Learn how to reset or update a company’s GSTIN in Suvit. Follow this step-by-step guide to safely change GSTIN in the GST Reconciliation module.

If you need to update or reset the GSTIN for a company in Suvit’s GST Reconciliation module, follow the steps below carefully. Please note: Changing the GSTIN will permanently delete all associated data like GST filings, reconciliations, and reports for that company.

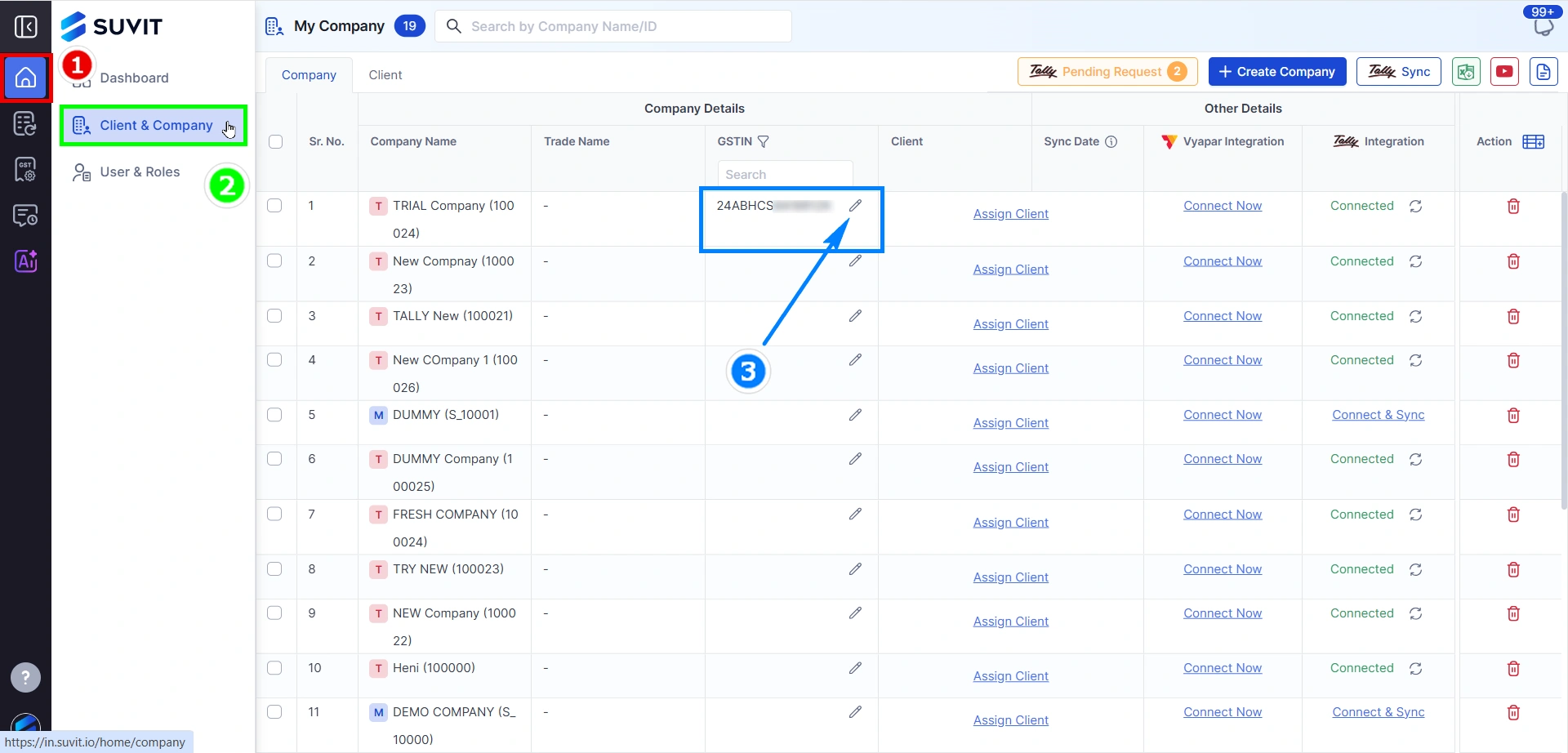

→ After login go to Home Button.

→ On the left panel, click on Client & Company.

→ Locate the company for which you want to change the GSTIN. Click the ✏️ edit icon beside the current GSTIN field.

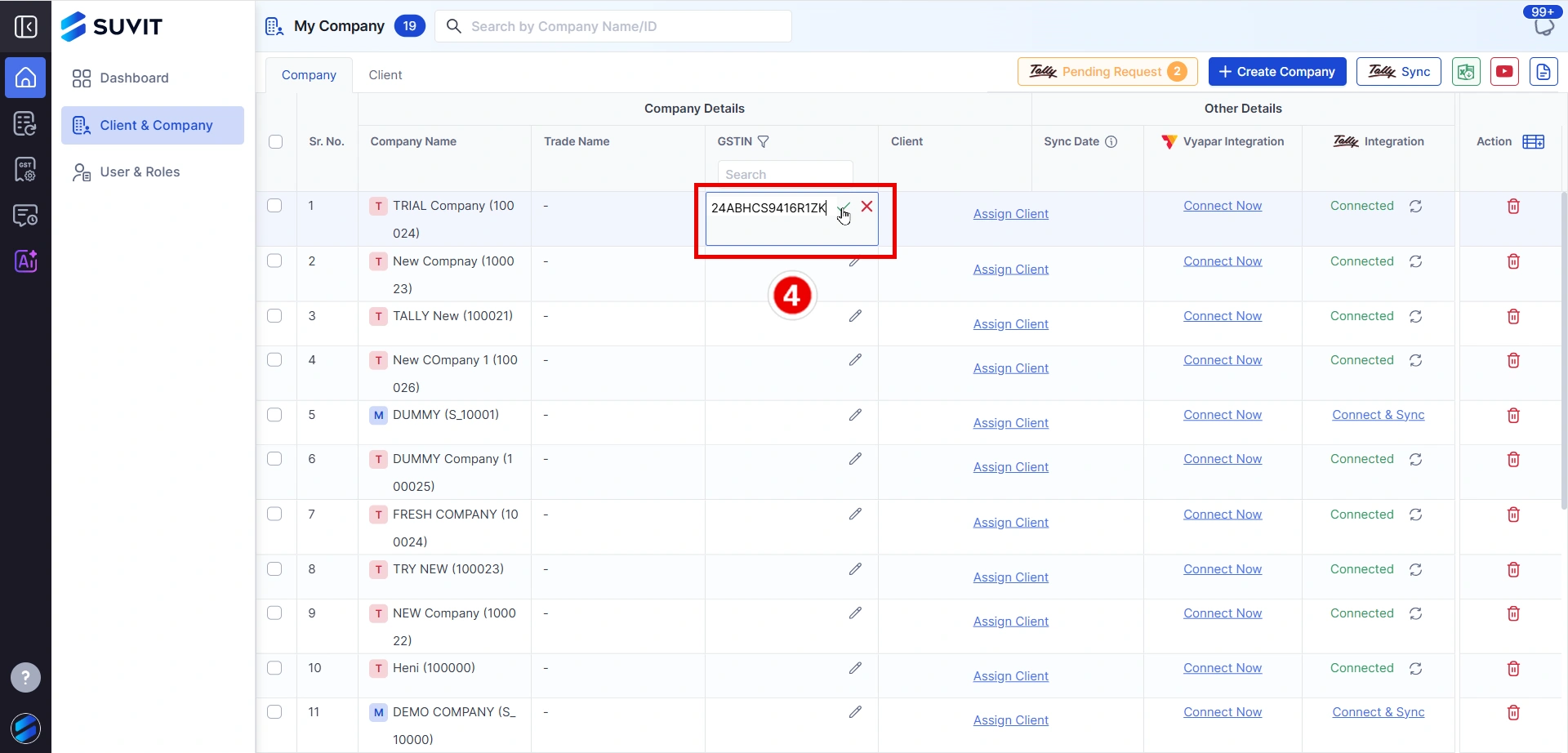

→ Input the new GST number and click the ✔️ check icon to save it.

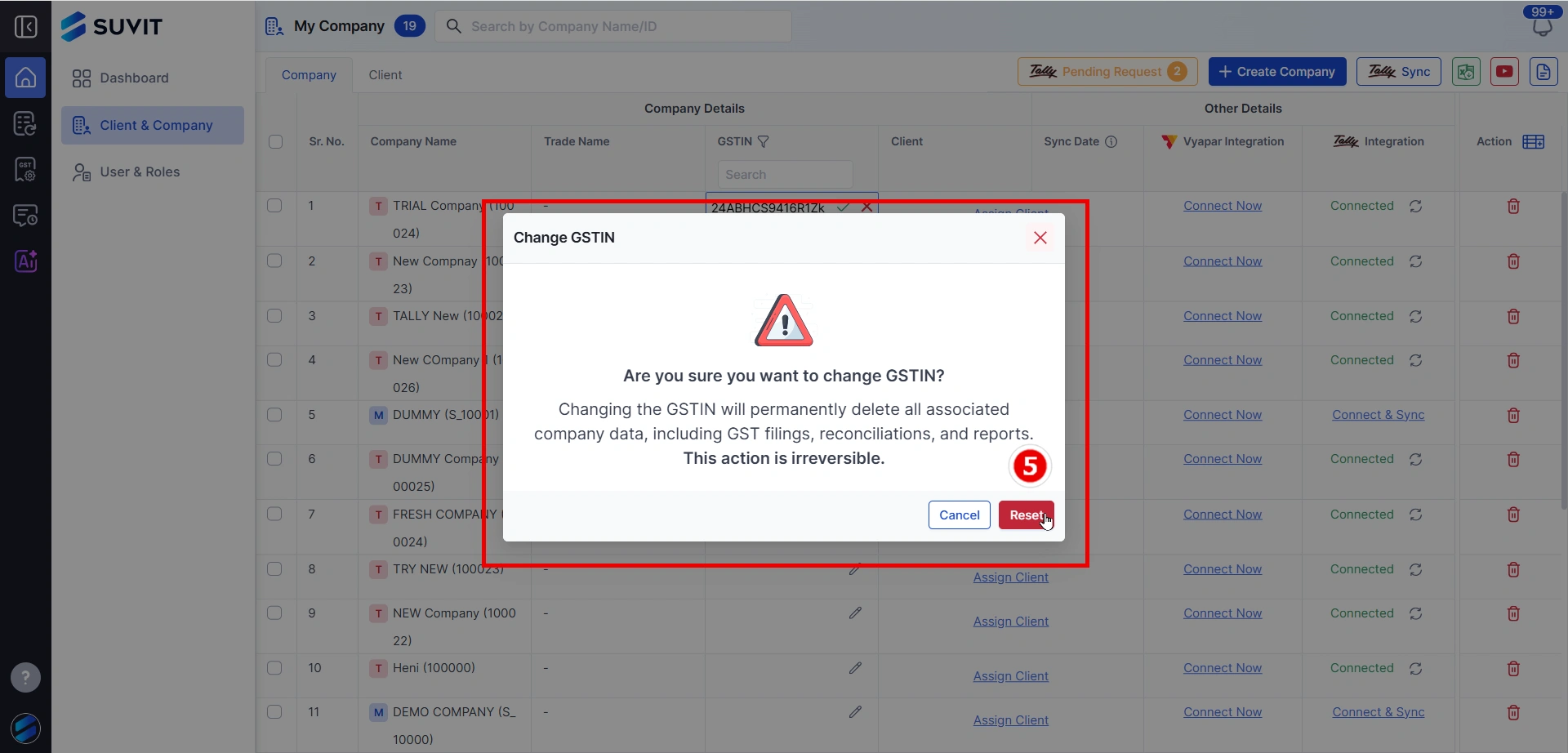

→ A warning popup will appear. Read it carefully and click on Reset to proceed.

→ Once the action is successfully executed, you’ll see a confirmation toast at the top-right corner: “Operation is successfully executed.”

📌 Note: This action is irreversible. Make sure the new GSTIN is correct before resetting.

→ Go to GST reco and sync your GST data How to sync GST data from GST Portal