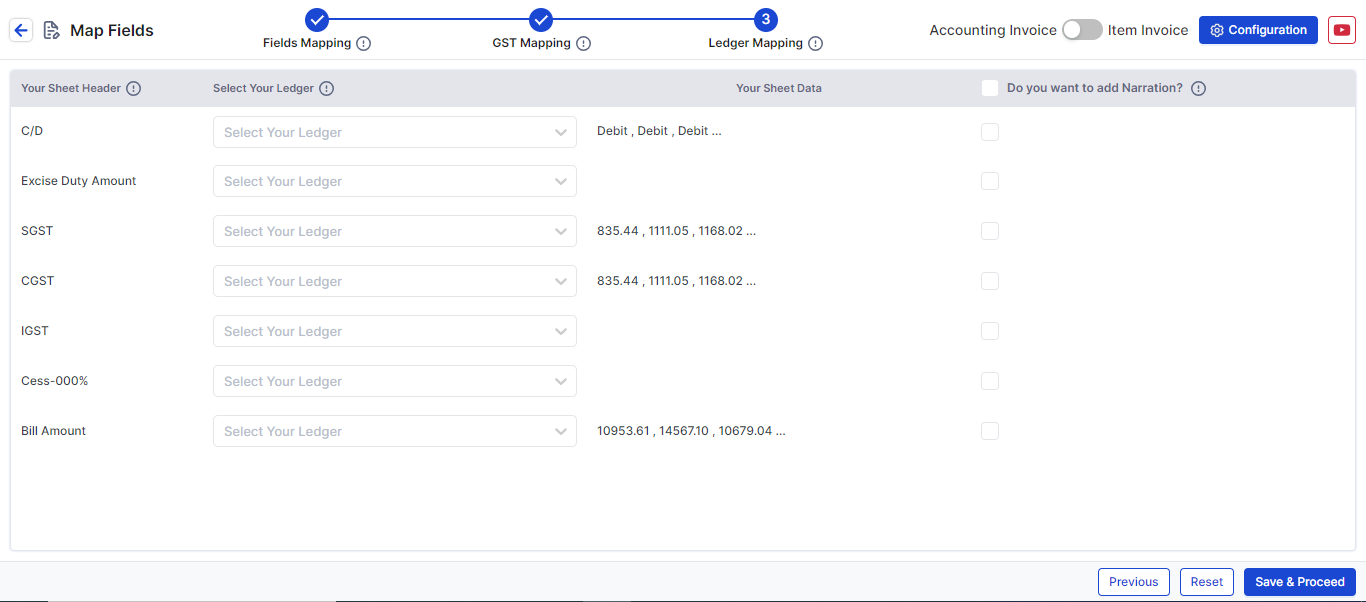

Step 3: Ledger Mapping

- In this step, you can map additional fields such as, discount, freight amount, etc., by selecting the appropriate file header and ledger.

Click Save & Proceed to move to the process screen.

This action will also save the particular format within SUVIT for future uploads.