How to Enter Purchase Data with Common Duties & Taxes

Upload purchase bills with the same tax ledger using Suvit. Map GST, duties & taxes easily and save format for future uploads.

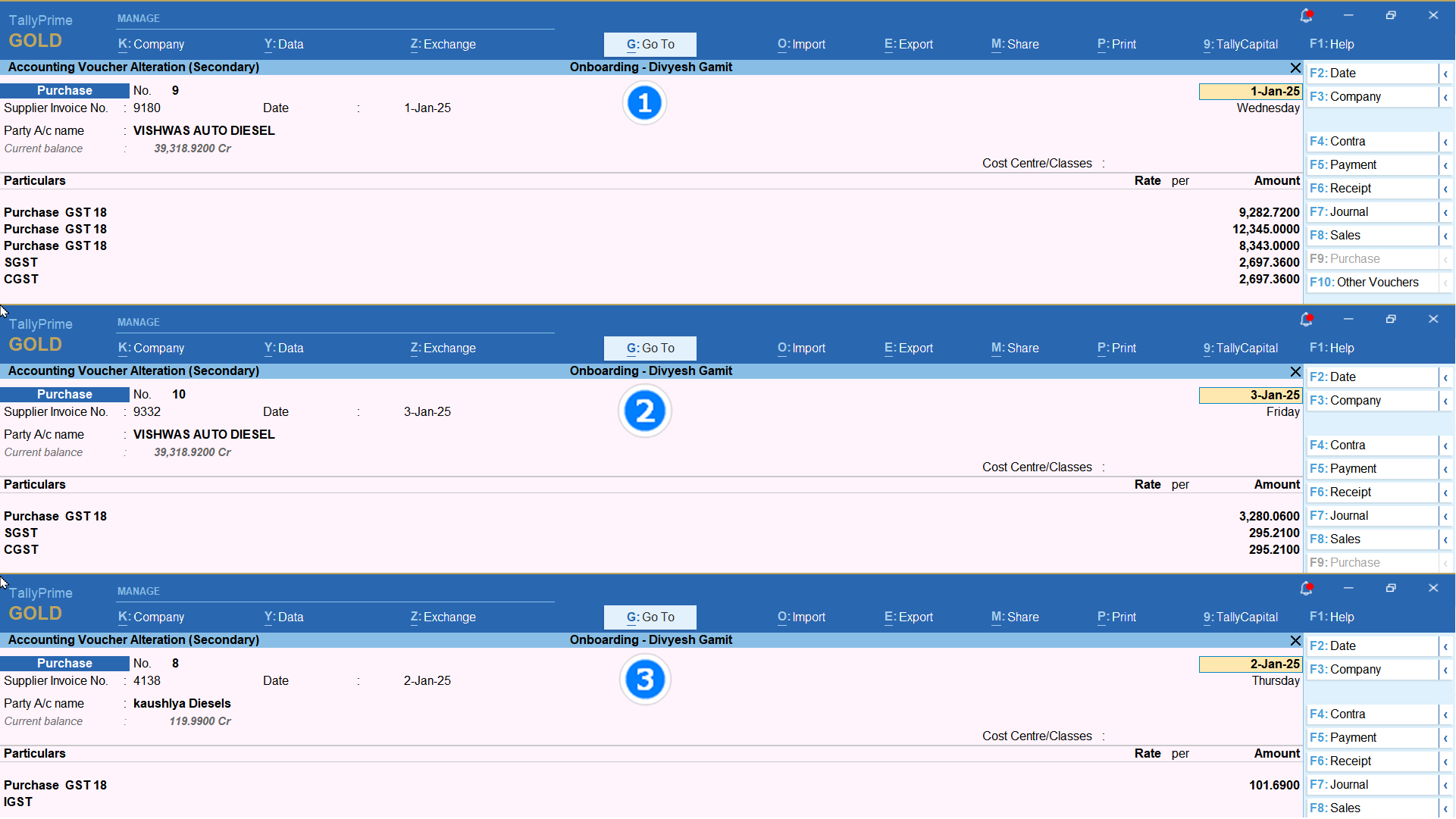

Single Taxable Rate with Common SGST/CGST/IGST (Duties & Taxes)

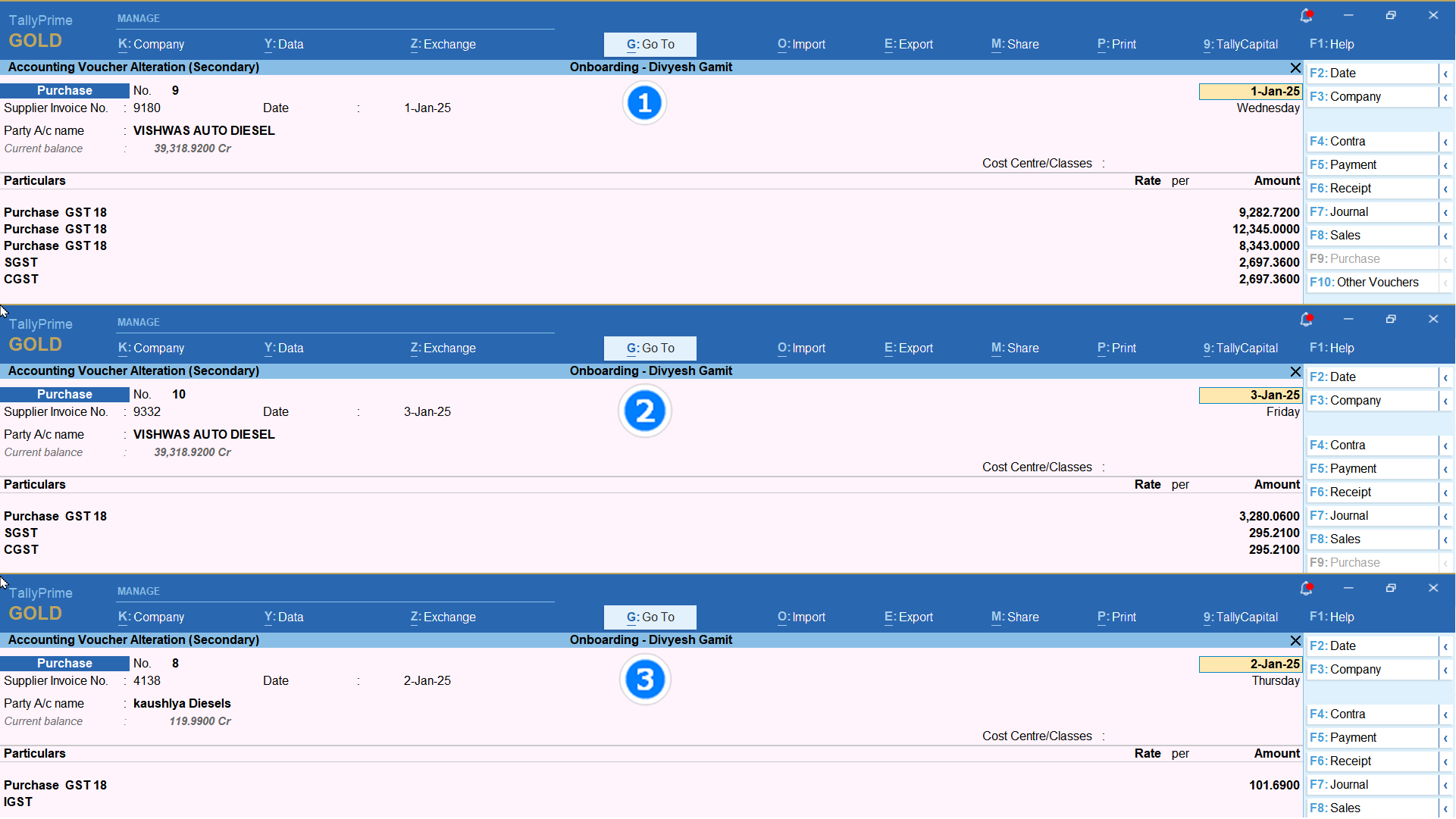

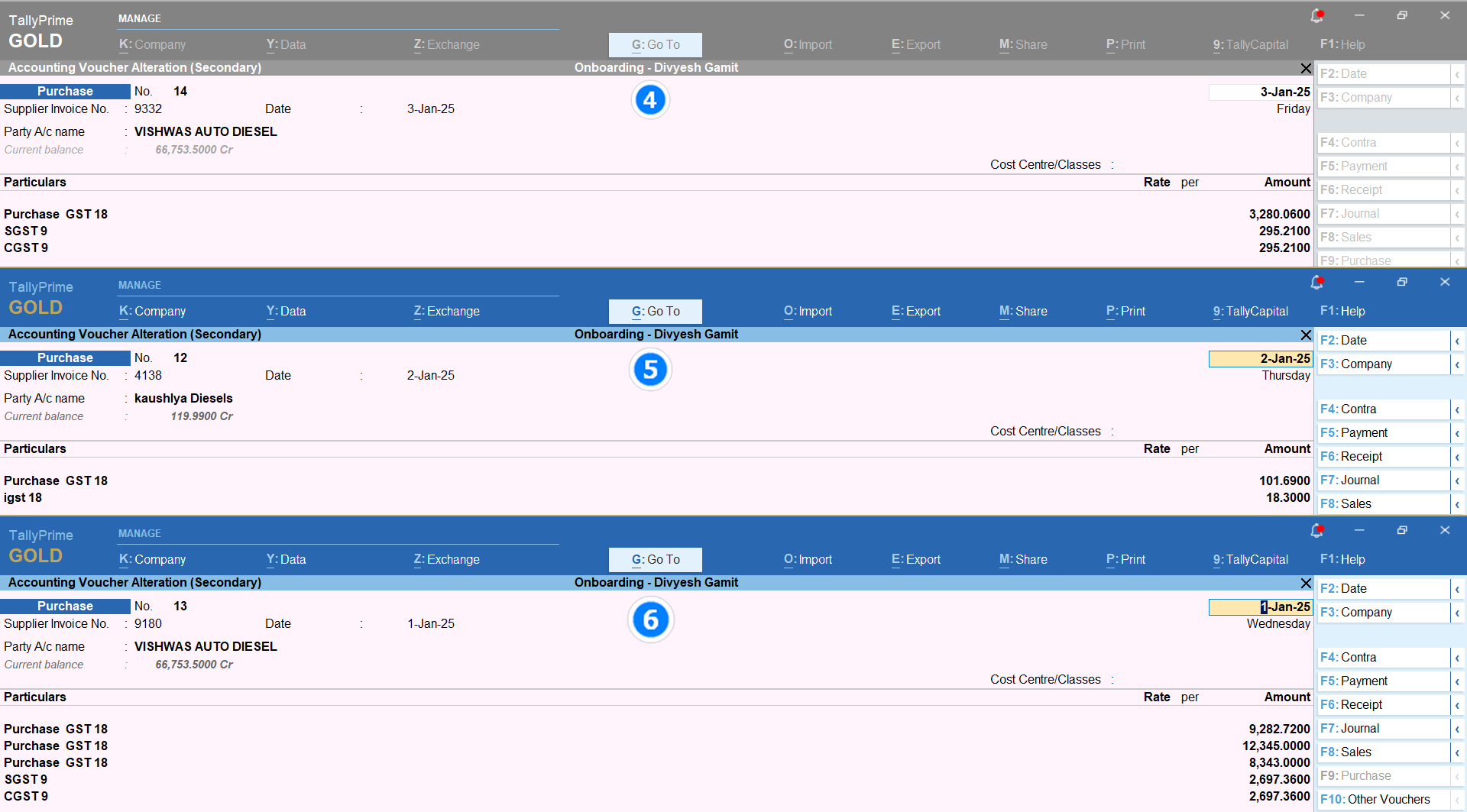

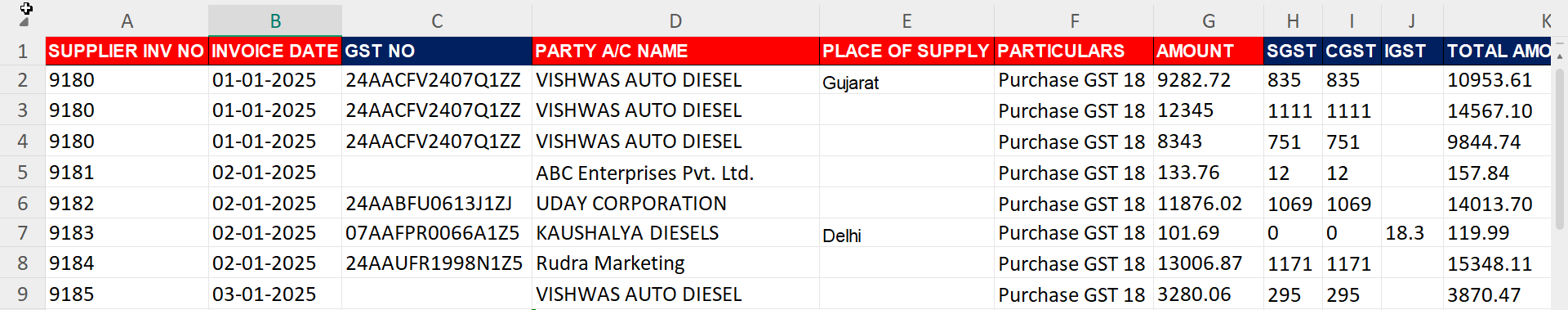

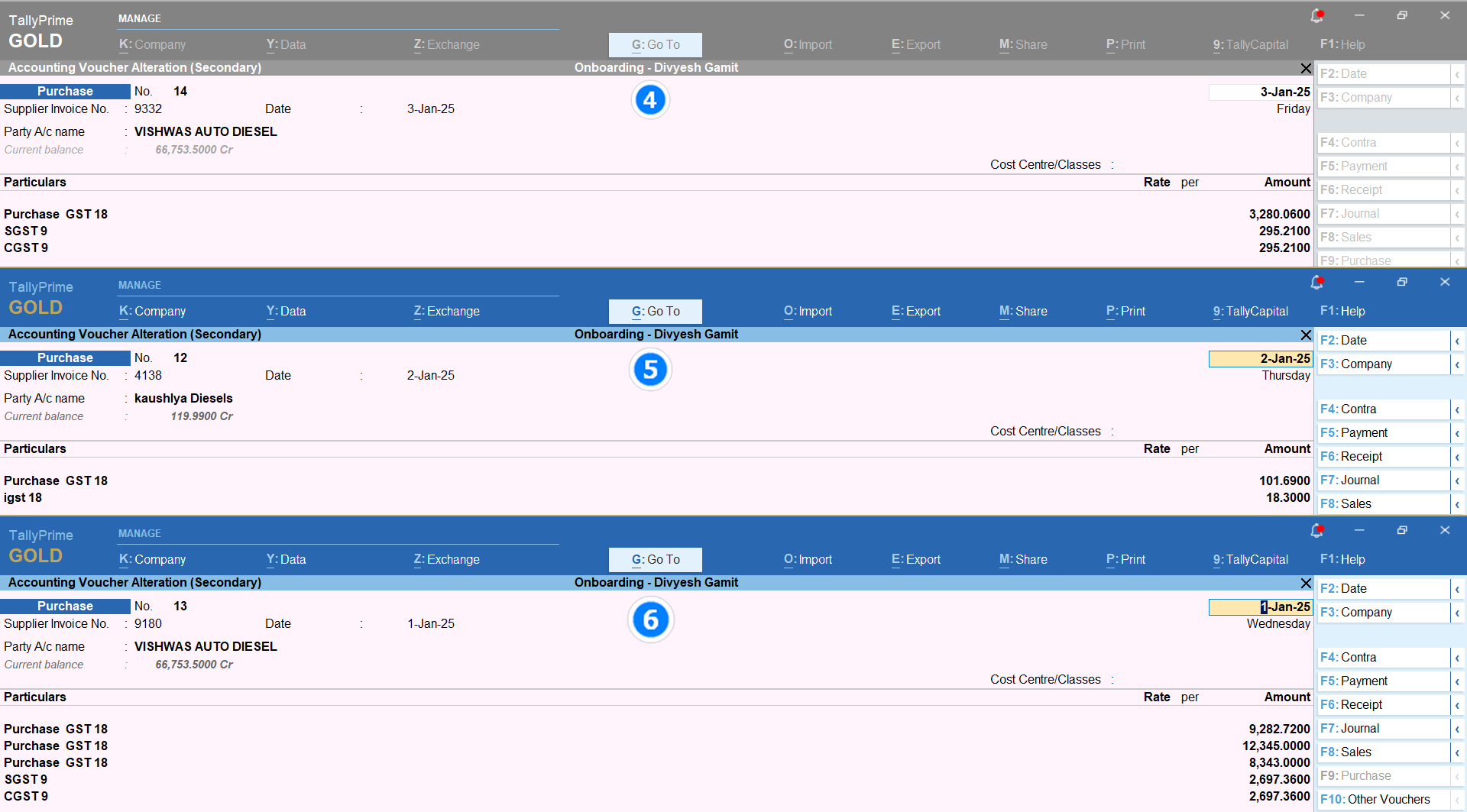

If your entry looks like the image below, or if you want to enter a similar type of entry, where each purchase bill has the same DUTIES & TAXES ledger, you can do so. This can be for either a single bill with a single entry or a single bill with multiple entries, all having the same TAX RATES.

**Data requirement for excel sheet**

- 1. Supplier Invoice number

- 3. GST number ( Not Mandatory )

- 5. Place of Supply (Not Mandatory )

- 6. Particulars ( Purchase Ledger Account Name )

- 8. SGST/CGST/IGST amount (Only required for **Manual Calculation**)

How to upload Excel sheet Click Here

Mapping

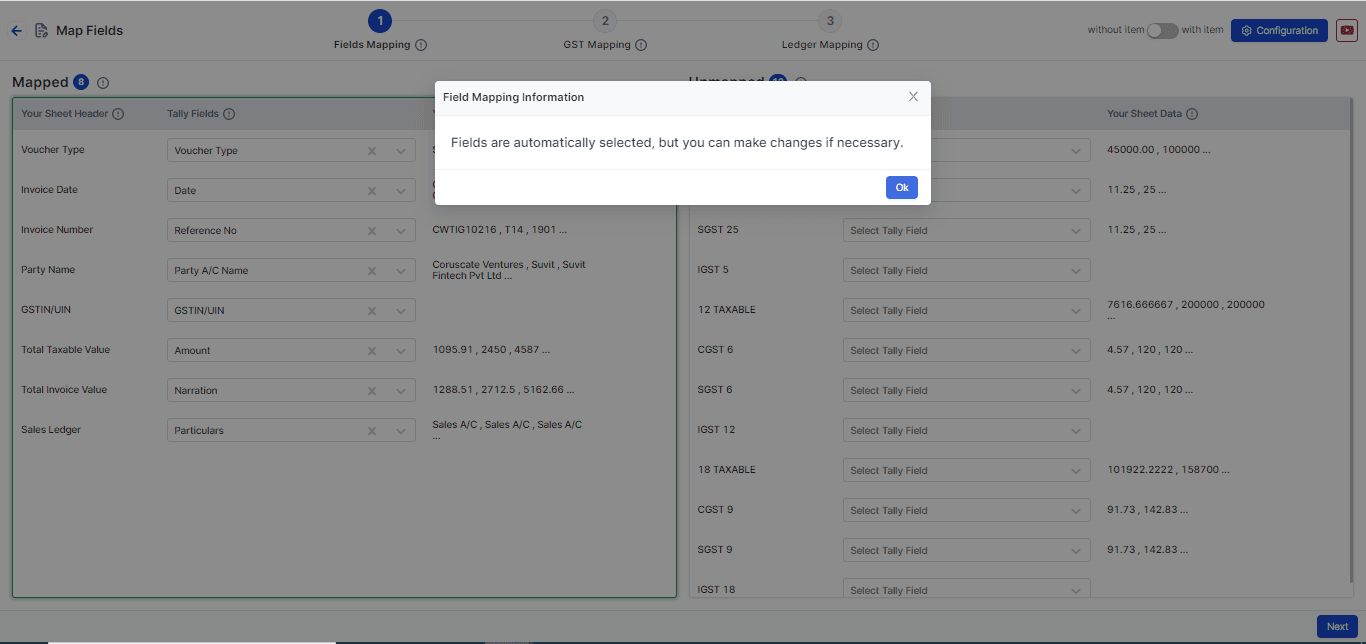

- Click on file to open Mapping Process

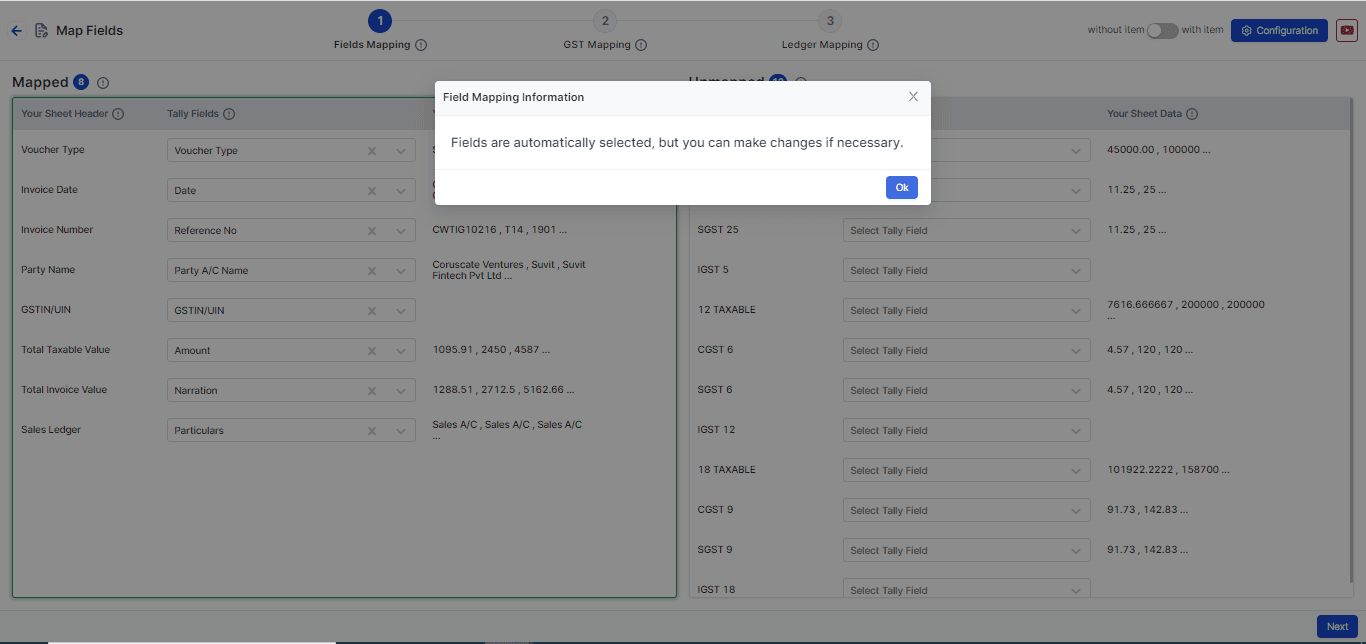

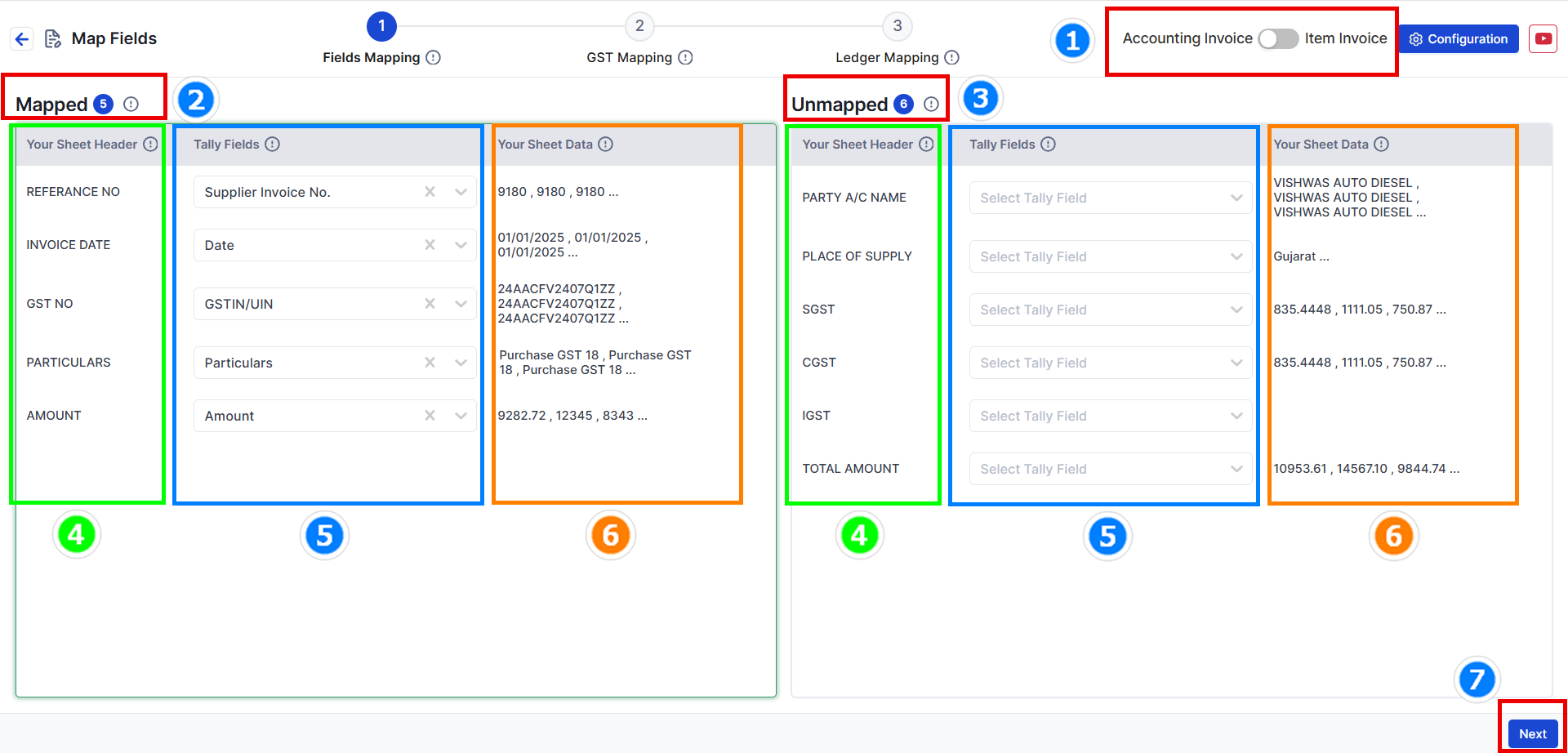

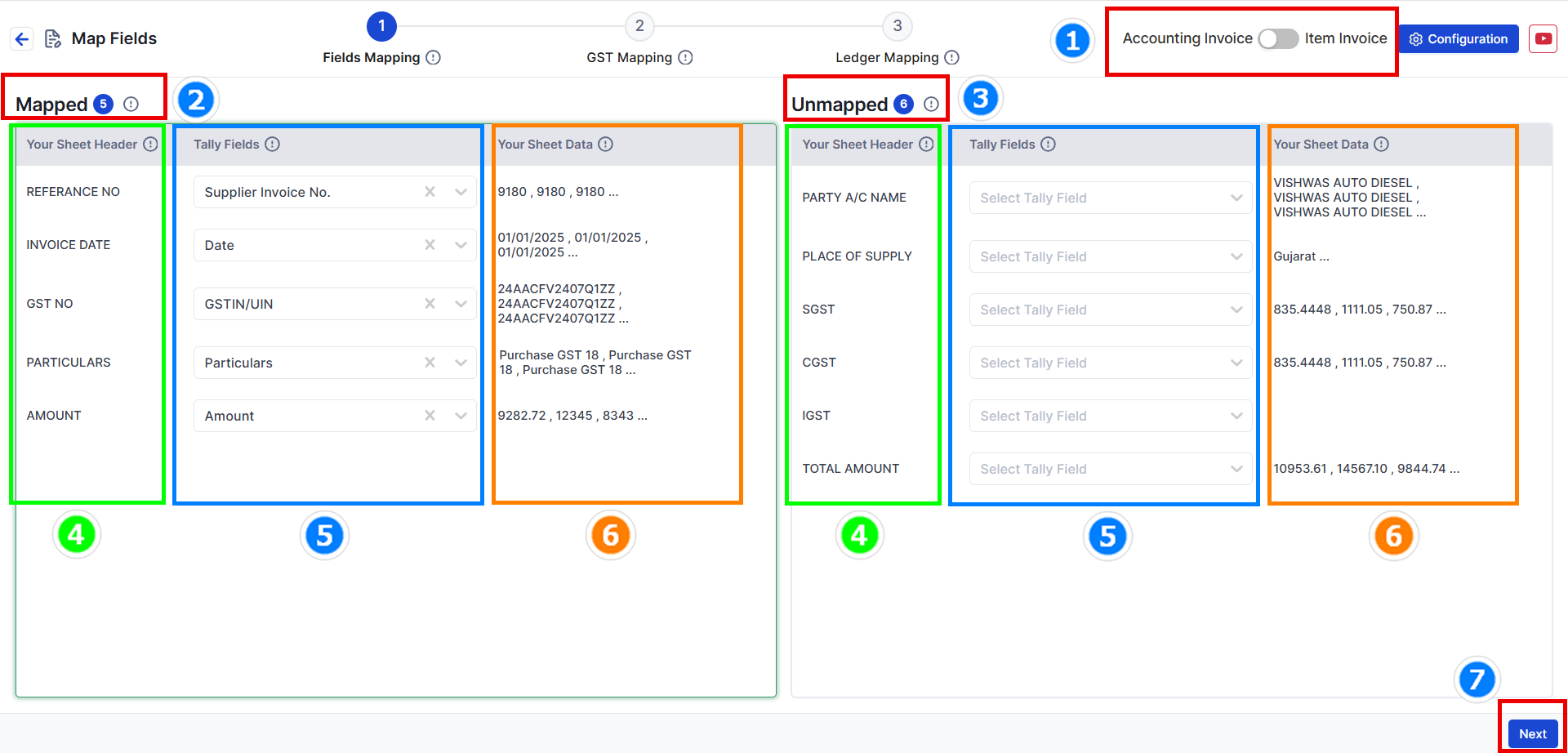

Step 1: Field Mapping

- Choose your data type: Decide if your data has items or no items. For this example, we will choose Without Item (see the image above).

- Mapped Fields: These are fields that the system has matched automatically from your uploaded data.

- Unmapped Fields: These are fields not matched yet. You need to select the right Tally fields for them. (Not all fields need to be matched.)

- Your Sheet Header: The headings from your Excel sheet will appear here. This helps you understand the data easily.

- Tally Fields: These are fields matched with Tally filed. You can change them if needed.

- Your Sheet Data: Shows the top 3 values from your Excel sheet to help you cross-check the data.

- Press Next to go to the GST Mapping step.

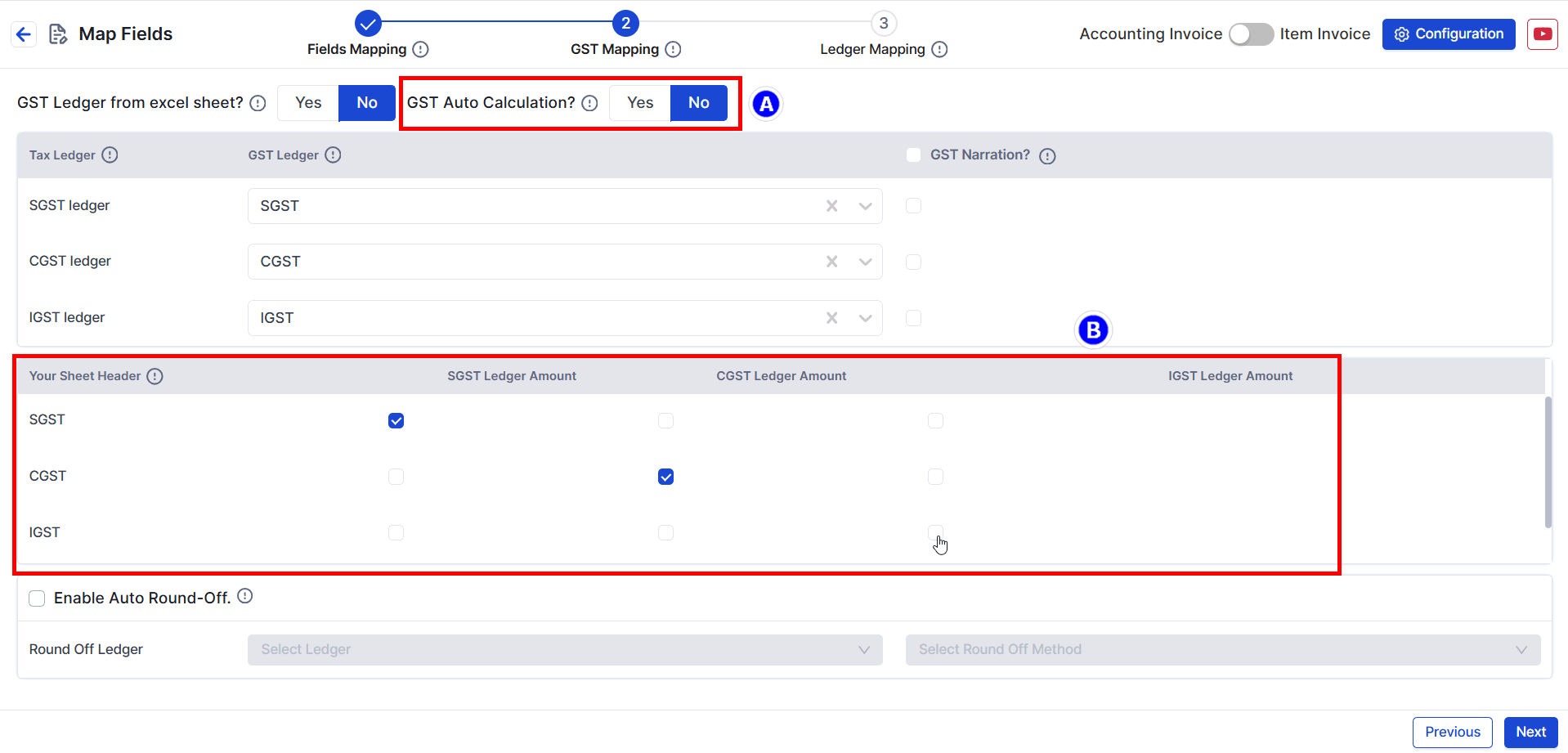

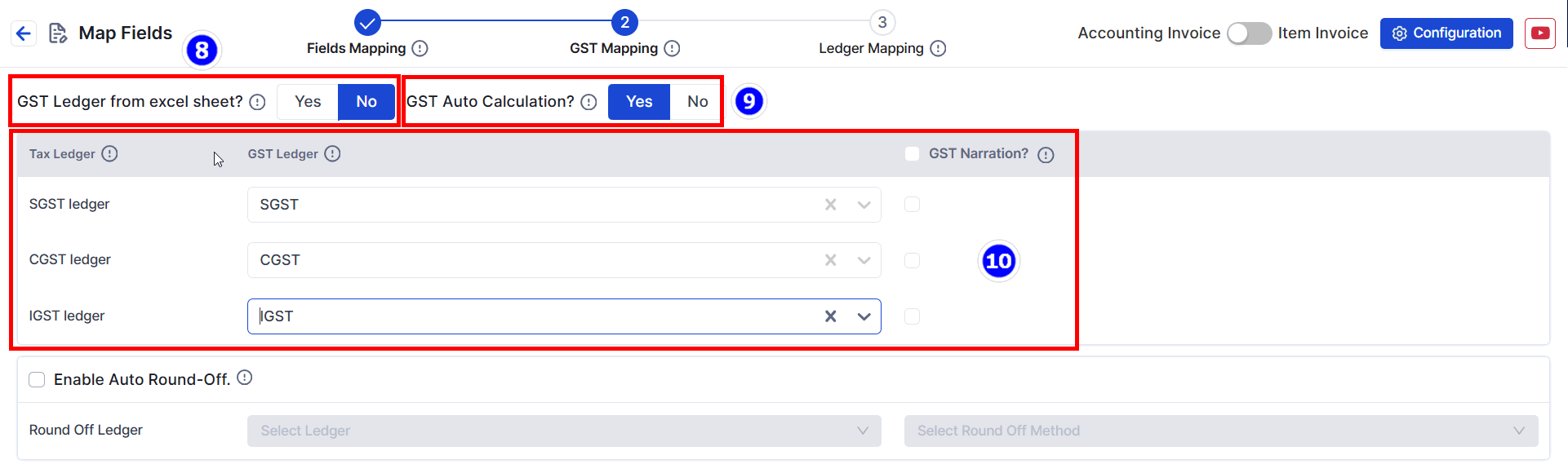

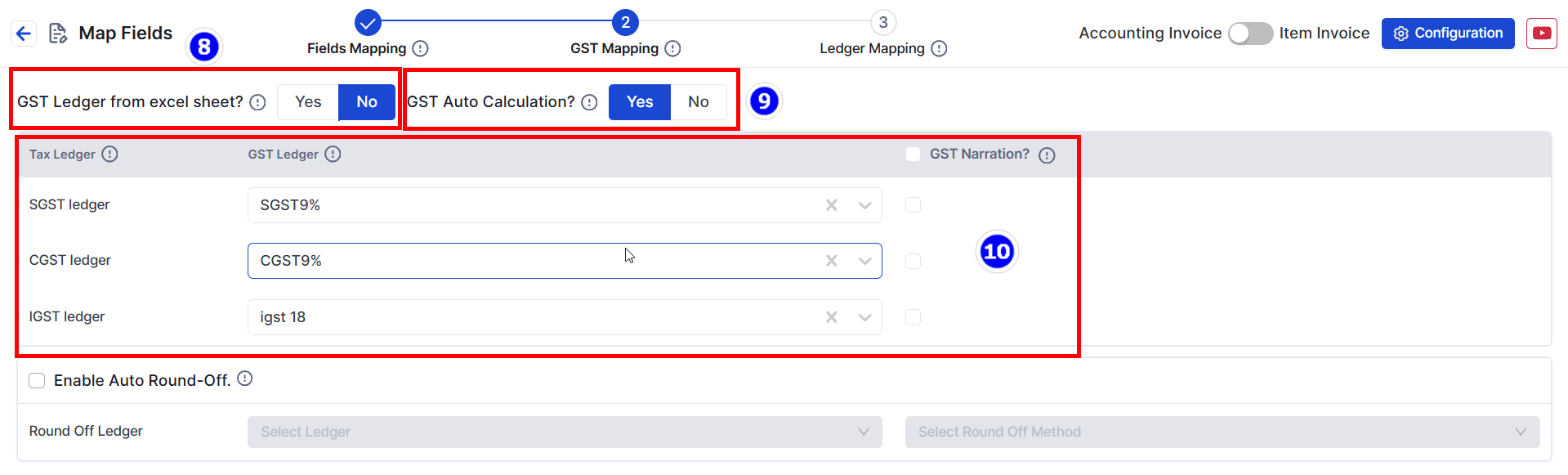

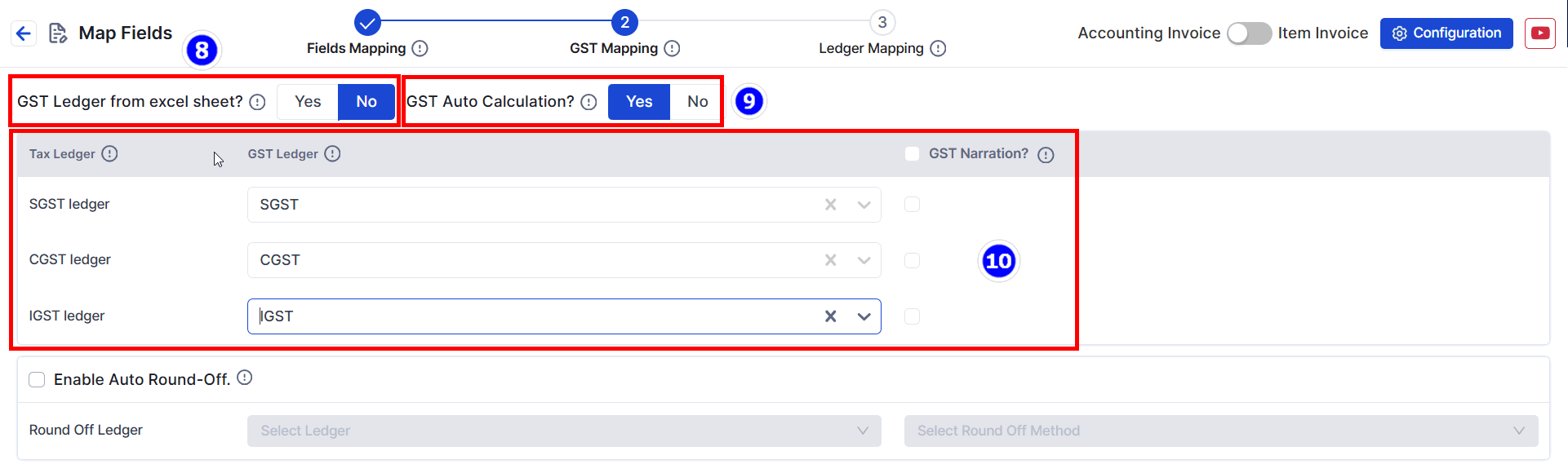

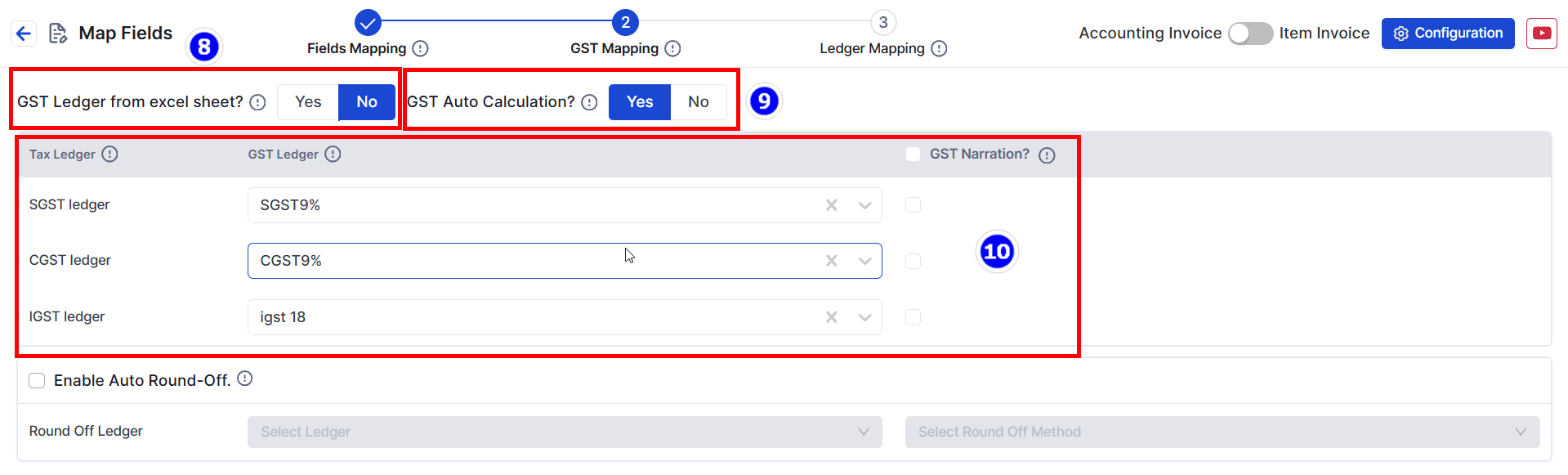

Step 2: GST Mapping (Map Your Tax Ledger).

- Here we will map the Duties & Taxes and its details

-

GST Ledger from Excel Sheet : It will remain as it is

-

Gst Auto Calculation: If you have Defined GST TAX Rate in Tally. Keep this setting as it is.

10. Duties & Taxes: You can select common Duties & Taxes ledger

10. Duties & Taxes: You can select common Duties & Taxes ledger

- For Example: If entire sheet belongs to 18 GST Rate You can choose SGST, CGST, IGST or else SGST 9, CGST 9, IGST 18

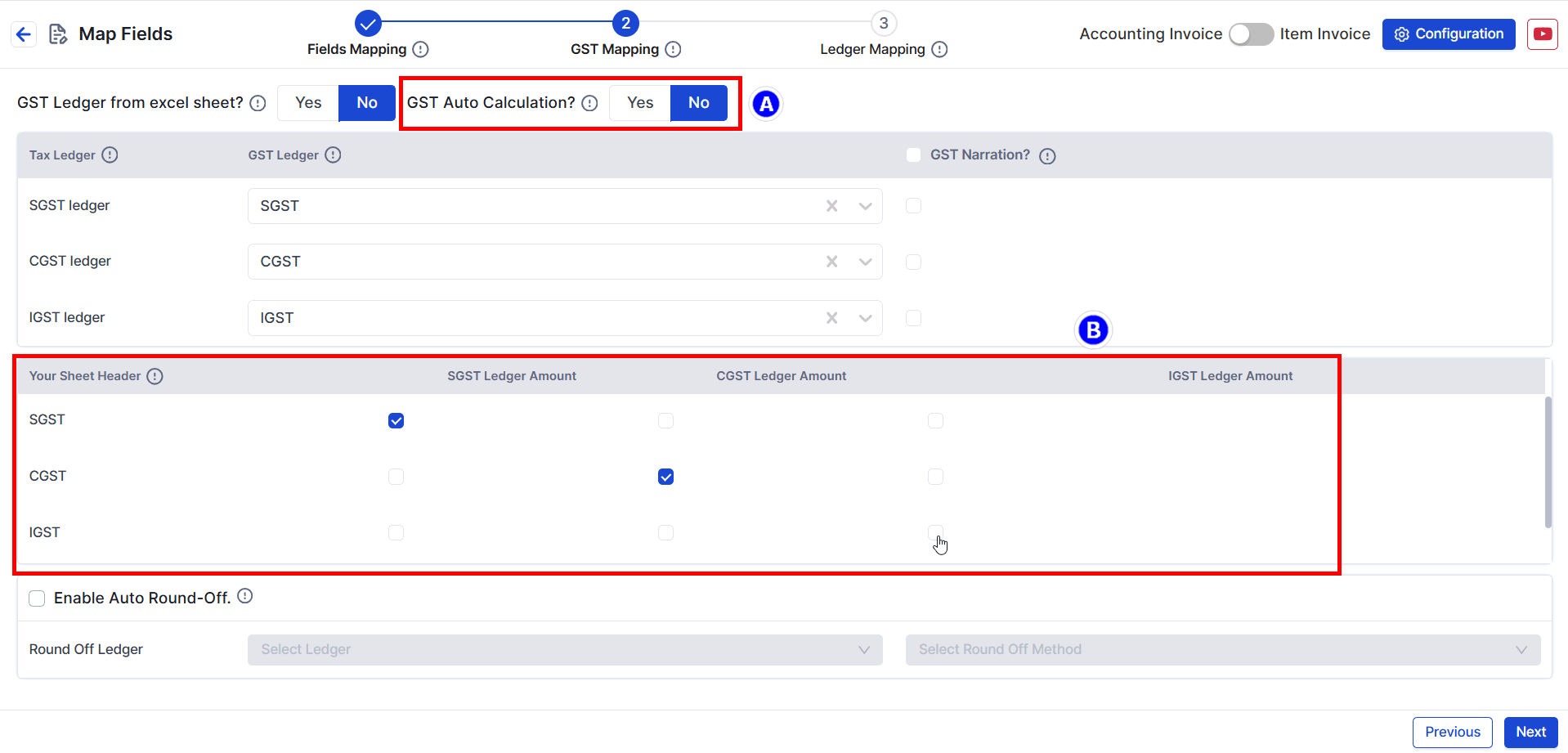

- A. Manual Calculation If You click NO. You can pick the Duties & taxes(SGST/CGST/IGST) Amount from the Excel Sheet

- B. You will have the option to tick mark the SGST, CGST & IGST tax amount from the excel sheet.

**Note**: SGST, CGST, and IGST Tax Ledgers are mandatory fields that must be mapped. You can also map the round-off ledger from below option.

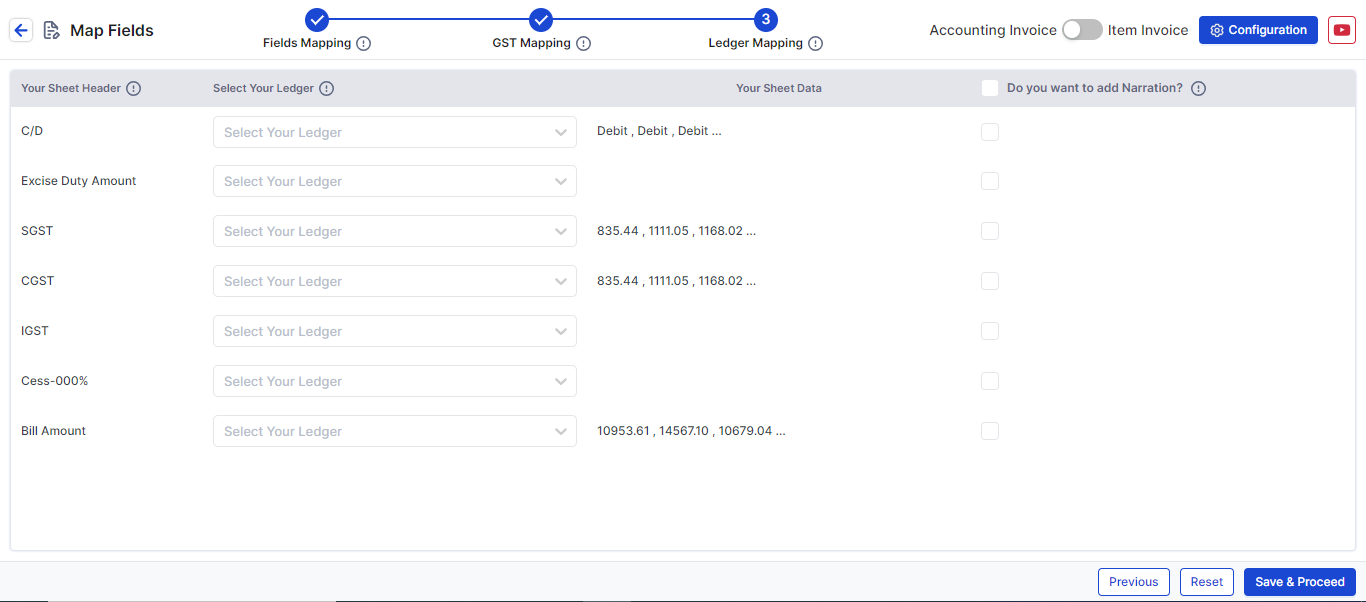

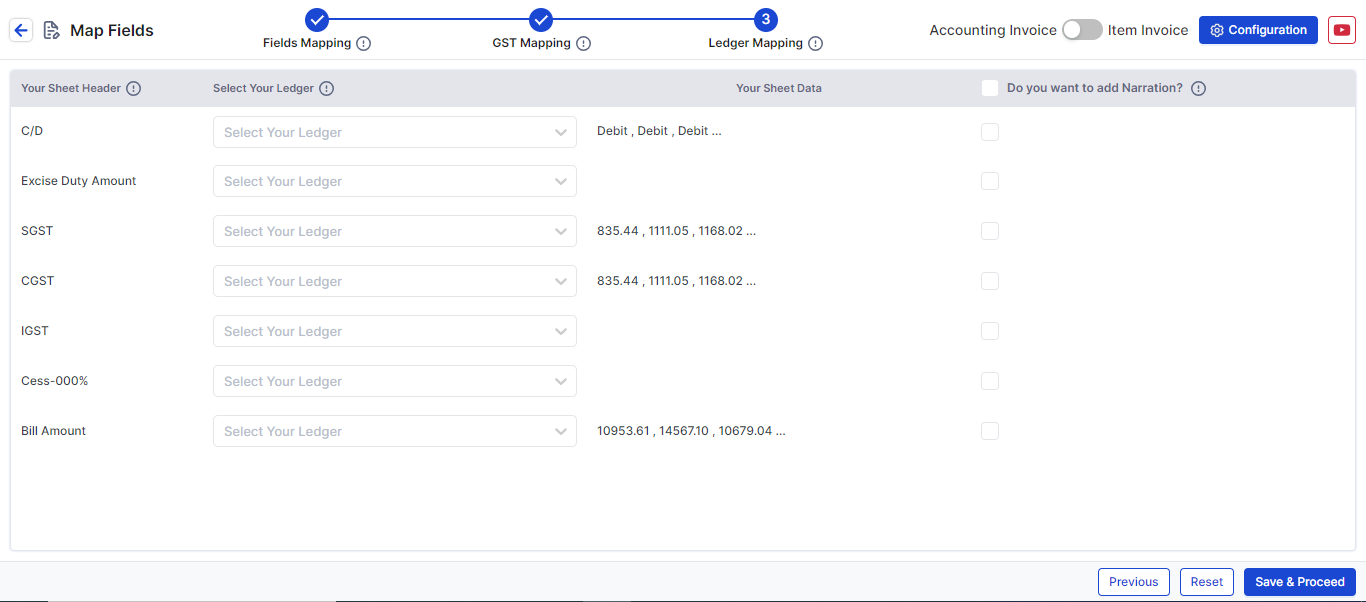

Step 3: Ledger Mapping

- In this step, you can map additional fields such as, discount, freight amount, etc., by selecting the appropriate file header and ledger.

Click Save & Proceed to move to the process screen.

This action will also save the particular format within SUVIT for future uploads.

10. Duties & Taxes: You can select common Duties & Taxes ledger

10. Duties & Taxes: You can select common Duties & Taxes ledger